Patriot Games

Patriot Media CEO Holanda sees growth ahead for Astound after $8.1 billion deal

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

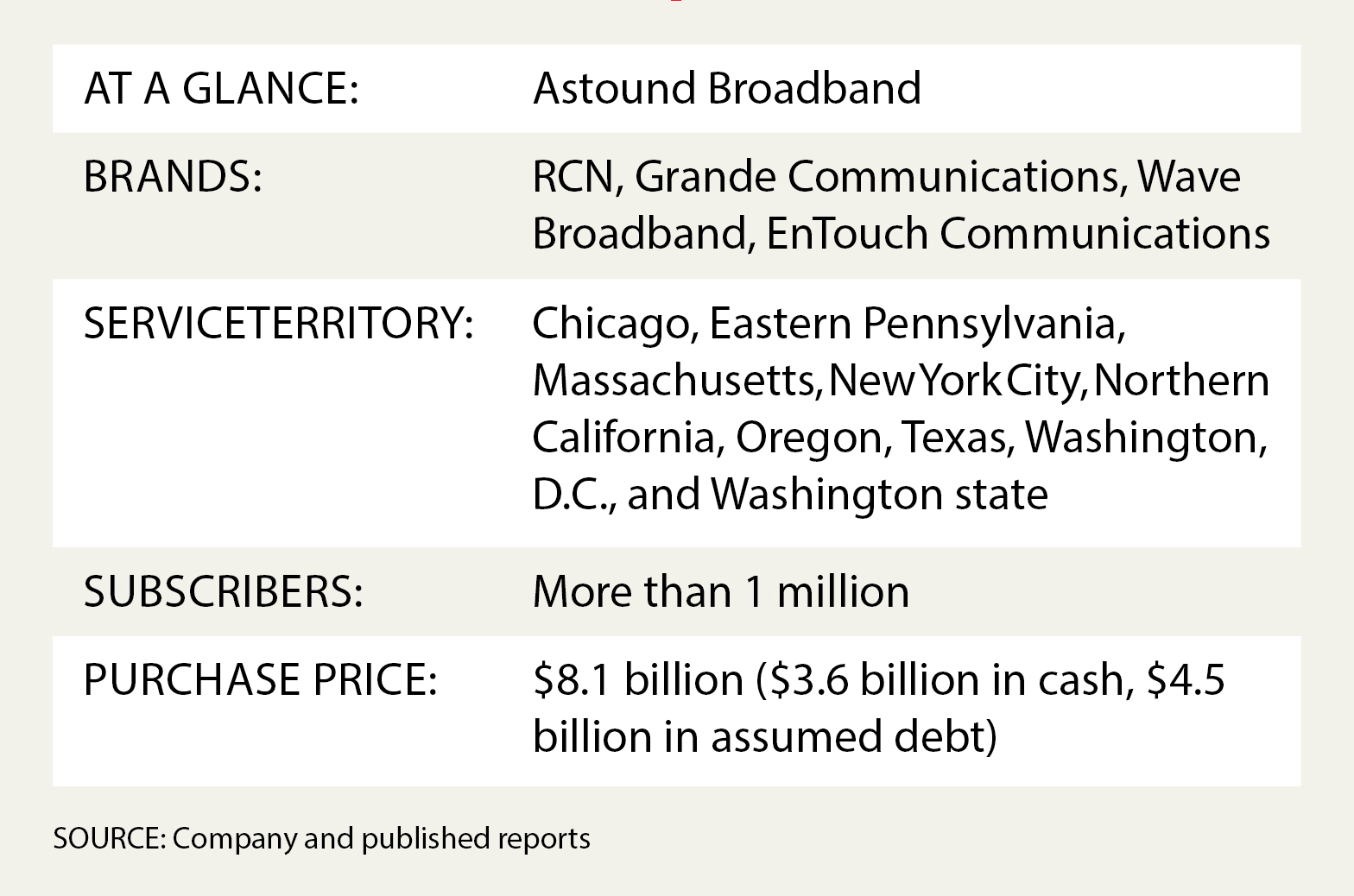

As CEO of Patriot Media, Jim Holanda has had a lot of experience running Astound Broadband, the cable and internet service operator purchased by Stonepeak Infrastructure Partners for $8.1 billion. Patriot, which has been running the assets for about a decade, will continue to do so after the Stonepeak deal is closed, and will also have an ownership interest in the assets. Holanda spoke with Multichannel News senior content producer, finance, Mike Farrell about the Astound deal and his plans for the company going forward. The following has been edited for space and clarity.

