Viewer Watch 2021: The Charts

Charts for the multichannel landscape, multichannel business, advertising landscape, content game, and more

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

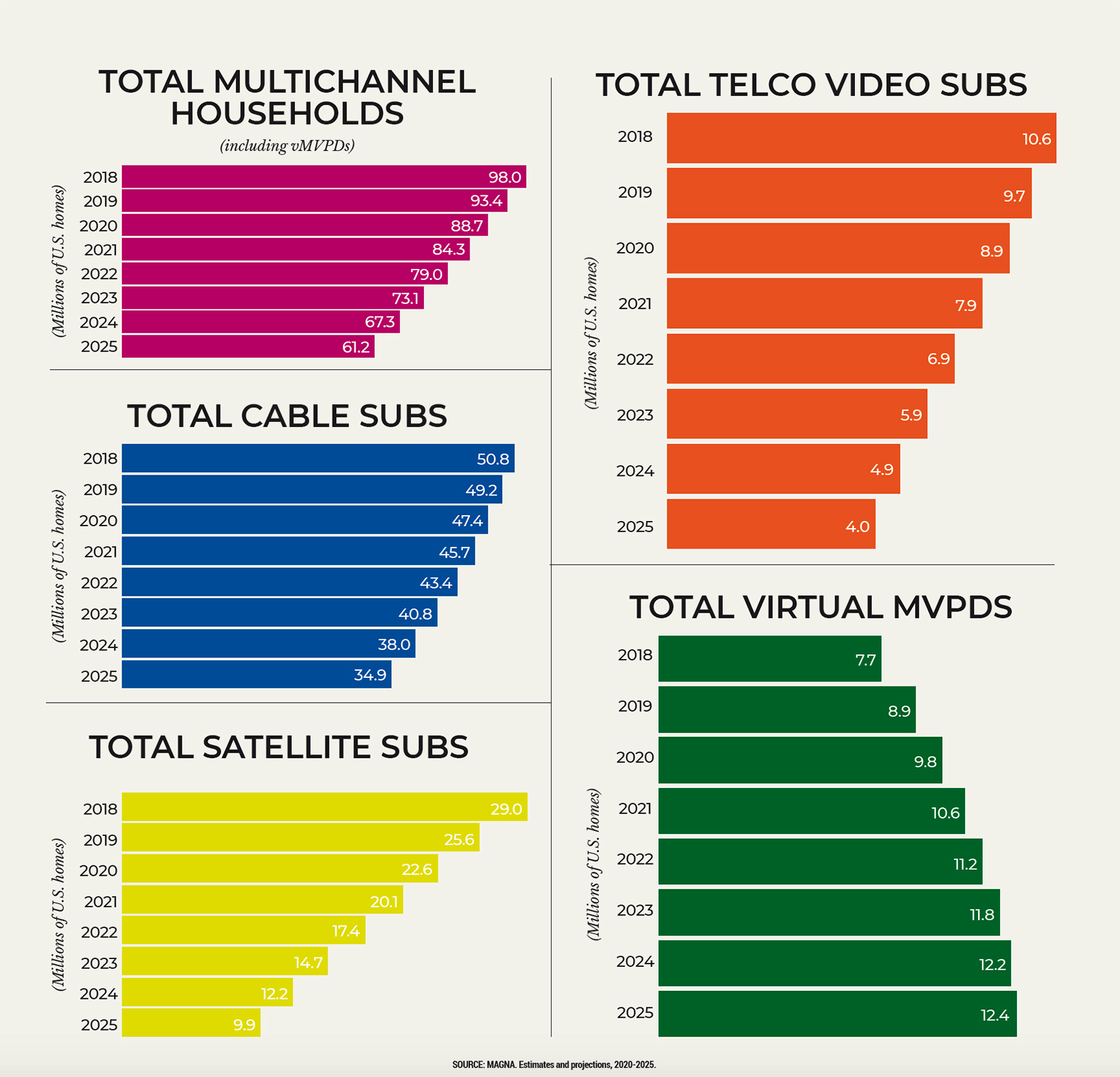

The Multichannel Landscape

Total multichannel television households, including virtual multichannel video programming distributors (vMVPDs), will fall to only 61.2 million in 2025, according to projections from Magna. Virtual MVPDs will see a modest uptick to 12.4 million by 2025, while cable subs will drop from 45.7 million in 2021 to 34.9 million in 2025.

