Peacock Will Experience 'Peak Expense Mode' Loss of $3 Billion in 2023, Comcast CFO Said

The migration to streaming is a 'costly pivot,' Jason Armstrong conceded, 'and we're right in the middle of it now'

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

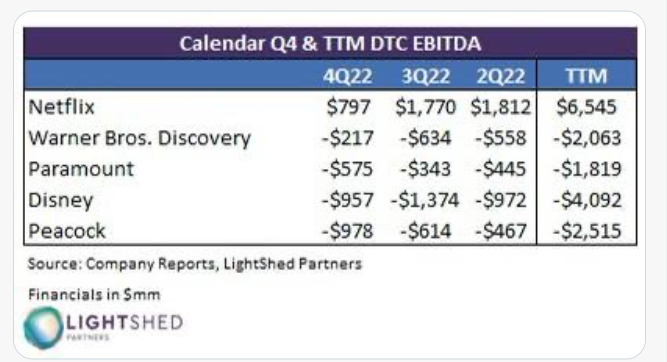

As the just completed Q4 earnings cycle for technology, telecom and media just showcased, EBITDA losses on direct-to-consumer tie directly to customer growth for subscription streaming, at least for the traditional media conglomerates.

Among that grouping, only Comcast seems to have not lost its will to fight the Streaming Wars.

Comcast CFO Jason Armstrong reiterated an earlier company prediction to equity analyst at a Deutsche Bank tech conference Monday morning that the company will lose around $3 billion building Peacock in 2023, up from just over $2.5 billion in red ink last year.

“It’s a costly pivot, and we’re right in the middle right now," Armstrong said regarding the conglomerate's transition to streaming. (The Penske Showbiz Trade Monopoly covered Monday's Deutsche Bank event virtually.)

"You’re adding a streaming service sub as you lose linear subs, and you’ve got it covered domestically," he added. "Right now we’re in sort of a peak expense mode around funding this transition."

As shown by the chart above (provided by LightShed Partners based on public data), Comcast's DTC losses steadily escalated throughout 2022, even as Warner Bros. Discovery and Disney markedly reduced red ink at the end of the year through aggressive cost-cutting initiatives.

And in Q4, Disney experienced its first ever global subscriber loss for Disney Plus, which lost 2.4 million customers during the period.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Warner Bros. Discovery, which had grown paid users by over 6 million pro forma for HBO Max and Discovery in the final three months of 2021, expanded total DTC subscribers by just 1.2 million in Q4 2022 at it trimmed DTC losses by nearly two-thirds.

For its part, Peacock doubled its paid users in 2022, adding around 5 million subscribers in the final three months of the year.

Perhaps as closely as anyone, Comcast has tied Peacock to its broadcast and cable programming efforts, enabling cross-platform buying opportunities for advertisers and building brand awareness for NBC shows like new hit comedy reboot Night Court, which appear on both outlets.

“We’re running the business in total," Armstrong said. "You've got the linear business, which is a very good business and a cash-flowing business that you want to protect, but [we’re] migrating to streaming.

“The good news is linear plus streaming is a growth business,” he added.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!