Why ESPN Plus On Hulu Is a Much Bigger Deal Than Disney Plus’ 100 Million Subs

Disney tears down the silos between its secondary streaming platforms and tightens up its bundles

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Disney used last week’s annual shareholder’s meeting to trumpet news that streaming service Disney Plus had crossed the 100 million subscriber mark just 16 months after launch.

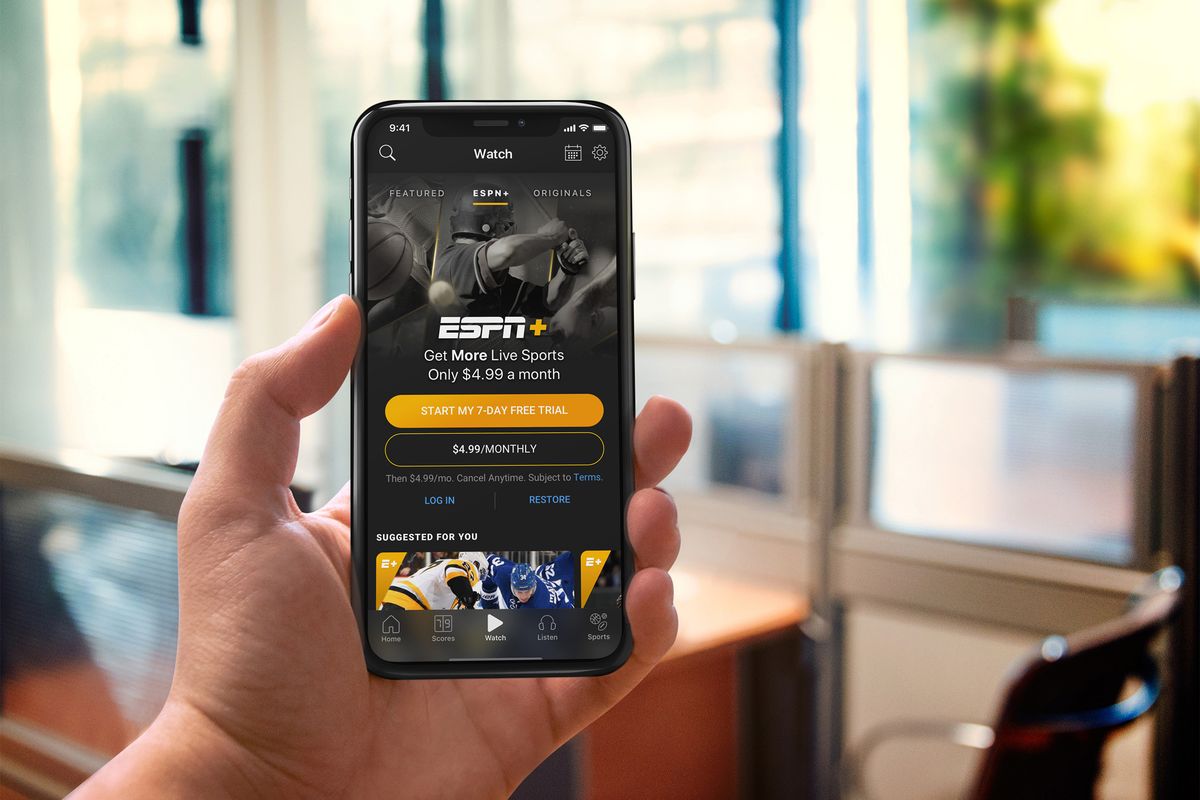

The company certainly had reason to brag. But the bigger news might be what came later in the week, with the appearance of ESPN Plus programming (and an easy subscription link) on Hulu. Hulu will also make available ESPN Plus pay-per-view events, including UFC matches beginning this summer.

It marks the first substantive crossover between the two neglected children in Disney’s streaming family, and suggests the Mouse House is finally unwinding some of the most problematic aspects of its original, deeply flawed streaming strategy.

“Deeply flawed” because until this week, the only real sign to consumers that the three services were connected was advertising for TheDisneyBundle.com, which yoked them together for $12.99 a month. Even the bundle’s sign-up process remains relatively clunky and involved, treating the services largely as standalone products from separate organizations. You’d probably have a simpler experience buying them through Apple or Amazon.

That bundle aside, the three services have had different sign-ons, billing and the rest, and no presence on each other’s home page. Now, it’s finally starting to change, just as consumers are beginning to expect more from their streaming services than a bottomless well of superhero and princess movies.