Viewer Watch 2021: More Streaming, More Uncertainty | Digital Diversity Key to Streaming Success | Beyond Cord-Cutting: Reinventing Multichannel TV | Looking Ahead to Post-Pandemic Tech | Streaming Platforms Are Doing It Live

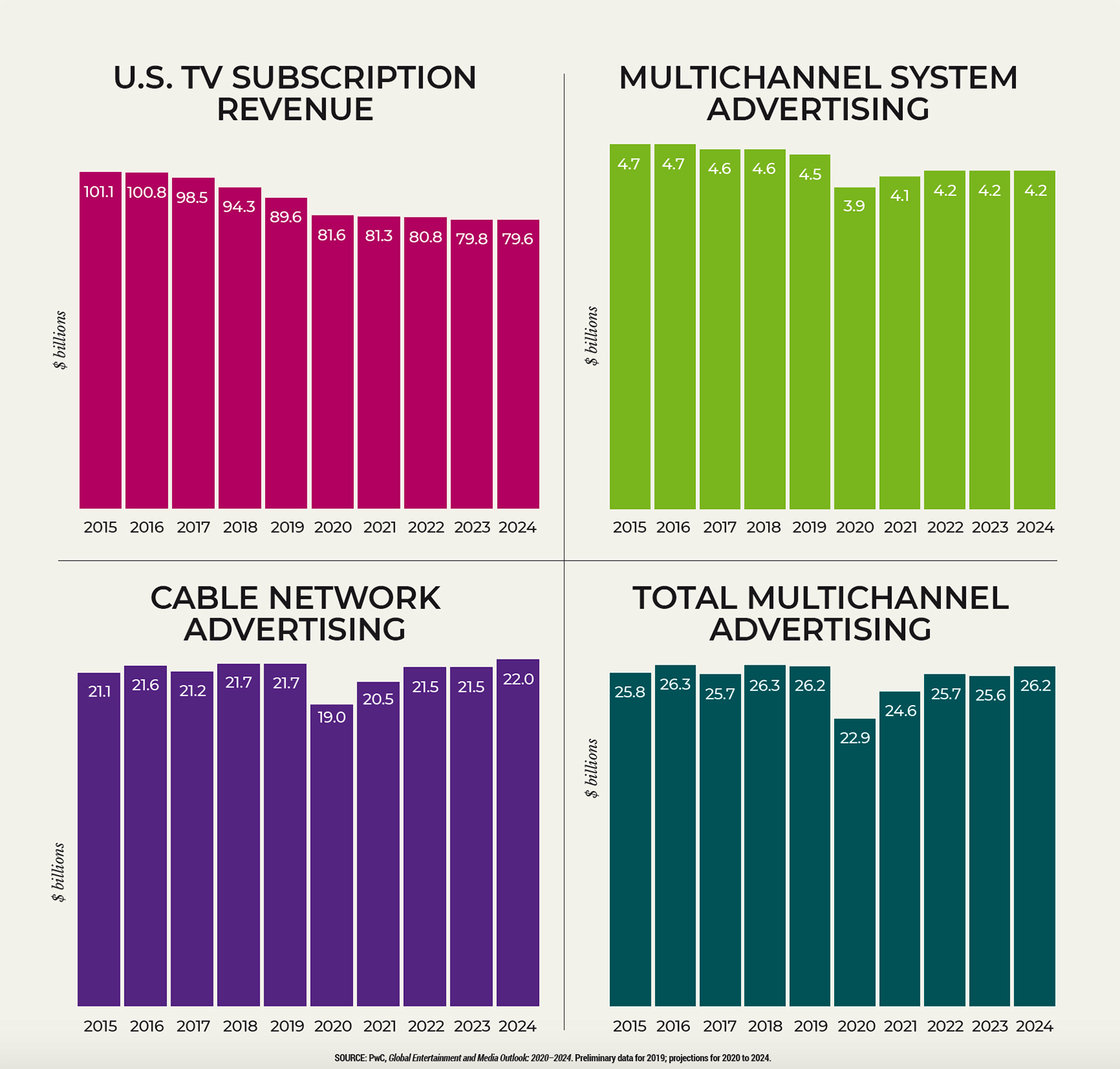

The Multichannel Business

Subscription TV revenue, which peaked at $101.1 billion in 2015, will fall to $81.3 billion in 2021 and further fall to $76.9 billion in 2024, PwC predicts. The sub losses will also hurt multichannel advertising, which is projected to grow from $24.6 billion in 2021 to $26.2 billion in 2024.

