Netflix Gets the Chills

After a pandemic period of feverish growth, streamer’s gains expected to slow

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

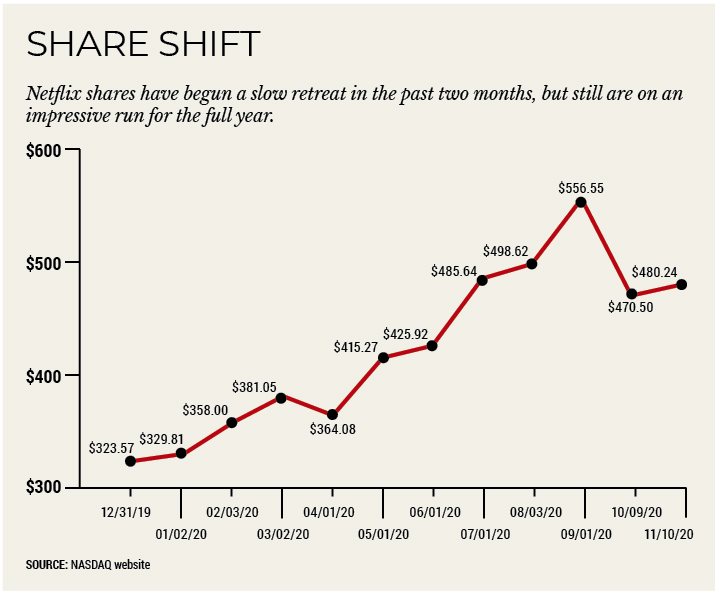

Netflix stock, on a 70% run-up through August, has been on a retreat over the past two months as its subscriber growth has waned. And though a short bump after a planned rate increase helped goose the shares in early November, a combination of near saturation in the U.S. and a shift in focus toward more profitability could impact the stock even further.

Netflix stock has performed well this year — it was up 48.4% between Dec. 31 and Nov. 10, when it closed at $480.24 per share. But since Sept. 1, when the stock peaked at $556.55, Netflix shares have declined nearly 14%. And as the company warns that subscriber growth will likely slow down in the second half of this year, euphemisms like “Netflix and chill” are taking on new meaning.

In a research note, MoffettNathanson media analyst Michael Nathanson said after that impressive run, it is likely that Netflix shares will take a breather.

“While it is no surprise that Netflix stock has been on fire over the past few quarters, perhaps now, after posting underwhelming 3Q net subscriber adds of 2.2 million and citing a pull-forward effect in their guidance for the next couple of quarters, this is the time for Netflix’s stock to chill,” Nathanson wrote.

The analyst stressed that he is in no way claiming that the Netflix growth engine has stalled, and said he expects the streamer to continue to grow revenue, subscribers and earnings over the long term.

“Our issue is the stock has clearly benefited from COVID-related tailwinds, emerging as a winner among a tall pile of relative losers,” Nathanson wrote. “That could all change in the final quarter of this tumultuous 2020 and into the early quarters of 2021 if some cyclicality impacts the market, breathing new life into the stocks weakened by the pandemic and the economy while perhaps hindering the winners’ upside during these unprecedented times.”

Netflix added about 2.2 million paid new subscribers in Q3, less than one-third of the 6.8 million it added in Q3 2019 and just below the 2.5 million it had projected. The decline came after two straight quarters of record subscriber growth — 15.1 million additions in Q1 and 10.7 million in Q2 — fueled by the pandemic. Netflix had warned that the second half of the year would see slowing growth: Its fourth-quarter target is 6 million additions, lower than the 8.8 million added in Q4 2019, but enough to push the company past the 200 million subscriber milestone to 201.5 million global paying customers.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Netflix’s domestic subscriber growth has been slowing for several quarters. It added 180,000 new paid subscribers in the U.S. and Canada in the third quarter, down from the 610,000 it added in the same period last year. The slowdown was even more pronounced when the pandemic months are taken into account. Netflix added 2.9 million and 2.3 million domestic customers in Q2 and Q1, respectively, the height of lockdown orders associated with COVID-19.

Recovery and Reversion

“The state of the pandemic and its impact continues to make projections very uncertain, but as the world hopefully recovers in 2021, we would expect that our growth will revert back to levels similar to pre-COVID,” Netflix said in its Q3 note to shareholders. “In turn, we expect paid net adds are likely to be down year over year in the first half of 2021, as compared to the big spike in paid net adds we experienced in the first half of 2020. We continue to view quarter-to-quarter fluctuations in paid net adds as not that meaningful in the context of the long run adoption of internet entertainment, which we believe is still early and should provide us with many years of strong future growth as we continue to improve our service.”

Shortly after the Q3 results were released, Netflix initiated its second monthly rate increase in two years. Consumers on the standard plan would see rates climb to $13.99 per month from $12.99, while premium plan subscribers would pay $17.99 per month, up from $15.99. Entry-level rates would stay the same at $8.99.

Wall Street shrugged the rate increases off just as it had the slower subscriber growth. Netflix stock was up about 5% in the two days after the announcement, rising from $480.24 on Nov. 9 to close at $490.76 each on Nov. 11 as investors were encouraged by the rate hike and its prediction that it will add about 34 million subscribers in 2020, soundly beating the old mark of 28.6 million additions in 2018. That rise didn’t last too long though, as the stock fell back to about $480 per share on Nov. 13.

At the same time, other direct-to-consumer streaming services are seeing their subscriber growth wane as well. Disney Plus added 16.2 million subscribers in fiscal Q4, less than the 24 million it added in fiscal Q4. While that could be due to a possible pull-forward of some subscribers in the early days of the pandemic, with 73.7 million global customers, the Disney streaming service is rapidly gaining ground on the larger Netflix. At its current pace, Disney Plus should end the calendar year with nearly 100 million customers less than 14 months after its launch, a milestone it took Netflix about 10 years to reach.

