Media Stocks Pounded on Bundle Worries

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

UPDATE (via B&C):Media Stocks Continue Post-Earnings Free Fall

RELATED STORIES:

Viacom Q3 Earnings Dip on Ad Decline

BBC America Helps AMC Networks to Higher Profits

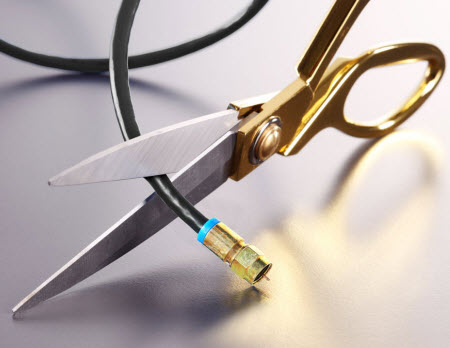

Media stocks took a pounding yesterday after a series of earnings calls focused investors on the risk that the pay TV bundle could be unraveling.

The wave started with Tthe Walt Disney Co. on Tuesday when CEO Bob Iger tried to address concerns that falling subscriber numbers were forcing ESPN to cut costs in order to maintain its profitability.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

By Wednesday, when four big media companies reported earnings, executives were peppered with questions about the sustainability of affiliate revenue growth,

When the dust cleared, nearly every big media stock was down. Discovery -- which bragged about its new distribution pact with Comcast -- took the biggest hit, down 12%. Disney was down 9%, Time Warner off 8%, Viacom and AMC Networks fell 7%, Scripps Networks dove 5% and CBS and Comcast slid 4%. (Ominously, Netflix was up 2%.)

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.