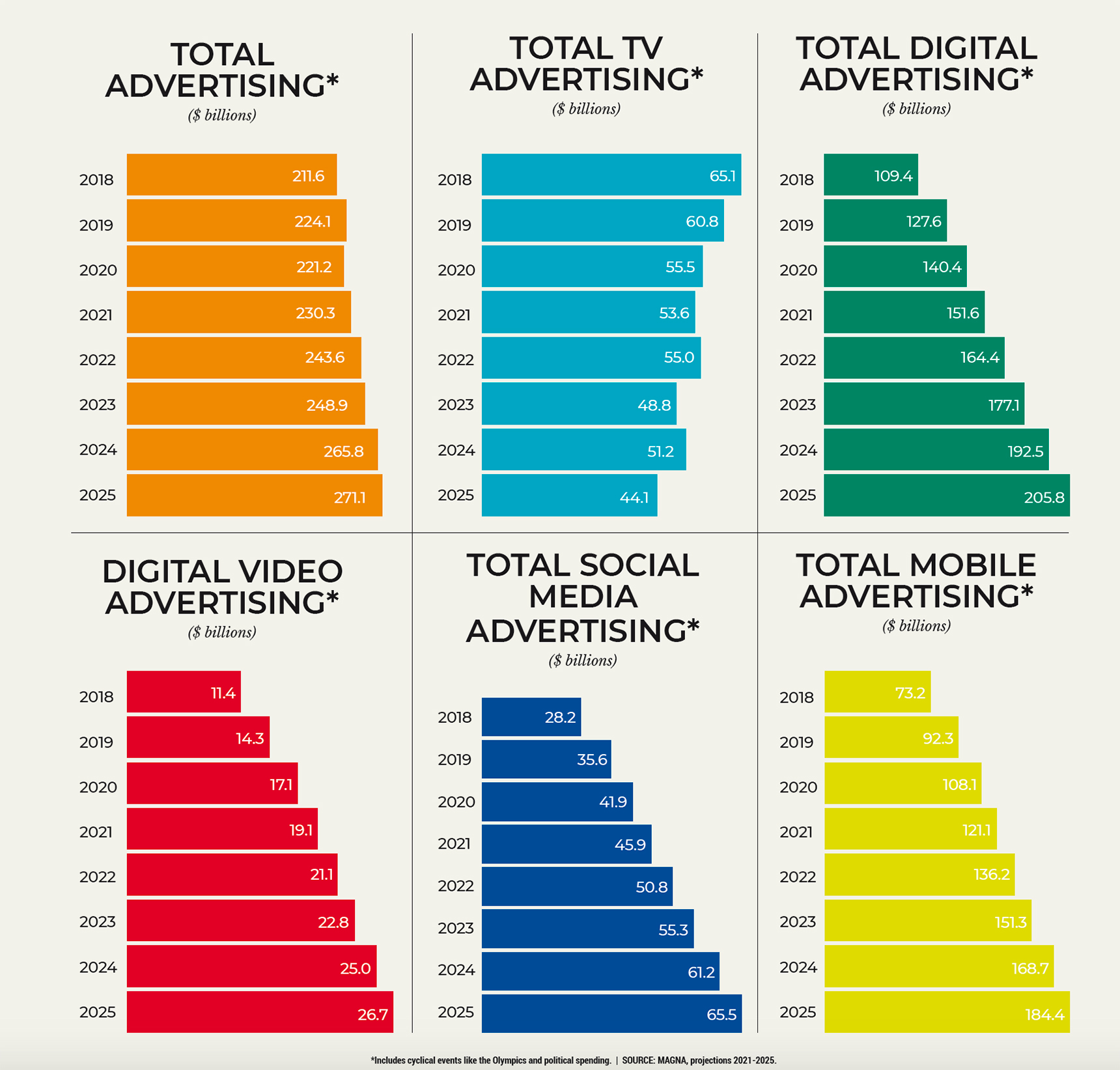

The Advertising Landscape

Digital advertising will be more than four times larger than TV advertising by 2025, when spend on digital will hit $205.8 billion, versus $44.1 billion for TV. Digital video, meanwhile, will rise from $17.1 billion in 2020 to $26.7 billion in 2025.

