Roku OS Only Controls 22% of the Installed Base of U.S. Connected TV Devices

Focusing on the built-up mass of smart TVs, streaming players and game consoles currently in their active life cycles, Samsung still has the biggest share of the global OTT gadget market

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Flying somewhat in the face of the popular notion that the Roku platform controls up to half video streaming in the U.S., UK research company Strategy Analytics published data this week suggesting Roku’s control of the installed base of connected TV devices in the U.S. was actually only 22% at the end of 2020.

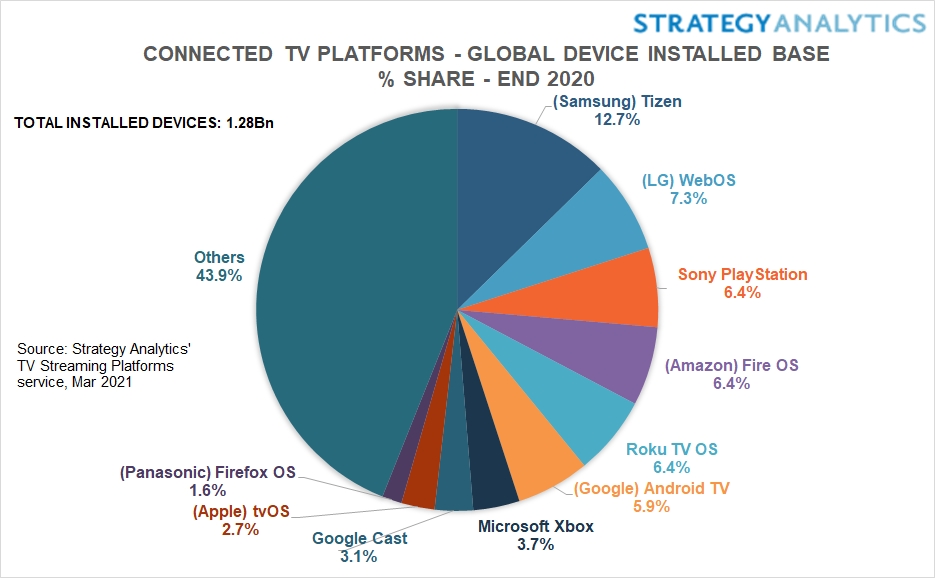

Globally, Roku’s share of the smart TV, OTT player and game console platform market is even more diluted, with the firm pegging the Roku OS at only 6.4% market share, trailing leader Samsung’s smart TV OS Tizen, which controls 12.7%.

With equity analysts and media pundits pondering a future in which Roku runs away with the game ball, controlling a critical mass of viewer data and advanced advertising levers, this kind of information matters.

Other research companies peg Roku’s domestic installed base market share at around 40% or more. And Strategy Analytics itself concedes that the Roku OS currently powers a third of the smart TVs sold in the U.S. We reached out to London Tuesday to ask David Watkins, director of TV streaming platforms for Strategy Analytics, how could his report be right?

Without specifying any of his employer’s research competitors, Watkins said Strategy Analytics data isn’t survey-based—its information, rather, is culled directly from vendors and retailers. Fair enough.

And the metric in question is “installed base,” not current sales or shipments, and not active devices.

“We’re not distinguishing usage here—usage could be very different,” Watkins said. “We’re simply reporting the platforms' installed in people’s homes, regardless of whether they’re used or not.”

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

So while sales of Roku smart TVs through OEM brands like TCL and Hisense have been hot of late, the built up “installed base” of Roku devices won’t immediately reflect a change in market dynamics. This is particularly true for smart TVs, which have a life cycle of around six years, Watkins said. OTT players, dongles and sticks are replaced more often, he added, anywhere from two and half to four years.

Roku is still the installed base leader in the U.S. But globally, Tizen is the leader in 22 of the 25 countries surveyed in the Strategy Analytics report, while LG’s smart TV OS, webOS, ranks second in 13 markets.

“Samsung’s smart TV market leadership gives it a great foundation to sustain Tizen as the leading TV streaming platform for years to come,” Watkins said.

Overall, Strategy Analytics said the number of connected TV devices in use worldwide increased by 21% year-on-year to 162.3 million.

Google’s Android TV saw the biggest increase in installed base growth at 42%, the report said, followed by Roku (40%) and Amazon fire TV (35%). Game consoles Sony PlayStation and Microsoft Xbox saw installed base declines, as did Google’s recently supplanted Chromecast platform.

Notably, while, Roku has seen brisk proliferation from smart TV OEM sales, Amazon Fire TV has actually surpassed Roku in U.S. player, dongle and stick sales, Watkins said, thanks in part to brisk movement of low-priced gadgets at Prime Day and other sales events.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!