Altice One Burns the Churn

Advanced video and WiFi system shows its stickiness with customers

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Comcast’s X1 has received much attention as the prototype for modern, advanced video delivery systems that incorporate cloud DVR, voice control and WiFi management and, in the process, reduce churn.

But more quietly, since it first debuted in January 2018, Altice USA’s Altice One platform has carved out a similar success story, downsizing the cable operator’s video churn for the last six quarters while simultaneously spurring broadband growth.

During Altice USA’s second-quarter earnings call, CEO Dexter Goei called the launch of Altice One, which incorporates set-top, cable modem and WiFi router functions, to be “a very, very strong success.”

Indeed, video attrition during the period was 21,000 subscribers, down from 24,000 in the second quarter of 2018, despite cord-cutting levels reaching a record high for the broader pay TV industry. Broadband net additions were 13,000 vs. 10,000 in the second quarter of 2018.

Average revenue per user is also substantially higher in homes with Altice One, the company said, while not citing specific data.

The metrics are impressive, considering only about 400,000 Altice USA customers have the Altice One system. That’s 13% of the company’s base, up from 4% infiltration in the second quarter of last year.

Three Le Boxes in One

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

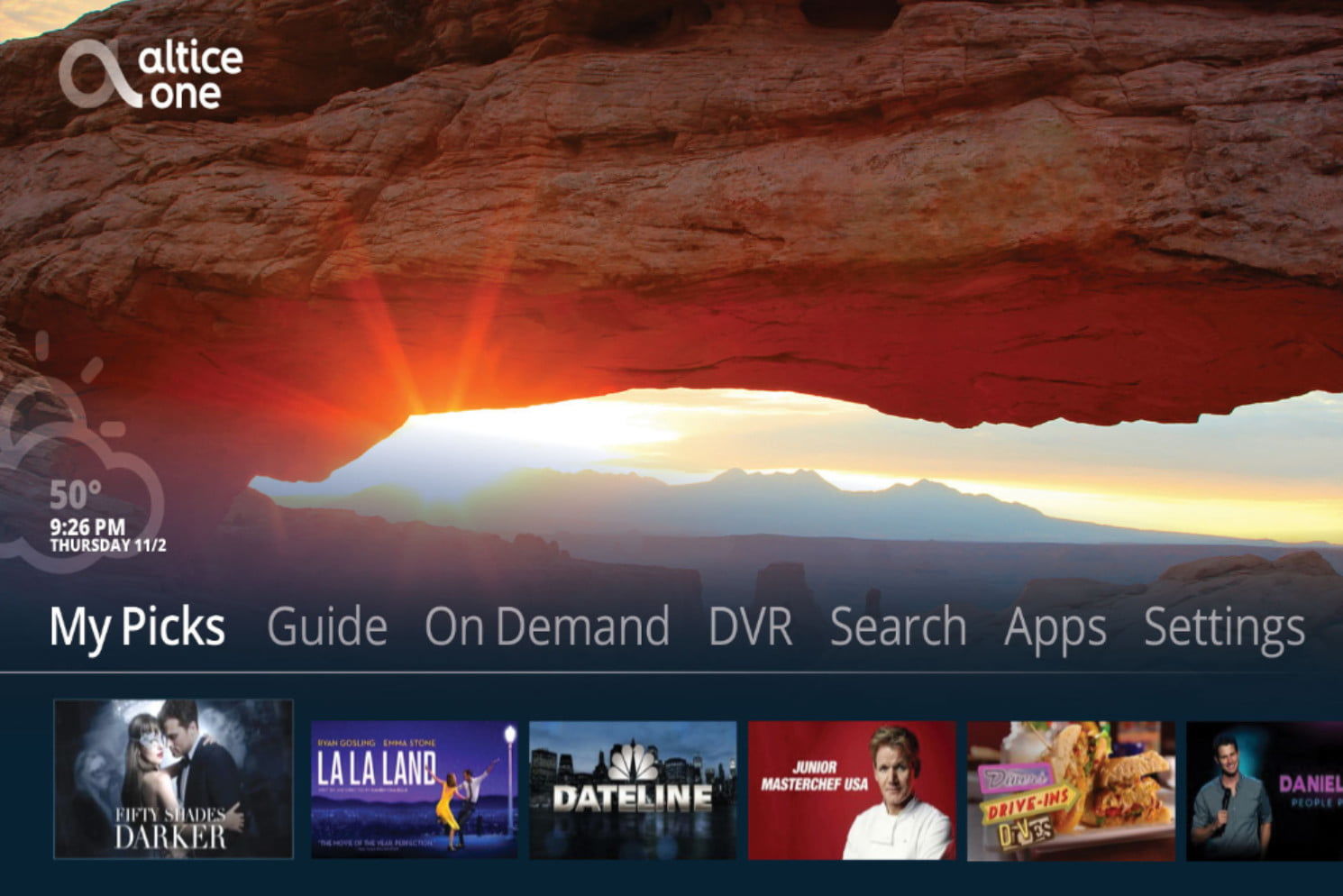

Blending hardware from Sagemcom, silicon from Broadcom, content security from NAGRA and transcoding services from Cisco Systems, Altice One combines advanced TV search and discovery, as well as cloud DVR and voice control, along with integration of key digital services, notably Netflix and YouTube, with more OTT services on the way. There are WiFi optimization and control features. New offshoots have been added, such as an Alexa-powered smart speaker.

RELATED STORY: Altice's Model Behavior

When European telecom conglomerate Altice suddenly swooped in and acquired U.S. cable companies Suddenlink Communications and Cablevision Systems in 2015, there hadn’t been a lot of recent investment in terms of advanced user interfaces and various other modern pay TV features across the two companies, Altice USA co-president and chief operating officer Hakim Boubazine said.

Indeed, Cablevision lost around 5% of its video customers from Q2 2014 to the second quarter of 2015, a time when cord-cutting was a thing, but not nearly as robust as it is today. The attrition wasn’t much better at Suddenlink. The technology and user experience were being overwhelmed by the many new ways to consume video in the marketplace.

“The [Altice One] platform has helped us transform the user experience,” Boubazine said, noting that the mere modern look of the CPE, which contains no ’90s-era “bulky remote control,” has been a key selling point that allowing Altice USA to tap into younger consumer segments.