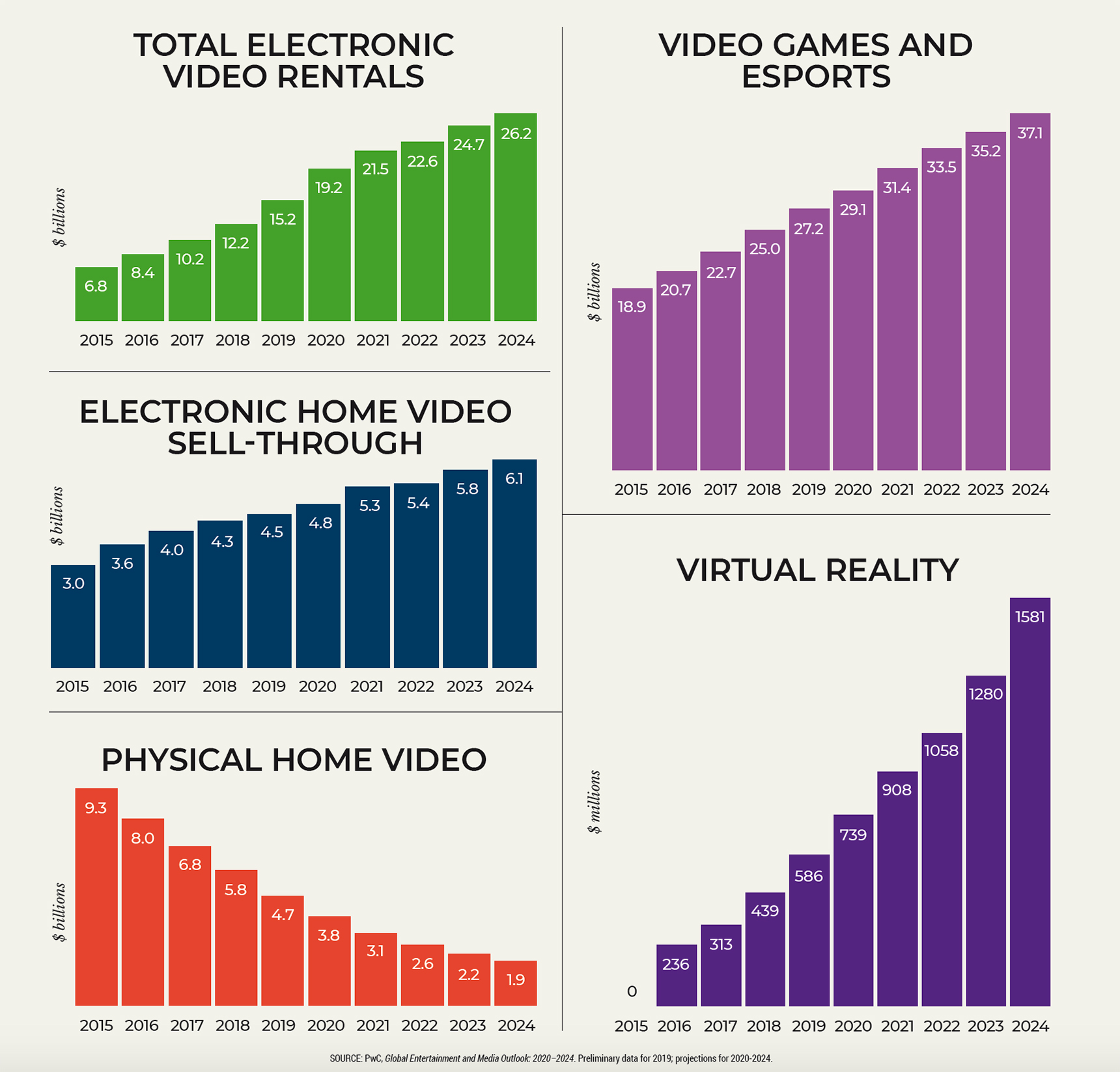

The Content Game

Electronic delivery of home video content continues to grow, hitting $26.2 billion in 2024 for rentals and $6.1 billion for the sell-through sector, according to PwC, while gaming and eSports will top $37.1 billion by 2024.

