Amazon Prime Video: Everything You Need to Know About the Most Powerful Empire in Video Streaming

From Studios production to Prime Video SVOD, IMDb TV AVOD and Channels a la carte distribution, to the Fire TV ecosystem, why the sun never sets on Amazon's OTT business

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Amazon’s biggest and best-known video-streaming unit is Amazon Prime Video, which is roughly as old as the streaming version of Netflix. Amazon Prime Video actually launched back in 2006 as Amazon Unbox. Since then, Amazon Prime has undergone a string of makeovers worthy of a Hollywood starlet, including multiple name changes, technological shifts, and the 2011 acquisition of Love Film, a British service similar to Netflix.

And, like Netflix, Amazon Prime Video is now available in roughly 200 countries, with the main exceptions being mainland China, North Korea, Iran and Syria.

Also Read: Amazon Infiltrates Fire TV into Cable TV Market with NCTC Deal

Amazon Prime, a program that involves free shipping on select goods, has an estimated 126 million members, who also get access to Amazon Prime Video as part of their $119/year fee, though third-party research suggests only about half of those customers take advantage. Amazon Prime Video is also available a la carte, at $8.99 per month, or only 93 cents less than the pro-rated cost of the much broader Prime subscription.

Amazon spends an estimated $6 billion a year in programming, largely through Amazon Studios, presided over by former NBC entertainment chief Jennifer Salke for the past two years.

The studios have been productive under Salke, particularly in comedy, where The Marvelous Mrs. Maisel and Fleabag took turns the past two years winning the Emmy for Best Comedy Series, among many other awards.

Amazon also has invested heavily, both in production and marketing, in other originals, most notably for a spinoff series based on Lord of the Rings. For those rights, secured amid peak interest in HBO’s Game of Thrones, Amazon paid $250 million, and is spending a similar amount to produce the initial series episodes.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

