Hulu Just Quietly Had Its Slowest Subscriber Growth Quarter in 2 Years (Our Deep Dive Into a Chart-laden Garden of Analytical Delights)

Hulu has added 20 million customers since Disney took full control, and the latest quarterly financials looked solid. But with full ownership yet to be resolved with Comcast, the platform doesn't appear poised for explosive growth anytime soon

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

While Disney tried to steer investor attention to a revived Disney Plus content slate, and away from stagnant subscriber growth for its two-year-old subscription streaming service, it quietly and matter-of-factly this week also released quarterly and full-fiscal-year data for its other general entertainment SVOD service, Hulu.

For the most part, business at Hulu seems good.

Hulu finished Disney's fiscal 2021 year by leading a 38% revenue spike for its parent's overall direct-to-consumer business, with sales reaching $4.6 billion.

With Hulu raising subscription prices in October on some of its most popular tiers, and ad sales improving on subscription tiers with limited commercials, Disney said that average revenue per user (ARPU) for Hulu SVOD customers increased from $12.59 to $12.75 in the most recent quarter.

Hulu's primo tier with virtual MVPD service, Hulu + Live TV, was particularly buoyant, adding 300,000 customers to return to the 4 million subscriber threshold. The growth came despite a $10-a-month October price increase that drove ARPU up from $71.90 to $84.89.

Much of that Hulu + Live TV subscriber increase seems seasonal, with Cleveland Browns quarterback Baker Mayfield back in his green No. 6 uniform for a new series of "Yes, Hulu Does Have Live Sports" linear TV spots, which entered heavy rotation during NFL and NCAA football game coverage starting in early September. Hulu's vMVPD numbers also spiked last year in fiscal Q4, reaching an all-time high of 4.1 million before a wave of cancellations that came at the end of football season.

There's been a fair amount of speculation among analysts--and the B2B press that strangely worships them!--

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

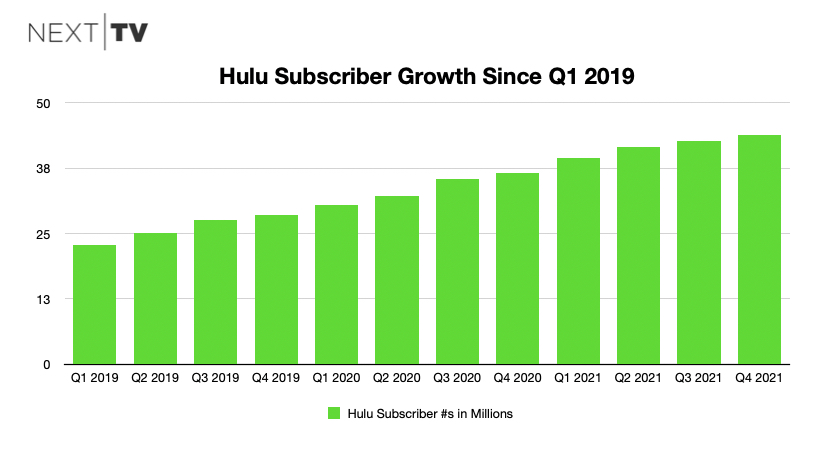

Overall, Hulu added just 1 million customers in Disney fiscal Q4, reaching 43.8 million. It was Hulu's slowest growth quarter in two years, trailing only the growth occurring from fiscal Q3-Q4 in 2019, the first full two-quarter period following Disney's closure of its Fox acquisition and its subsequent full takeover of Hulu operational control.

Indeed, Hulu has expanded its customer ranks by 20 million since Disney assumed full oversight of the joint venture. And celebrity analyst Craig Moffett recently published a bullish investor note suggesting that growth rate might be sustained, predicting Hulu will reach as many as 65 million customers by 2024.

But Hulu customer growth actually seems to be decelerating. Hulu added 7.2 million customers overall in fiscal 2021, compared to 8.1 million in fiscal 2020.

The chart above reveals a fairly steady but unspectacular two-year growth spree under full Mouse control. But the data released Thursday by research firm Kantar presents a more compelling narrative of a Hulu deceleration.