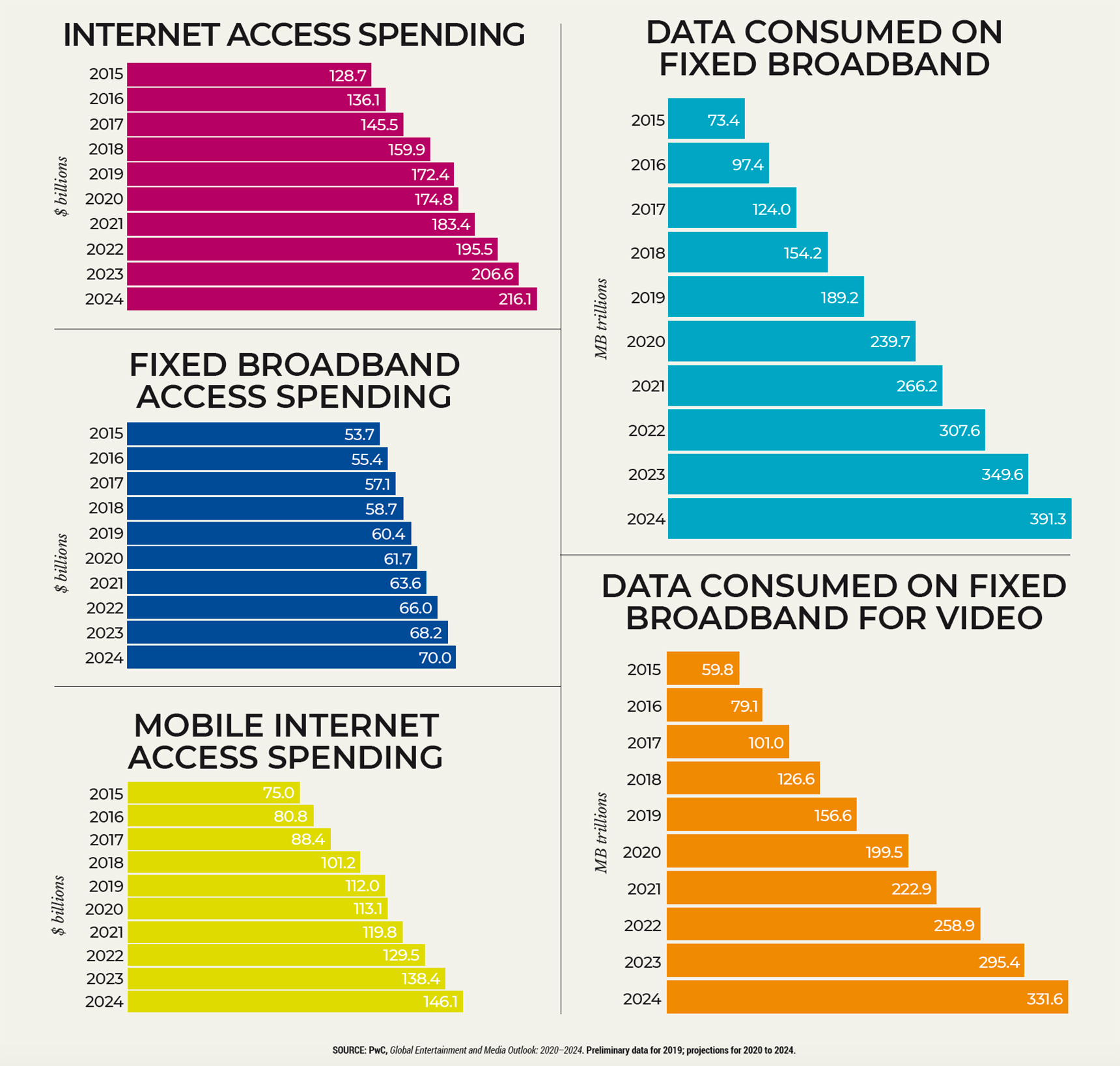

The Broadband Landscape

Revenue from fixed broadband, which has been a bright spot for cable operators in recent years, will continue to grow, hitting $70 billion in 2024, according to PwC. And the amount of data flowing over broadband networks will continue to skyrocket, from 239.7 trillion Megabytes in 2020 to 391.3 trillion MB in 2024, with much of that — about 331.6 trillion MB — consisting of video.

