How Disney Plus Shakes Up the OTT Market

Opinion: Disney's impressive subscriber numbers are likely the result of several factors, says Parks Associates analyst Brandon Riney

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

“Baby Yoda.”

These are two words that many consumers have come to recognize, and frankly adore, as of Q4 2019. The surge in popularity of the lovable character is symbolic of the company behind it. During its fiscal Q1 earnings call, The Walt Disney Company reported strong growth for its direct-to-consumer division, which includes Hulu, ESPN+, and newly launched Disney Plus.

Disney uncommonly announced subscriber figures for each of its streaming services, illustrating its success in the space. Disney Plus ended the year with 26.5 million subscribers, claiming its spot as the fourth largest subscription OTT video service in the US, behind Netflix, Amazon Prime Video, and Disney’s own Hulu (the “Big 3”).

Also read: Disney Plus: How It Went From Zero to 28.6 Million in Less Than Three Months

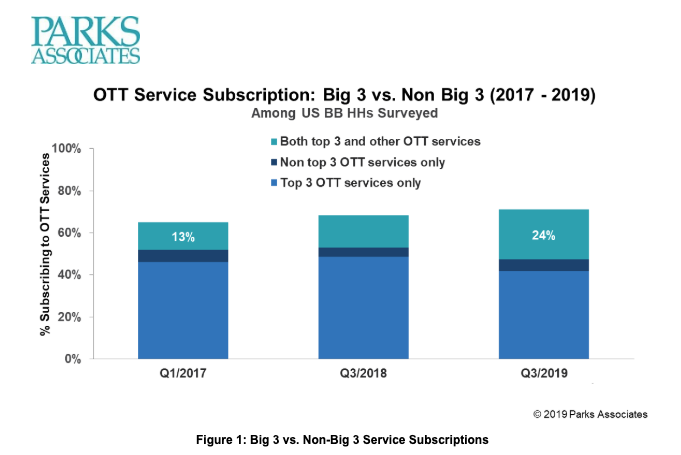

Parks Associates finds that a quarter of U.S. broadband households subscribe to at least one of these services and others, nearly twice the amount from two years prior (Figure 1). HBO Now, now the fifth largest service, required over three years to reach 7.8 million subscribers, something Disney Plus managed to overcome in its first day. Hulu ended the quarter with 30.4 million total subscribers, with 27.2 million attributed to the SVOD and 3.2 million to its Live TV plan.

Disney’s third leg of its streaming strategy, ESPN+, ended with 6.6 million subscribers, a tremendous year-over-year growth of nearly 500%. CEO Robert Iger expanded on these figures, stating that each Disney Plus, Hulu, and ESPN+ actually reached 28.6 million, 30.7 million, and 7.6 million subscribers throughout January, respectively. Continued growth of millions of subscribers within one month reflect the company’s ability to effectively reach new consumers.

Disney Plus’s accomplishment in subscriber numbers is likely due to several factors, including a marketing reach that goes beyond advertising and promotional budget. Among Disney’s assets are theme parks, cruise ships, cable networks, local affiliate stations, merchandise, and two other streaming services - Hulu and ESPN+. Together, these properties touch millions of consumers every day. Disney’s corporate brand is widely recognized and associated with family content.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Where other streaming services rely on promotion of particular content titles or original content, Disney benefits from a portfolio of recognized brands - Marvel, Star Wars, Pixar, and National Geographic. Disney Plus was able to attract subscribers despite a limited amount of new original content, in contrast to Apple TV+, Netflix, and HBO Now, although exclusive titles such as The Mandalorian (home of Baby Yoda) helped generate its hype. Most of its offering consists of content previously viewed by consumers, with titles dating back as far as 1928. The majority of this content had been placed in a vault, making it difficult to access by consumers. Disney Plus essentially opened this vault, providing unlimited access to all of its content – a key driver in its adoption.

Perhaps the largest influence of Disney’s direct-to-consumer success is its distribution strategy. The partnership with Verizon to offer a year free of Disney Plus to Verizon’s Unlimited mobile and FiOS home internet customers is what Disney’s CEO credits 20% of the service’s subscriber base. This distribution partnership is a trend that many services have relied on to drive adoption. Other partnerships of OTT video services with telco providers include: Netflix and upcoming mobile-service Quibi with T-Mobile, Amazon Prime (and consequentially Prime Video) with Metro by T-Mobile, Hulu with Sprint, and upcoming SVOD HBO Max with AT&T. Including access, whether limited to a year or continuous, allows these services to establish immediate bases of subscribers through the telcos’ millions of customers. T-Mobile, Metro, Verizon, Sprint, and AT&T get a value-added promotion to drive mobile subscriptions and association with popular brands.

Disney Plus was also offered in a discounted bundle with ESPN+ and Hulu’s ad-supported SVOD plan, which recently expanded to Hulu’s ad-free and live TV options. At its $12.99 per month lowest cost, this bundle creates an enticing proposition that includes a well-rounded out offering of family, sports, and general entertainment content. Consumers essentially receive three services at a price that is lower than Netflix’s Premium Plan or HBO Now, an easy perception of value. Offering Disney Plus in a package with the company’s two existing streaming services enabled Hulu and ESPN+ to boost subscribership by sharing in Disney Plus’s hype as the service made its splash in the market.

The Walt Disney Company hopes to leverage this distribution strategy as Disney Plus expands internationally. The company signed a deal with France’s leading pay-TV provider, Canal+, and is in talks with various other potential distributors throughout the region, such as Sky in the United Kingdom. Iger also announced in its earnings call that Disney+ will launch in India through the company’s Hotstar service, bundling it as a premium tier dubbed Disney plus Hotstar. This distribution strategy augments Disney Plus’s potential by positioning it in front of Hotstar’s ~400 million monthly active users. Just as Disney’s other US streaming properties benefited from Disney+’s launch, Hotstar is likely to follow.

Disney Plus’s quick success is reflective of both the shift to and demand for online video. What took leading services Netflix and Prime Video a decade to accomplish, Disney managed to do in a couple of months. As the market for OTT video becomes increasingly saturated, upcoming entries HBO Max and Peacock from WarnerMedia and NBCUniversal, respectively, are faced with a new bar for comparative success. Where achieving one million subscribers was once a notable milestone, consumers and industry players (and investors) will now assess success in comparison to Disney. HBO Max and Peacock will be considered underperforming if they do not significantly exceed 1-2 million subscribers within months of launch.

Parks Associates tracks the robust market of OTT video services, including Disney Plus, in its OTT Video Market Tracker. Additionally, the evolving dynamics of aggregation and bundling are examined in Partnering, Aggregation, and Bundling in Video Services from Parks Associates.