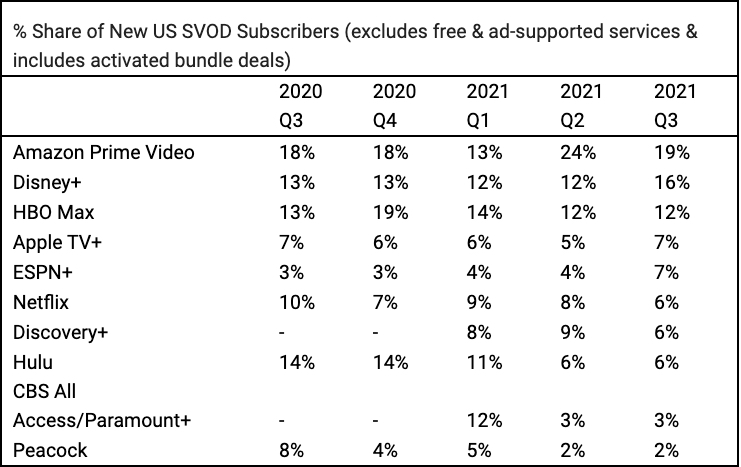

Notably, in what Kantar describes as an increasingly saturated U.S. subscription streaming market, Hulu's share of new SVOD customers declined from 14% to just 6% in one year.

You can probably see where we're going with this. Yes, much has been made by equity analysts--and the B2B pubs like this one that fawn on them!--about the ongoing negotiation between Disney and Comcast/NBCU over the latter's 33% non-controlling share in Hulu, and how it'll inevitably be sold to Disney in the next few years at a price determined by Hulu's market value.

It has been suggested that it's not in Disney's interest to grow Hulu too much until the conglomerate can secure that last outstanding vestige of the JV ... and at that point roll it into Disney Plus, or do whatever else it wishes.

At last report, Disney and Comcast seem to have exited arbitration without a deal.

Also read: Comcast Might Hold Onto Hulu? 'We're Happy to Be Along For the Ride,' CFO Says

In the meantime, Hulu's top marketing executive, Kelly Campbell, who had moved from CMO to Hulu president to replace the departed Mike Hopkins in 2017, abruptly jumped to NBCU and Peacock last month.

"Now, Hulu controlling partner, Disney, must install a new sucker, er, executive to run its oldest, most lucrative, and most widely used service while it continues to figure out just where Hulu fits in the Mouse House streaming future," our David Bloom wrote at the time.

Also read: Hulu Needs a New President, But Who Wants the Job?

Beyond what Bloom described as Hulu's "clear as mud future," there does seem to be a palpable pullback in promotional heft. Disney said this week that marketing costs were up for its prioritized DTC business in fiscal Q4, and Hulu live streaming has been amply promoted during the ongoing pigskin season. But it has now been two years since our live, linear TV viewing lives were filled up with commercials featuring Alec Baldwin, reprising his 30 Rock Jack Donaghy role.

Indeed, Disney took over Hulu at a time when originals such as A Handmaid's Tale seemed to be generating momentum, too.

But lately, the platform seems bereft of its next big hit. Quirky comedy Only Murders in the Building generated plenty of late-summer/early fall buzz, with stars Steve Martin and Martin Short appearing on all sorts of talk shows in the run-up to an August 31 premiere.

Hulu released the first three episodes of the podcast-themed comedy on that date, and according to Nielsen, Only Murders generated a solid-but-unspectacular 444 million streaming minutes in its first six days on the platform.

Nielsen hasn't released streaming minutes data covering Only Murders' Oct. 19 finale. But the series, which was greenlit for a second season, never significantly grew its audience. In fact, Nielsen measured the full-week audience for the Season 1 penultimate installment at only 317 million viewing minutes.

You can see Next TV's full compendium of Nielsen's weekly streaming reports going back to the beginning of 2021 here.

Likewise, producer Ryan Murphy's also-buzzed-generating Impeachment: American Crime Story, which ran simultaneously on FX and Hulu this fall, also saw its audience decline precipitously.

Beyond the steadily cratering basic cable ratings, the limited series tracking Bill Clinton's sexual affair with an intern never once registered on any of Nielsen's sub-ranking of acquired or original streaming shows.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!