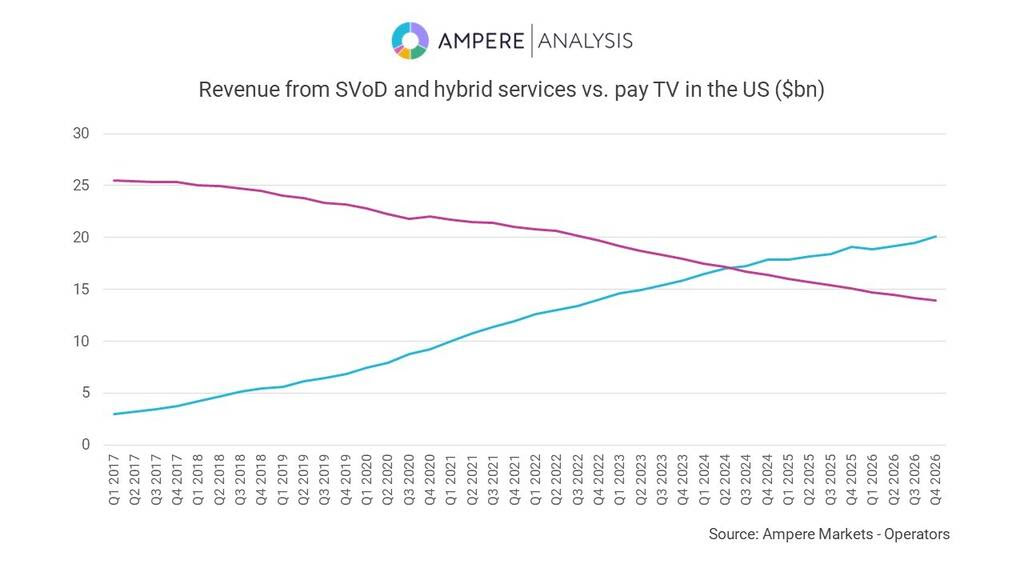

U.S. Streaming Revenue Will Surpass Total Pay TV Coin in Q3, Research Company Predicts

The introduction of cheaper ad tiers has driven up ARPU, according to London's Ampere Analysis

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Revenue generated by U.S. streaming services will surpass sales from domestic pay TV operators for the first time in the third quarter, Ampere Analysis predicts.

The London-based research company said total domestic reach for streaming actually surpassed linear pay TV back in 2016. But with streaming's average revenue per user (ARPU) coming in at one-tenth of cable, satellite and telco TV, it's taken a little while for streaming's total revenue to catch up.

Streaming's reach advantage is well-corroborated. U.S. pay TV penetration only stands at around 64% of U.S. TV homes, according to a survey conducted by Leichtman Research Group back in October. Conversely, in August, LRG found that 83% of U.S. households now have at least one streaming service.

Ampere says the recent introduction by major U.S. SVOD operators of cheaper ad-supported tiers has markedly increased streaming revenue generation, while rekindling market expansion. The company predicts that these ad tiers will surpass $9 billion in U.S. sales this year, bolstered by the entry of Amazon Prime Video into the partially ad-supported business.

“Most major streaming services in the U.S. have launched their hybrid advertising tiers, which, along with increasing clamp-downs on password sharing, have been successful at reigniting growth in the streaming market," said Rory Gooderick, senior analyst at Ampere Analysis.

"There is still a way forward for pay TV, however. Disney and Charter’s recent deal in the U.S., which gave almost 15 million Charter subscribers access to Disney Plus' advertising tier, shows how the two businesses can work together to maximise streaming’s reach to domestic subscribers, and highlights the importance of traditional distribution platforms as service aggregators," Gooderick added. "Longer term contracts and the reduction in churn makes this an attractive proposition for streamers, while control over the billing relationship also means there’s something in it for the pay TV provider too.”

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!