The situation is an awkward artifact of the twisty history and corporate silos in which each service was birthed. Their continued separation remains both boon and bane for Disney as it expands globally and brands itself to customers who care little about its core, family-friendly and Hollywood-centric programming.

In part, the original strategy was built around maximizing streaming opportunities for disparate, isolated parts of the Disney empire back in the old days of 18 months ago, when Hollywood as a whole regarded streaming as a bottom-line add-on, a long-long-long-term play, or perhaps just a necessary evil that distracted from running lucrative traditional film and TV businesses.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

ESPN Plus was intended to attract cord-cutters and the hardest-core sports fans at a time when cable departures were eating painfully but not fatally into the financial underpinnings of the Four-Letter Network. It wasn’t designed to be a replacement so much as an add-on to what was still on cable.

As a result, ESPN Plus is rather anemic, featuring mostly sports documentaries, a smattering of so-so original programming and a plenitude of live games likely to appeal to niche and regional audiences. They’re the sort of stuff that fills out the programming grid on ESPNU or regional sports networks.

Hulu, leg No. 2 of the Disney streaming tripod, has an even more unlikely provenance. Founded in 2007 as a joint venture between News Corp., NBCUniversal and a private-equity firm, Disney didn’t buy in until 2009, and didn’t take control until a decade later, as a small part of its $71.3 billion mega-deal for most of Fox.

Even with Disney control (NBCUniversal remains a minority partner through 2024), Hulu still has seemed to be largely its own beast, with original programming, a vMVPD bundle, and a hybrid ad-subscription business model very different from ESPN Plus or Disney Plus.

Even Disney Plus started as a highly focused product for the Mouse House’s most dedicated fans, of which there are plenty. It might be seen as the TV channel of choice for Disney Stores, and the long lines waiting for a ride on Space Mountain.

One possible tell regarding the importance Disney leadership gave streaming back in the Before Times: Its surprise choice of successor to long-time CEO Bob Iger in the weeks before the pandemic hit the United States, Bob Chapek.

Chapek, who headed the parks and resorts division for several years after running what used to be called “home entertainment,” took over instead of alleged heir apparent Kevin Mayer, who’d overseen the streaming strategy and shepherded the big Star Wars and Marvel acquisitions. Mayer soon left.

To Chapek’s credit, after the pandemic closed all those parks and resorts and cruise ships and stores, cancelled months of ESPN’s and ABC’s game broadcasts, and sent the lucrative theatrical exhibition window into an uncontrolled tailspin, the company recalibrated, as evidenced by that December investor presentation.

There, company executives laid out plans to roll out more than 100 series and features, with 80% headed to streaming first. Indeed, even as sports have resumed and parks and theaters reopen, Disney will lean hard into its streaming future. Over the past month, they’ve repeatedly reiterated that changing mindset to investors, analysts, distribution partners, and everyone else.

“…We’d like to let the consumer be our guide in almost all situations,” Chapek said. “And I don’t think they’ll have much of a tolerance for a title, say, being out of theatrical for months yet it hasn’t had a chance to actually be thrown to the marketplace in another distribution channel, just sort of sitting there getting dust.”

But even as Disney leans in, it will need to figure out how to tighten up its streaming bundle even further, to get consumers that are missed in the current siloed approach. The appearance of ESPN Plus within Hulu seems like an important next step, at least in the United States.

Consumers need easier programming arrangements in the post-cable era. You sell more in the long run. Conveniently, bundles also seem likely to substantially reduce churn, the big headache facing all the streaming services crowding the market now.

Disney appears headed to a different solution beyond the domestic market, launching the Star service in recent weeks, and beginning to integrate connections between it and Disney Plus.

Star, a brand lifted from its Indian acquisition HotStar, appears to be Disney’s designated Hulu successor on the global stage, providing a capacious home for Plus and non-Plus content to live in without undercutting Disney’s sacrosanct pro-family core brand.

That still doesn’t solve what to do with ESPN Plus, though we’re getting more visibility with Disney’s just-signed deal with the NHL and widespread leaks about the imminent renewal of NFL rights across all the big media companies. How ESPN Plus, and those sports rights, travel to other countries, will be the next challenge.

In the meantime, expect Disney to continue tightening up the bundle approach, as its faces its streaming future with open arms, and seeks its next 100 million subscribers.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.