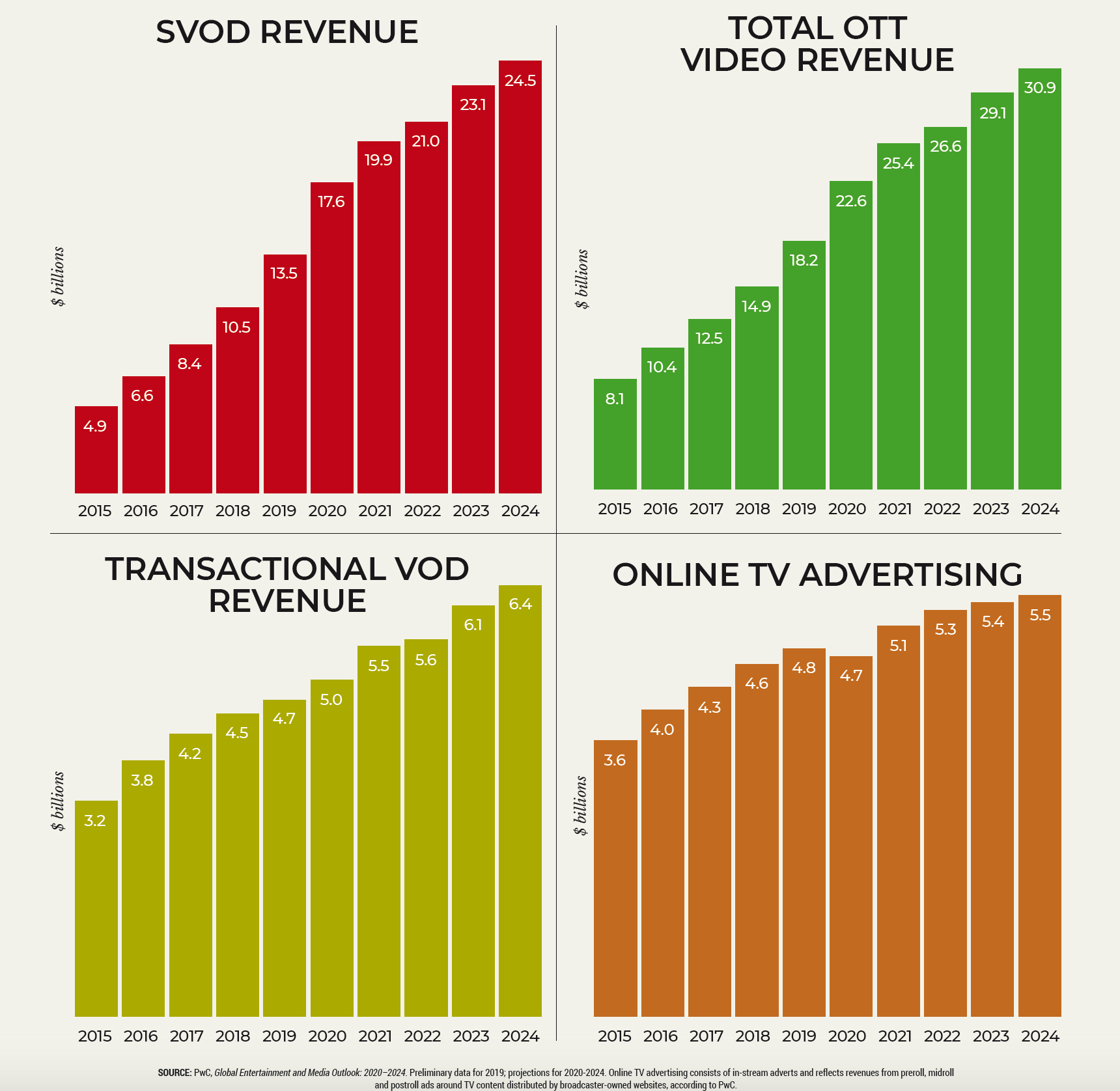

The OTT Landscape

Subscription video-on-demand revenues will rise to $24.5 billion by 2024, while total revenue from over-the-top sales and subscriptions will hit $30.9 billion in 2024, according to PwC.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