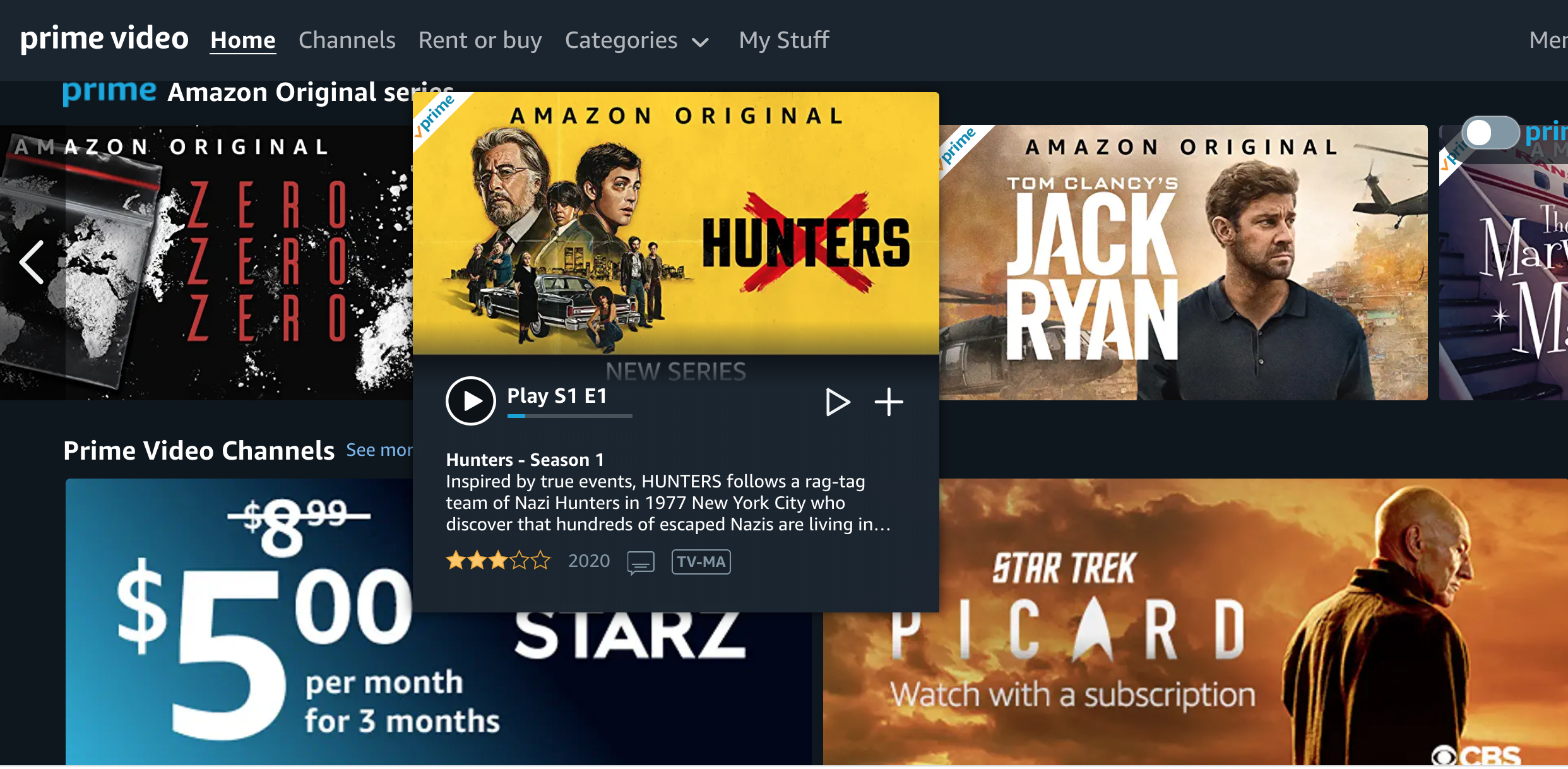

Amazon Prime Video’s newest big bet is Hunters, a revisionist historical take on Nazi hunters in the United States in the 1970s. It stars Al Pacino and Logan Lerman, and has been heavily promoted during the 2020 Oscars telecast and many other places. Other recent high-profile Amazon Prime Video programs include anthology show Modern Love, inspired by the New York Times column; Tom Clancy’s Jack Ryan featuring John Krasinski; and British sci-fi adaptation The Feed, featuring David Thewlis. There’s also plenty of licensed content to fill out around the originals.

The Sun Never Sets

But Amazon’s streaming-media reach hardly stops with Amazon Prime Video.

Amazon Channels is an Amazon Prime Video add-on, giving customers easy subscription access to still more TV, from roughly 150 providers, including such traditional pay-TV powers as HBO, Showtime, and Starz; basic-cable spinoffs such as BET+, Lifetime Movie Club, Noggin, and Hallmark; newer streamers such as CBS All Access, BritBox, and CuriosityStream; and specialty channels such as Upfaith & Family, and Yoga Anytime Channel.

Amazon Channels has been a lucrative outlet, for both the networks and Amazon itself. In late 2018, BMO Capital Markets estimated that the Channels unit generated $1.7 billion that year, as much as 30 percent going to Amazon. More importantly, Amazon Channels was generating anywhere from 25% to 40% of the subscribers watching those participating networks, BMO estimated.

But not everyone wants to build their own replacement cable bundle. For the audience segment that prefers their video content free and don’t mind ads, in early 2019, Amazon launched AVOD service Freedive, with content licensed from Warner Bros., Sony, and MGM, interspersed with ads. Less than six months later, Freedive rebranded to IMDb TV, which competes most closely with the Roku Channel and reinforces another big Amazon brand.

Also Read: The Five Spot: Q&A with Mark Eamer, VP of IMDb TV

Amazon still has its transactional side, too, selling traditional DVDs, Blu-Ray discs and CDs for the antediluvian audiences who still like old-fashioned packaged media. Its e-commerce operations are also a major Electronic Sell-Through and rental outlet.

It’s also worth noting that Amazon’s online-media offerings extend well beyond video.

There’s Twitch, the live streaming platform focused on live multiplayer videogaming, that Amazon purchased in 2014. Twitch’s technological knowhow might come in handy as Amazon gets into things like live sports broadcast licensing. In June, Amazon started staffing up its software engineering and product management ranks to begin offering live, linear streaming.

The Amazon Prime empire also includes IMDb, the vast reference database of film, TV shows, and other media content. Amazon Music provides subscription music streams on par with Spotify and Apple. Amazon Prime members get a subset of that music for free. And the company owns audible.com, the giant purveyor of audiobooks and premium podcasts.

These disparate Amazon Prime offerings don’t seem to fit together particularly well. In part, as one former Amazon executive told me recently, the company frequently experiments with formats and approaches in new sectors.

“They tend to do a lot of experiments and learn from them,” the executive said. “Even if they lose money, it’s okay. They then grow from the knowledge.”

Amazon Prime has already killed off some experiments, like Anime Strike, an anime-focused stand-alone network on Amazon Channels that required its own separate subscription.

Anime Strike launched in 2017 and lasted barely a year before shutting down, its content now available partly on Prime Video and partly on indie anime service HIDIVE.

But one part of the Amazon Prime empire does knit together all its disparate media experiments: its burgeoning hardware offerings. They include Fire TV tablets, connected TV interfaces, streaming devices, and a proliferating universe of first- and third-party devices built around the Alexa digital assistant.

With more than 40 million active users worldwide, Amazon Fire TV is the No. 1 OTT device ecosystem globally. It ranks only behind Roku in the U.S.

To borrow a well-used phrase from another famous brand, the range of Amazon media offerings allows customers to have it their way, on any of hundreds of devices and through just about every business model out there. Amazon Prime’s vast reach and resources allow it to be everywhere, and to try everything., to see what works for consumers.

As with some other massive players in the online space (Apple, Disney, increasingly Comcast), Amazon Prime’s media offerings are a way to make money, sure, but more importantly, they’re a way to keep customers coming back for everything else the company has to offer. Don’t call their media ventures a loss leader; call them a profit pusher.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.