MCN: How did this deal come about?

Jim Holanda: [Private equity firm] TPG has been a wonderful partner over these four-plus years, and their strength in providing capital allowed us to buy Wave Broadband and put this company together, make it the sixth-largest cable company in the country and give us a real national, coast-to-coast footprint. Clearly, when you’re with private equity, you’re always exploring optionality in terms of what people want to do. I think we were looking at that from the start of the year, looking at all of our options, as TPG has been an enthusiastic supporter of the business. And then COVID hits and you’re unsure of the world. We took advantage of the debt markets and the low interest rates at the end of August and the beginning of September, when we refinanced the company with even lower rates. At that point, [TPG] introduced a portability structure within the debt so that the debt could just be assumed by anyone that would take over the company at some point in the future. With that in place, that woke up people to the fact that there was no financing risk in purchasing the business.

MCN: What’s the plan going forward?

JH: We have the opportunity for organic growth within the footprint. We have the opportunity to expand our residential and commercial networks into new territories continuous with our existing footprint. We’ve been expanding fiber networks outside of traditional footprints, in partnership with anchor tenants, on some very large deals to build an even more robust and geographically diverse fiber network and we’ve made these material and tuck-in acquisitions. TPG buying Wave three years ago and putting the three brands together as a single company was transformative in nature. We announced the Entouch acquisition back at the beginning of the pandemic and closed on it just a month ago and that gave us a great fiber footprint in Houston, Texas, which was the only big city in Texas our footprint didn’t cover. We recently fi led with the FCC on a small fiber acquisition [Digital West] in central California that will fill a fiber gap for us. So I think we’re able to grow the company from all of those standpoints.

MCN: Will you continue under the Astound brand name?

JH: We own the Astound name because Wave four or five years ago bought a small company in California named Astound. That’s how people have come to know us on Wall Street and in the banking community. So whether we will pivot to that name in conjunction with the brands or as a replacement for the brands is a decision we have not made yet. We’re continuing to evaluate, but everybody seems to like it. Time will tell.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

MCN: With COVID, has the business changed for you?

JH: Today, commercial services represent less than 20% of our revenues. Having said that, for the past three or four years, it’s the fastest-growing segment within our business. Long term, we think that will continue to be not the only focus for us, but an important focus for us. The pandemic hits and clearly we are seeing the same strength, resilience and growth on the residential side of the business as others are seeing. That points to the importance of broadband within the home and having these reliable connections. We’ve clearly benefited from that. And clearly that first quarter after the pandemic hit, commercial services were hit pretty hard, but we came up with some creative solutions and creative programs and we’re seeing that slowly recover as the economy recovers.

MCN: Have you had a relationship with or known the people at Stonepeak before? JH: We had heard of Stonepeak, they obviously have a strong reputation. They own Cologix, which is a data-center business; they own ExteNet, which is building out fiber distributed networks and wireless connectivity. They recently bought Xplornet, which is a Canadian rural broadband provider. Obviously with the other fiber residential broadband infrastructure deals, clearly there has been a lot of activity on that side and we were hoping we would be able to find an infrastructure provider with a long term view of the business as a logical next partner in our evolution. In the months we've gotten to know Stonepeak, we’ve been very, very impressed with them. They have deep conviction in the business, a great deal of knowledge given their prior investments in infrastructure and have a very strong balance sheet in terms of their ability to allow us to grow across all of these various disciplines.

MCN: You have more than 1 million subscribers. Is that enough scale to do what you want to do?

JH: Almost all of our customers have broadband and we’re a broadband company. Buying Wave and getting a coast-to-coast fiber network in eight of the top DMAs gives us the scale that we need to be very successful in the long term. We’re happy at this size. We’re bigger than other public cable companies, like Cable One and WOW. I think we have the scale we’re very comfortable with. But if there are opportunities to grow through mergers and acquisitions or organically, we’re going to continue to pursue those, because they historically have been very accretive for us and have accelerated our growth.