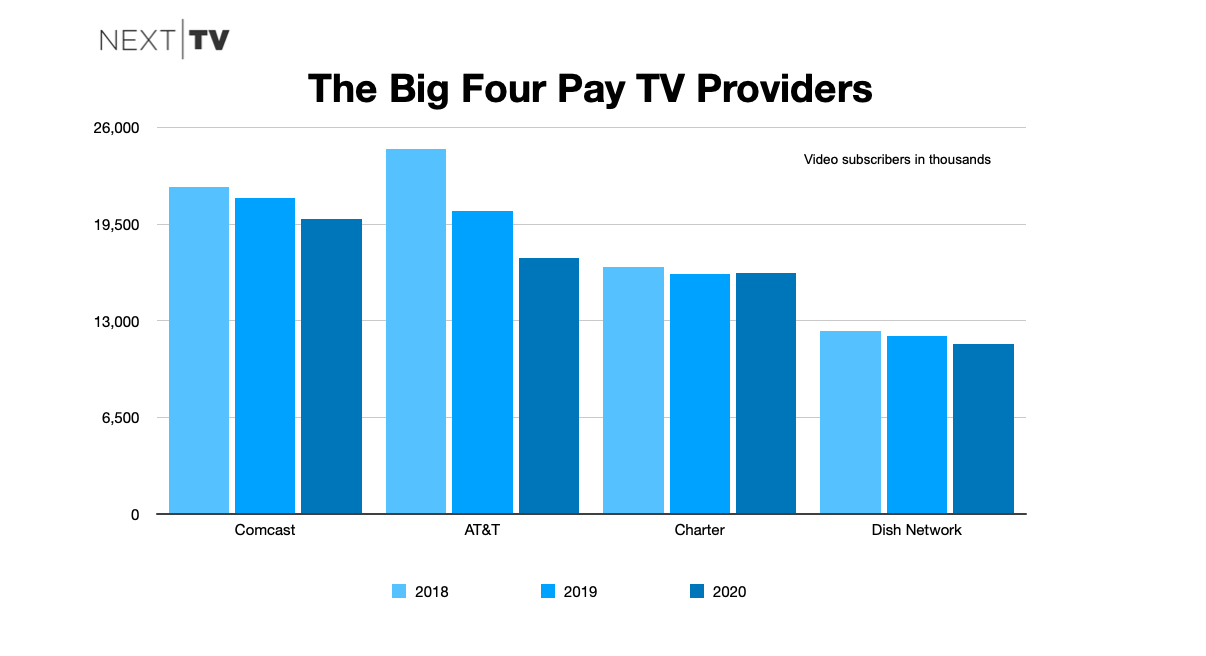

Cord Cutting Still Nearly Double For the Big Four U.S. Pay TV Providers Over 2018

Yeah, we already knew it was bad, but still … Comcast, AT&T, Charter and Dish collectively lost around 5.1 million customers in 2020, still more than double what they bled in 2018

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Cord-cutting for bundled pay TV services in the U.S. is now a widely accepted fact, with cable companies largely emphasizing broadband connectivity, and media companies having mostly moved onto prioritizing direct-to-consumer streaming.

But the pace of change has to be concerning.

Updated 2.23.21: An earlier iteration of this post miscalculated how bad AT&T's 2018 pay TV losses were. Turns out, they were even worse than we knew.

With Dish Network’s reporting of fourth-quarter earnings Monday, we can tally the trajectory of the four biggest providers of pay TV service in the U.S. and say decisively that the velocity of the erosion is still really, really fast ... the rate is slightly down from 2019's record pace, but still more than double the 2018 speed.

While Charter’s Spectrum TV service actually gained 56,000 subscribers in 2020 amid a massive expansion of the cable company’s high-speed internet customer base, Comcast, AT&T and Dish Network each experienced significantly accelerated pay TV customer losses.

Combined, the Big Four operators--those that are publicly traded and with video subscriber counts exceeding 10,000--lost 5.625 million customers in 2019. In 2020, they lost 5.139 million subscribers.

Including its DirecTV satellite platform, its sunsetting U-verse service, its IP-based AT&T TV product, and its discontinued AT&T TV Now virtual MVPD, AT&T lost 3.261 million pay TV customers in 2020. That's only slightly better than the nearly 4.1 million video customers lost in 2019.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Sure, AT&T's massive pay TV losses in 2019 and 2020 skew the picture. But Comcast saw its rate of attrition nearly double from 732,000 in 2019 to 1.408 million in 2020.

And Dish Network lost a combined 526,000 subscribers across its satellite and Sling TV vMVPD platforms last year. In fact, Sling TV lost 118,00 customers in 2020.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!