Currently, Altice One — now on version 3.0 of its operating system — is available across Altice’s Optimum footprint, as well as the portion of the Suddenlink footprint that offers 1 Gigabit-per-second broadband services.

Despite its success, Altice One isn’t hoisting heavy promotion of the platform. It is offered to new customers, those who are moving their service and, notably, those who are seeking to ditch their pay TV service because they want something better. “We use it a lot as a retention play,” Boubazine noted.

Boubazine didn’t disclose how much Altice USA is paying per truck roll to install Altice One. The platform requires technicians to wire up only one device instead of a video set-top, modem and WiFi router.

“The installation process is actually super simple and that allows our technicians to spend more time explaining the features and functions,” he said.

Despite that simplicity, installing new CPE into homes isn’t cheap, and Altice USA has a lot of other places to focus its cash flow — most notably on building out its fiber network and wireless infrastructure.

Expect deployment of Altice One to keep crawling along rather than getting up to sprint anytime soon.

White-Label Opportunities?

Boubazine was also asked if Altice USA has considered a white label licensing strategy for Altice One, similar to how Comcast licenses X1. Notably, Cox Communications repackages X1 as Contour. Canada’s Rogers Communications, Shaw Communications and Vidéotron do largely the same thing.

“We have looked into it, but cable operators use so many different [back-end systems] and those have to be aligned [with Altice One],” Boubazine said. “We decided it was better to focus on our own company.”

Boubazine also said that Altice One is decidedly a child of the Cablevision and Suddenlink mergers.

During its gestation, Altice One was called “Le Box,” and was reported as a technological offshoot of Altice CPE systems already deployed in Europe. But Altice One resembles Le Box only in form factor. The “guts” of the system, Boubazine said, were almost entirely developed by Altice engineers stateside.

“As we acquired Cablevision and Suddenlink, we realized that we inherited some of the finest engineers in the industry,” he said, noting the core contribution of these technologists to the platform.

As it surveyed its U.S. cable assets way back in 2015, four years before its launch of Altice Mobile, Altice was focused, Boubazine said, on the concept of cable wireline and wireless convergence. For Altice USA, that means seamlessly blending WiFi and cellular access for customers. Altice is now in the process of building out that cellular piece. But the deployment of Altice One has been a key step in improving the WiFi aspect.

“And Altice One was the most urgent piece,” he explained, noting the platform’s ability to extend WiFi range in homes up to 40%.

Finally, Boubazine noted that Altice One is able to work across multiple encryption access systems, saving the need for the company to build three different pieces of CPE for three different types of backends.

“It’s the finest piece of engineering I think we have,” Boubazine said.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!