Cable Analysts See Mixed Q3 Ahead

High-speed internet growth is expected to continue in period, but could slow in later years

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After a second quarter that saw the top publicly traded cable companies report record broadband growth fueled mostly by stay-at-home orders during the pandemic, analysts are expecting a mixed third quarter, as video losses pick up and the torrid pace of high-speed data additions begins to slow.

Pay TV shed about 1.8 million video customers in Q2, a record that was fueled by a combination of the pandemic, heavy satellite losses and the years-long shift toward streaming video. Broadband reached record highs in Q2 — Charter Communications alone added 850,000 high-speed internet customers in the period — again, driven by pandemic-related issues. While most analysts don’t expect that pace to continue, they do see strong gains for most operators.

Sanford Bernstein media analyst Peter Supino predicted Comcast, Charter Communications and Altice USA will add about 1.1 million high-speed data customers combined in the period — down from the 1.3 million added in Q2. At the same time, he expects their combined video subscriber losses to be about even with the prior period.

Supino expected Comcast to add about 580,000 internet customers, up from the 340,000 it added to the rolls in Q2. Last month Comcast chairman and CEO Brian Roberts said he expected strong Q3 broadband gains for the company at the virtual Goldman Sachs Communacopia conference, saying that Comcast had already added more than 500,000 broadband customers with less than a month to go in the quarter.

Content Pressures at Comcast

At the same time, Comcast, which will report Q3 results on Oct. 29, has been under pressure from its programming business. In late September, activist investor Nelson Peltz’s Trian Fund Management said it had accumulated about $900 million worth of Comcast stock and has had “constructive discussions” with company leaders, but wouldn’t say what its intentions are. In the past, Peltz has pushed for board seats and asset divestitures in the companies he has taken a stake in, but Trian’s interest in Comcast is small (0.4% of outstanding shares) and the likelihood it could force meaningful change without a nod from Roberts (who controls 33% of the company vote) is low.

Supino has been a big proponent of Comcast divesting its NBCUniversal and Sky programming units by spinning them off to shareholders. In a June 30 note to clients, he noted that Comcast stock “is demonstrably undervalued and that the pendulum of investor confidence now underappreciates Comcast's strategic intelligence and commitment to long-term value creation.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Comcast, to be a great stock instead of just a good one, needs to rethink its content strategy and structure, he added.

“The NBCU television, film and cable network businesses, which Comcast bought well and for good reasons in 2009, have more recently diluted shareholder returns through revenue shortfalls, expense growth, and deteriorating expectations,” he wrote. “Sky, for which Comcast paid a stunning premium in 2018, fell badly short of expectations even before COVID-19 ravaged it.”

Programmers in general have been battered by the pandemic and the move to streaming. Evercore ISI media analyst Vijay Jayant wrote in a research report last week that although ad spending trends bottomed out in Q2, he expected another 14% decline in Q3, driven by an uncertain upfront and falling volumes. The continued decline of pay TV subscribers is also expected to affect affiliate fees, which he predicted would continue to deteriorate, despite any lift caused by the return of sports. Jayant estimated that traditional pay TV distributors would lose about 2 million subscribers in the period, with virtual MVPDs like Sling TV, on a downward path over the past few quarters, would add about 1 million customers.

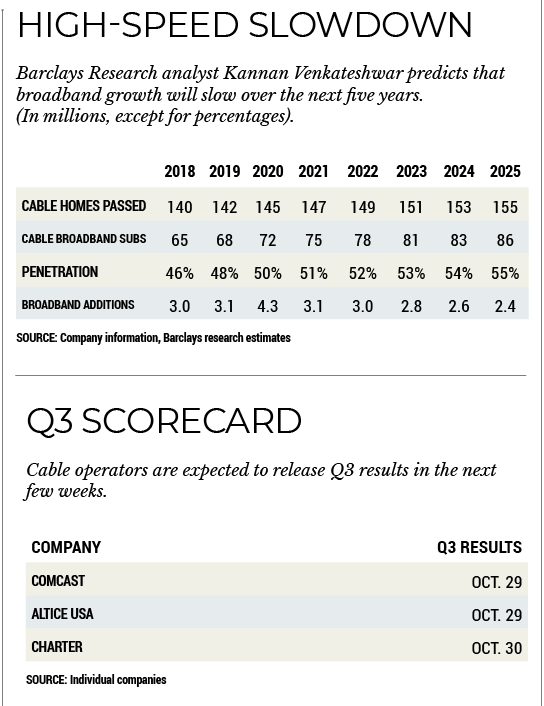

While both analysts expected strong gains on the broadband side of the business, Barclays Research media analyst Kannan Venkateshwar warned that robust growth may not last for long.

In a research note, Venkateshwar wrote that although new-home growth reached a record 2.28 million in Q2, that isn’t likely to be repeated, and broadband providers will have to count on projects to build out their footprint to drive high-speed data penetration. In addition, federal programs to boost high-speed internet availability in rural markets should also help drive the numbers.

“However, we believe that despite these factors, the second derivative of cable unit growth may start slowing in the next two to three years,” Venkateshwar wrote. “More immediately, growth seen in 2020 may also be more difficult to replicate in 2021 given the unique circumstances as well as the segments driving this growth.”

Broadband to Cool a Little

Cable operators should add about 4.3 million broadband customers in 2020, Venkateshwar noted, up substantially from the 3.1 million added in 2019. But he expects the pace of those additions to slow down to 3.1 million in 2021 and to 2.4 million by 2025.

Supino is more optimistic, adding that while Charter won’t have the same performance it had in Q2, Q3 should be a period of strong growth. He predicted Charter would add 450,000 broadband customers and lose about 200,000 video customers in Q3. At Altice USA, broadband additions should be at about 60,000 in Q3 (down slightly from the 70,000 added in Q2), according to Supino. But the analyst added that he sees upside potential in its more rural Suddenlink Communications unit, which should be positively impacted by the RDOF program and other government efforts to bridge the rural digital divide.

“In the near term, we expect positive 3Q results to help rebuild trust with investors as we believe the underlying fundamentals bottomed in early 2020,” Supino wrote. “We believe that core residential revenue growth, sequential advertising recovery, a political tailwind and structural cost reductions all suggest compelling upside for 2H EBITDA.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.