Analyst: Sports Drive App Downloads for Virtual MVPDs

Up 63% in June as NBA Playoffs, U.S. Olympic Trials Attract Viewers

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

App downloads of the major virtual MVPDs were up 63% in June, most likely driven by heavy sports content and the run up to the Summer Olympic Games in Tokyo, according to a report by Evercore ISI media analyst Vijay Jayant.

YouTube TV again accounted for the largest slice of overall vMVPD downloads -- 44% -- but it was sports-centric FuboTV that had the biggest year-over-year gain in the segment --312%, according to Jayant. FuboTV was a close second to YouTube TV in terms of download share (33%), followed by Sling TV (18%) and AT&T TV (9%).

“Virtual MVPD app download trends improved vs. the prior few months likely driven by the strong sports calendar and lead into the Olympics,” Jayant wrote in his report, adding that May downloads rose 11% year-over-year, driven by FuboTV and YouTube TV.

Also Read: Fubo TV CEO David Gandler Says VMVPDs Are Pay TV's Future Gateway

“Similar to trends in prior months, YouTube continues to dominate in terms of vMVPD download market share followed by fuboTV, SlingTV, and AT&T TV,” Jayant wrote.

June was a big TV sports month ratings-wise with the NBA Playoffs, Major League Baseball, the U.S. Olympic Trials, the NCAA baseball tournament and UEFA European Championship all attracting strong ratings.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

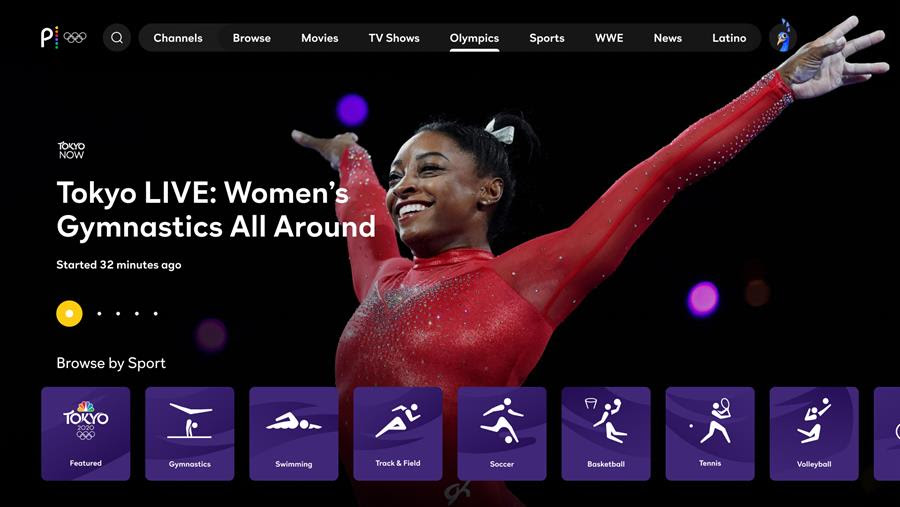

The Summer Olympic Games are scheduled for July 23-Aug. 8 in Tokyo and NBCUniversal plans to air about 7,000 hours of content on its broadcast and cable networks as well as digital platforms including Peacock and Telemundo Deportes.

For SVOD providers, the month was mixed. Netflix app downloads were down about 25% year-over-year, a slight improvement over May’s 30% decline. Showtime (up 132%), Disney Plus (up 114%) and HBO Max (up 63%) were the top performers in the sector, while Hulu rose 4% and Amazon Prime Video increased 1% in the period.

HBO Max, according to Jayant, dominated the SVOD space with strong releases of originals and library content in June. Its June 29 expansion into 39 Latin American and Caribbean countries should help drive downloads in July, he said.

Newer entrants Discovery Plus (launched Jan. 4) and Paramount Plus (launched on March 4) were not included in year-over-year estimates. But Jayant wrote that month-over-month trends at Discovery Plus have been marginally weaker, with June 2021 downloads at about 1.2 million, fewer than the 1.5 million downloads in May. Paramount Plus’s ad-supported tiered launch June 7 helped push total downloads to 2.3 million in June, up from 1.4 million in May.

Disney Plus was driven mainly by gains in Latin America, ahead of its planned August launch of the Star Plus general entertainment streaming service and a new promotion that will give new Amazon Music Unlimited subscribers Disney Plus for six months free. Existing Amazon Music Unlimited customers can get Disney Plus for free for three months.

On the ad-supported side, Jayant estimated that app downloads were up 48% year-over-year in June, fueled by gains at Tubi TV (up 49%). Trends for Pluto TV were down about 3% for the month, but the ViacomCBS-owned streamer still holds the biggest share of download activity at 38%, according to Jayant. NBC Universal’s Peacock launched in April 2020, so year-over-year comps were not shown, but Jayant wrote the service has a 26% share of download activity, close behind Pluto.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.