Video Biz Entering ‘Deflationary Era,’ Analyst Says

Michael Nathanson forecasts -0.4% declines over the next five years as industry transitions to dependence on streaming

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Traditionally a resilient sector even in the most recessionary of times, the business of providing consumers with video entertainment is about to enter a period of transitionary decline, according to a rather exhaustively thorough research report assembled by MoffettNathanson.

In the immediate term, combined market forces including the COVID-19 pandemic and pay TV cord cutting will reduce the compounded annual growth rate (CAGR) for the video business by 5% in 2020, the research company predicts. Revenue growth from video streaming will not be enough to keep up with declines for not only linear cable, satellite and telco TV, but also theatrical movie distribution.

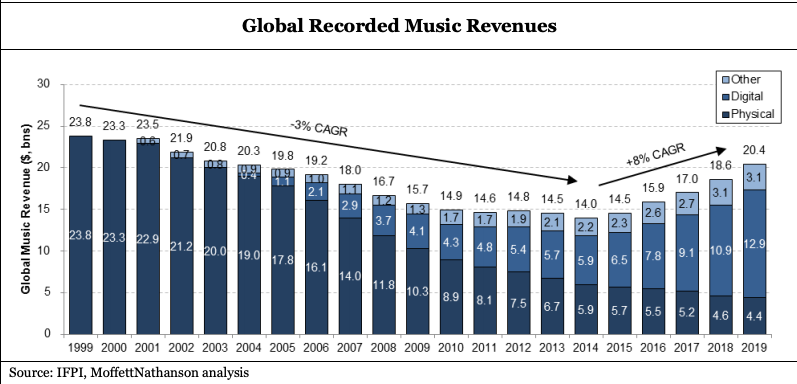

But looking out over a five-year span, MoffettNathanson sees transitionary challenges for the video business—not as acute as the two-decade garden hose the music industry is only now emerging from, but “deflationary” nonetheless.

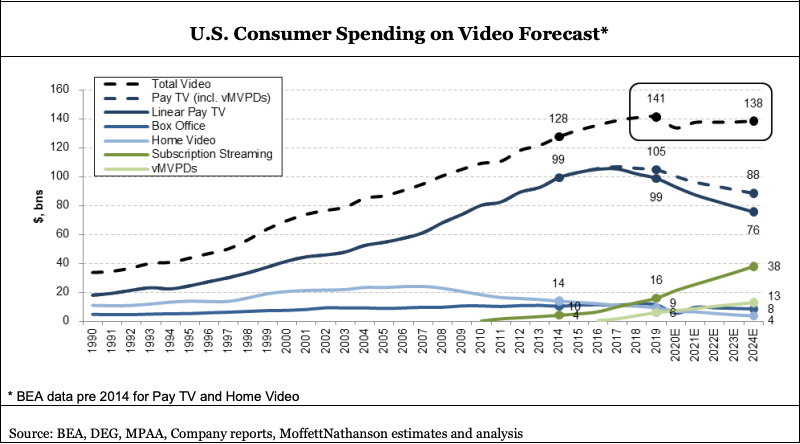

“In aggregate, we anticipate a slight -0.4% CAGR decline in video spending over the next five years compared to the +2% CAGR increase from 2014-2019 as declines in linear and traditional consumption are offset by growth in SVOD and vMVPDs,” report author Michael Nathanson wrote.

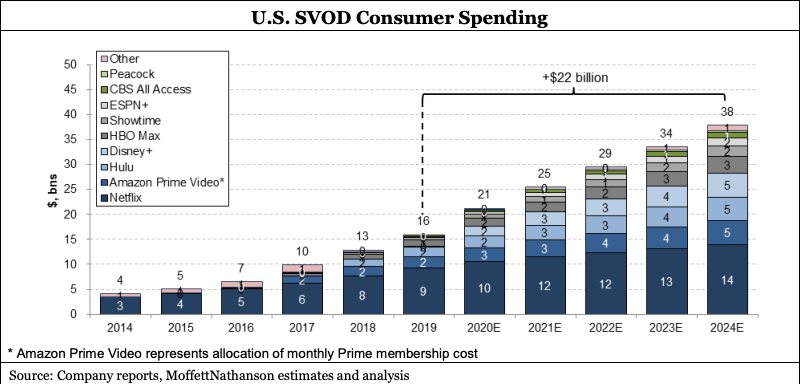

The study predicts that U.S. consumer spending on video will decline from $141 billion in 2019 to $138 billion in 2024. Annual revenue from subscription streaming (SVOD) will more than double from $16 billion to $38 billion over that span, growing at an 18.9% CAGR. But annual pay TV revenue will decline from $99 billion to $76 billion, dropping at a -5.2% CAGR. Home video (-17.1%) and theatrical box office (-5.7%) will also take CAGR hits.

As Nathanson noted, the decline of the music business is a “cautionary tale for how technology can disrupt an established industry, shifting surplus to consumers by offering an easier, more affordable and better way to access content.”

He acknowledges that, “The case for video is a bit different,” with news and sports resiliently remaining bundled, and video providers not ceding too much power to one specific technology company (i.e. the music industry with Apple).

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

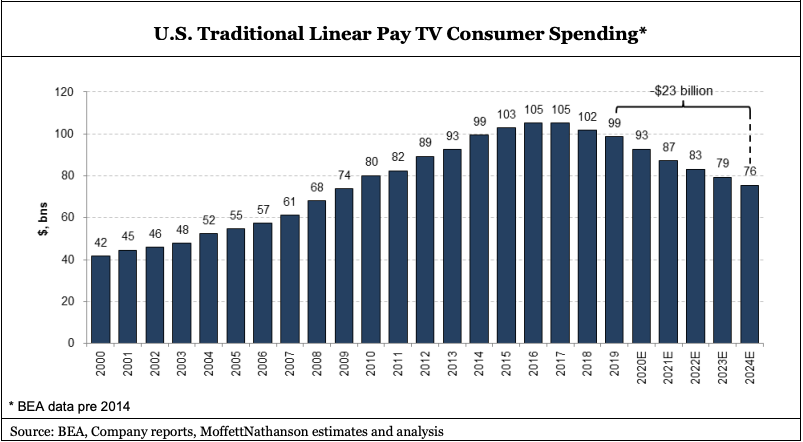

For the U.S. video business, the decline in pay TV distribution will be driven by a loss of 22 million linear subscribers over the next five years, with the business dropping from 93 million customers in 2019 to a projected 71 million in 2024. Annual revenue for linear pay TV services will decline by $23 billion over that span, MoffettNathanson predicts.

The study predicts that virtual MVPDs will grow from 10 million U.S. subscribers to 16 million over the five-year span, with vMVPDs generating around $70 per user vs. $109 per linear customer. With vMVPDs factored in, combined consumer spending for U.S. pay TV will be $88 billion in 2024, according to the forecast.

The real offset will come from growth in U.S. subscription streaming, with recently launched SVOD services Disney Plus, HBO Max and Peacock generating around $11 billion combined $11 billion by 2024, adding to the $14 billion Netflix is forecasted to bring in that year.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!