Disney’s other streaming service, Hulu, added about 1.1 million customers in fiscal Q4, with about two-thirds of those adds coming from virtual MVPD Hulu Plus Live TV.

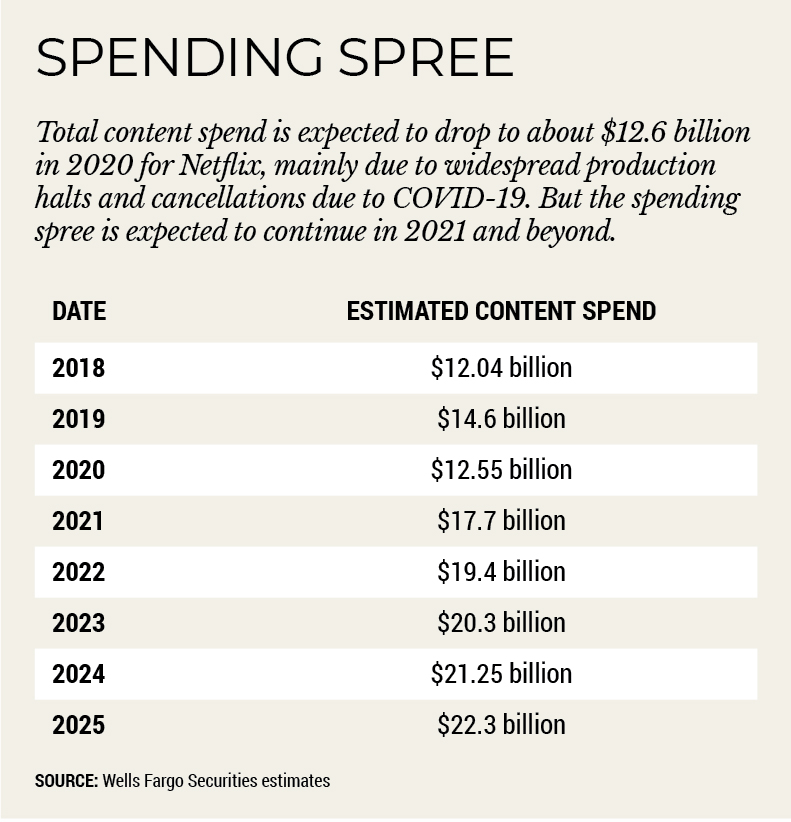

In a research note, Nathanson wrote that the slowing subscriber growth at the Disney services could mean that they will need to boost their content spend.

“Given the increasing competition in original content that is being funded by the likes of Netflix, Amazon Prime Video, Apple TV Plus, HBO Max and soon-to-be-launched Paramount Plus, it appears Hulu is in need of a massive original content spending boost of its own, which is now the table stakes in the general entertainment DTC space,” Nathanson wrote.

Further weighing on Disney Plus subscriber growth is the Nov. 12 expiration of a promotion allowing Verizon Wireless’ unlimited data customers to receive the service gratis for 12 months. Several million customers were believed to have taken advantage of that promotion and many could drop the streaming service.

Even if that doesn’t happen, Netflix still has a strong advantage over the competition: With 195.1 million global subscribers (73.1 million in the U.S. and Canada) it still dwarfs Disney and HBO Max combined.

And not every analyst predicts a big subscriber growth slowdown. Bernstein media analyst Todd Juenger wrote in a late October note to clients that he expected the pandemic’s impact to last longer, increasing consumer demand for streaming video and reducing the amount of content available from other sources because of production shutdowns.

Originals a Strength

Netflix’s slate of original content is strong, Juenger added. The streamer expects more originals each quarter in 2021 than this year.

“We believe there is a much greater chance of over-delivery, vs. under-delivery, over the near/mid-horizon,” Juenger wrote.

But with costs rising — Netflix spent about $15 billion on programming in 2019 and is expected to spend more than $36 billion annually on content by 2035 — and only one major revenue stream (subscription fees), rate hikes are inevitable. As the subscriber base continues to grow — at 73.1 million paid members in the U.S. and Canada, Netflix has about 55% of the TV homes in both countries — and with more streaming services competing for attention, the SVOD pioneer may have to look for other ways to wow investors.

“After a huge 2020 for sub growth, we think the new Netflix narrative is going to focus on how profitability scales,” Wells Fargo Securities media analyst Steven Cahall wrote in a note to clients. “The flywheel is well understood, but competition also abounds both in video streaming and entertainment more broadly. That leaves a lot of room for debate about what a Netflix sub is ultimately worth.”

In his report, Cahall calculated the lifetime value of a Netflix customer, adding that over the next 15 years, its average customer would be worth about $719, compared to the -$106 he estimated a Netflix customer is worth in 2020.

“[W]e see the story transitioning along with Netflix’s maturity to less about quarterly/annual sub gains and more about operating leverage through the business model,” Cahall wrote. “The recent Q3 miss on net adds but significant positive surprise on 2021E FCF is a great example of this shifting narrative.”

Netflix has operated its business at a loss of $1 to $3 per subscriber between 2015 and 2019 as it concentrated on building global scale, Cahall estimated. This year (2020), when the service is expected to cross more than 200 million global paid customers, should be the year it turns the corner.

With modest paid customer growth (churn at around 5% per year), annual rate increases of about 5% and a reduction in content spend from 60% of total revenue to about half of that by 2035, Cahall estimates that Netflix could boost profitability from $10 per subscriber in 2020 to $30 per subscriber by 2025, rising to more than $100 per subscriber by 2035.

“Taking the medium to long-term view, it’s now more of a story about the expected level of return that Netflix can achieve,” Cahall wrote.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.