Iger: Disney Plus Needs to Move Beyond Spandex … and Pump Up the Volume

In his valedictory CNBC interview/career retrospective, outgoing media mogul Bob Iger says the streaming service needs more ‘dimensionality’

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

There. He said it. “He” being Bob Iger, departing Disney after a celebrated career heading Hollywood’s biggest media company as CEO and chairman. And he just said Disney Plus, whose creation Iger presided over as part of one of the most consequential media company pivots ever, needs to change.

"I think [Disney Plus] needs more volume," Iger said in a valedictory CNBC interview/career retrospective filmed at Disneyland that aired in segments all day Tuesday. "And there probably needs to be more dimensionality, meaning, basically, more programming or more content for more people, different demographics. But, [CEO Bob Chapek] is aware of that and is addressing those issues.”

Taking Disney Plus to a much wider group of people is not quite the populist comment you’d expect from one of Hollywood’s ultimate Masters of the Universe and the staunchest defender of the Disney brand.

And doing more of what you’re already doing should be relatively easy; Just open the spigots a bit wider. It’s amazing what another billion dollars can buy. But adding “dimensionality” to the Disney Plus recipe, that could be a major challenge for Iger’s successor if he still wants to preserve the Disney brand.

Chapek faces a conundrum. Disney Plus vaulted to success over the past two years with a much-loved collection of family-friendly blockbusters from Marvel, Star Wars, Pixar, National Geographic and Disney’s vast animation library.

But durable as the audience for that content is, it’s something of a “spandex ghetto,” attracting a highly defined set of superhero fans and parents urgently seeking safe shows for the kidlets to binge during lockdown. How does Disney move beyond that narrowcast to a broader array of programming that still protects its prized name?

One option is music. Much as Apple has profitably done, Disney is now mining music-related documentaries and performances for popular programming.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Apple TV Plus and Disney Plus even have dueling Billie Eilish projects, though Disney’s more recent Happier Than Ever is billed as a “concert experience” rather than documentary. Disney Plus also offers the filmed version of Hamilton, High School Musical spinoffs, and Beyonce’ and Taylor Swift projects.

Most unexpectedly, the three-part, 7 1/2-hour documentary The Beatles: Get Back turned out to be a hit far beyond the Fab Four’s many obsessive fans. But the massive documentary, with its million small moments captured 51 years ago during the creation of the Let It Be album, proved absorbing to many others who weren’t even born then.

Not every musical venture seems right for Disney Plus. It’s hard, for example, to imagine Disney Plus carrying Todd Haynes’ wonderful exploration of the Velvet Underground, given its subject’s still shocking explorations of drug culture, S&M and other taboo topics amid Andy Warhol’s mass-media hacking.

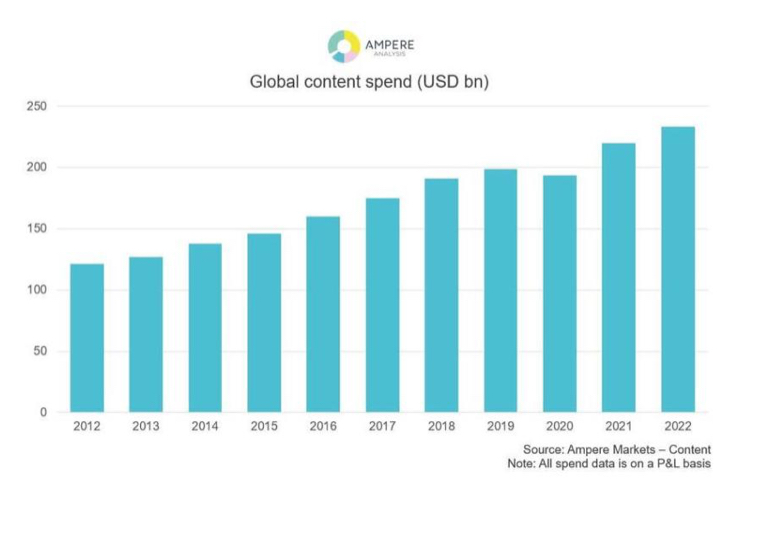

And even expanding on what Disney already does isn’t actually “simple” amid huge competition for the best projects and intellectual properties. Ampere Analysis estimated worldwide content spending jumped 14% this year, to more than $220 billion. That was led by the SVOD services, whose nearly $50 billion in content spending was up 50%.

Of the SVOD total, Netflix spent around 30%, making one wonder what it will take for everyone else to catch up.

By Ampere’s analysis, Comcast and Disney units each collectively exceed Netflix’s investment in “professional video content” but a third of their content spending went to sports rights. Other spending went to legacy broadcast, satellite and cable operations at both companies.

Ampere is predicting only a modest increase by everybody from 2021 levels, to $230 billion worldwide, driven once again by the SVOD services.

The real opportunity remains overseas, where most of the potential audiences live, and where dozens of production centers are creating shows for local audiences. Occasionally, as Netflix Co-CEO Reed Hastings likes to say, those local shows become worldwide hits. For Netflix, the list of international breakouts this year includes Squid Game, Lupin and Money Heist. It’s difficult seeing any of those projects on Disney Plus.

No doubt there are other kinds of shows where Disney Plus can expand. So far, the obvious opportunity, though, seems to be further integration between Disney Plus and label mates ESPN Plus, Hulu, and Hulu’s overseas doppelgänger, Star.

Creating tabs to access sister services, as Star does, and Hulu Plus Live TV is now doing, seems a step in that direction.

Whether even more integration is possible while preserving the pristine Disney Plus brand is no doubt the subject of ongoing conversations. But Iger’s comments suggest Disney executives understand they need to restart the sputtering growth rocket they keep promising.

During the company’s most recent earnings call, Disney execs aggressively reiterated projections that Disney Plus would have 230 million to 260 million subscribers by 2024.

That’s despite the flattening growth rate for subscriber adds in the second half of 2021, which sent Disney shares down precipitously. Since a September high of about $185 a share (and a 52-week high of $203), share prices have plummeted nearly a quarter, to around $150.

Share prices and quarterly market gyrations aren’t always the best way to evaluate a company. But they do starkly illustrate what a large group of invested observers think of the job a company is doing. Iger’s comments suggest what Disney insiders are thinking. Now comes the hard part. Fixing it all. ■

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.