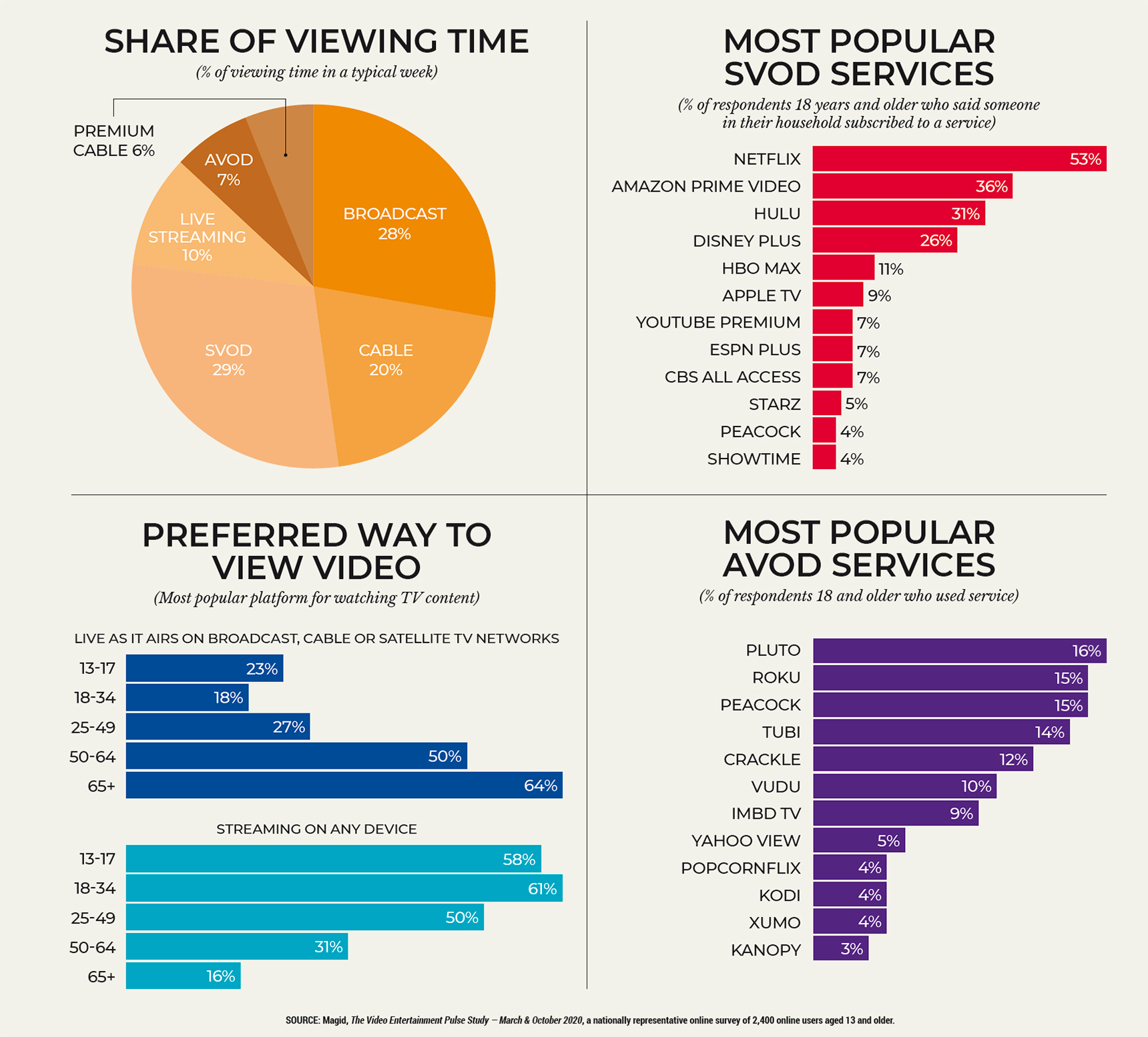

The Emerging Platform Landscape

Consumers report that about 46% of their weekly viewing time is now spent watching subscription VOD, live-streaming or ad-supported VOD services, per survey data from Magid. Only 23% of viewers ages 13-17 say watching shows in real time on broadcast or cable is their preferred way to view video.

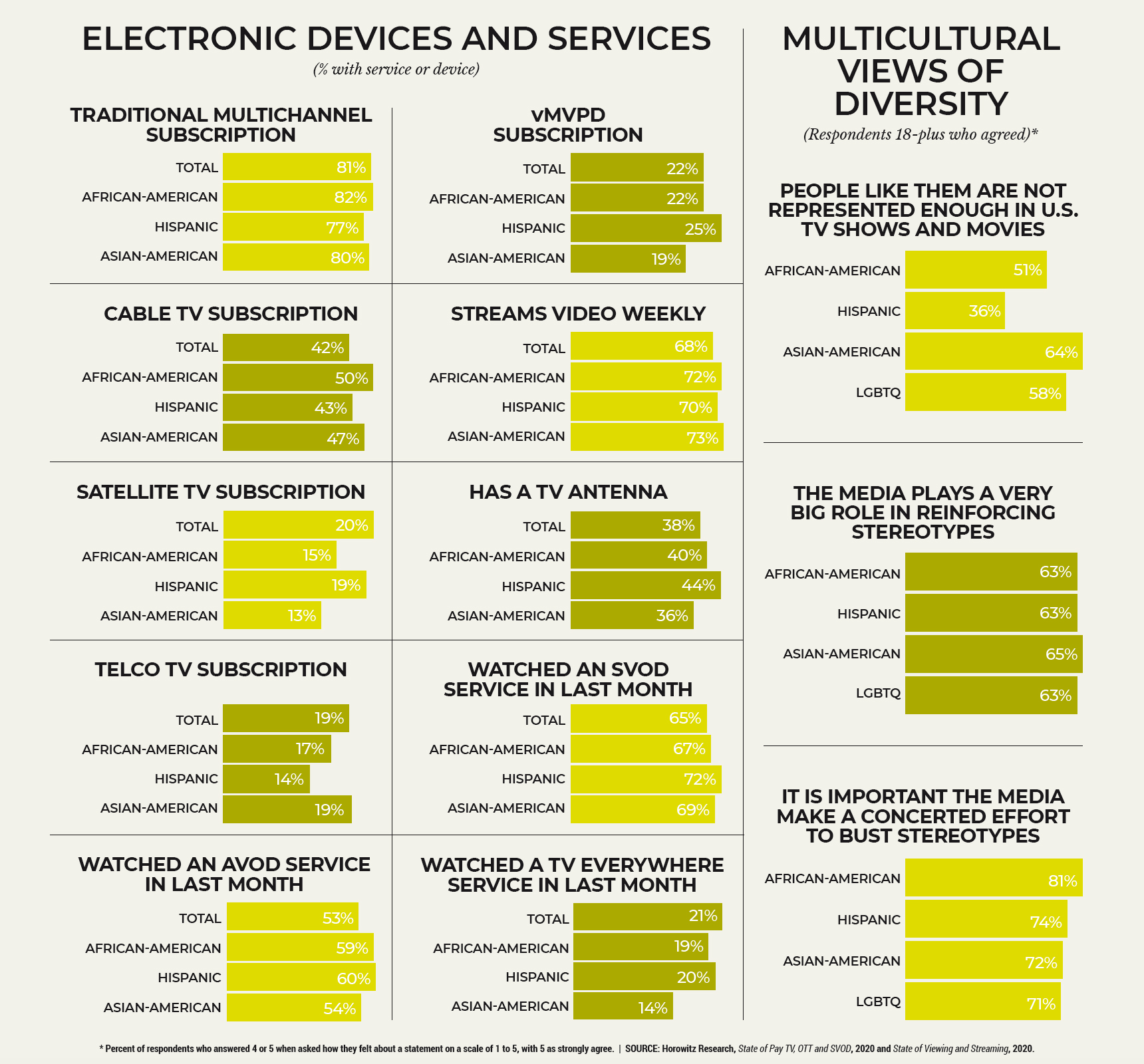

The Multichannel, Multi-Device Landscape

African-Americans are more likely to have a multichannel subscription than consumers overall, but consumers in that demographic also subscribe to streaming services at higher rates, according to Horowitz Research.

The Cord-Cutting Landscape

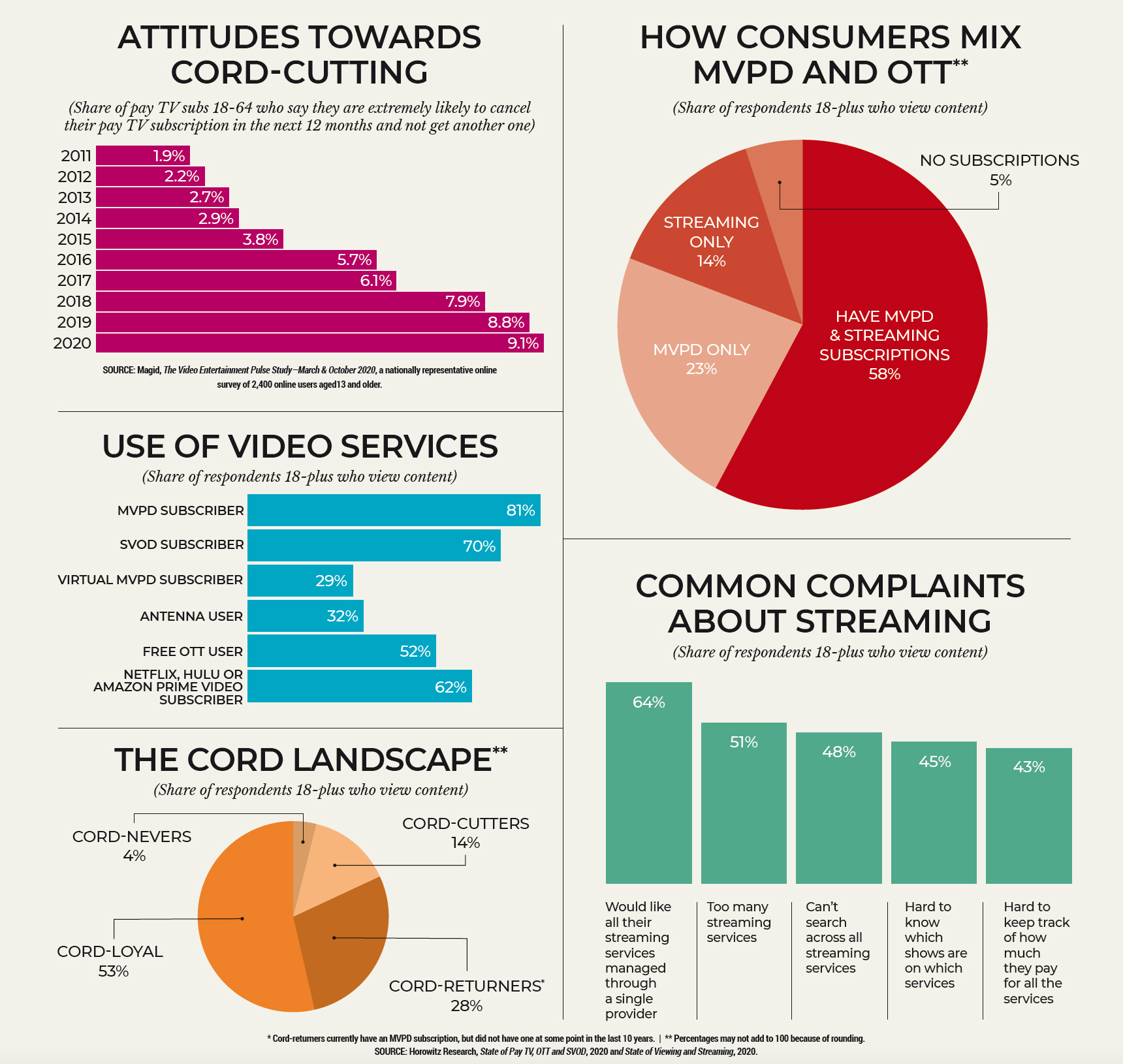

In 2011, less than 2% of all pay subscribers told Magid researchers they planned to get rid of their pay TV subscription. Today, that figure stands at 9.1% while Horowitz Research reported that more than half of households (58%) subscribe to an SVOD service and a vMVPD.