Biden Win Would Have Minor Impact on Cable Profits

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The possible election victory of Joe Biden and Kamala Harris in has worldwide implications, but for the cable industry, it all comes down to dollars and cents.

While a Democratic victory usually means greater scrutiny on the regulatory side — and a new Federal Communications Commission, which would oversee the rules — for businesses, Biden could seek to implement a corporate tax increase. Cable companies, long averse to tax payments, are mostly regular taxpayers now. And that could mean a Biden presidency could eat into profits.

See Also: 'Blue Ripple' Would Make Regulatory Waves | Hooray for Hollywood | Networks All In as Election Day Turned Into Election Days | The New FCC?

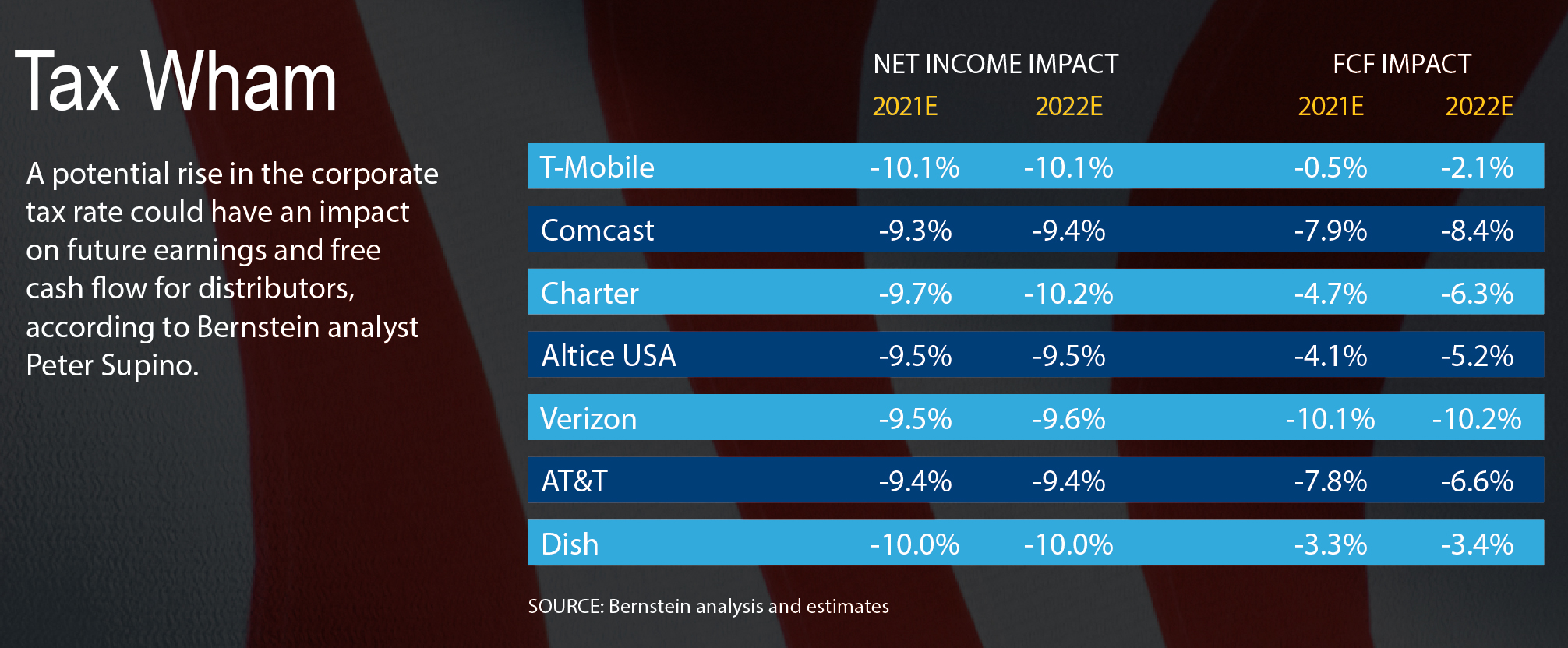

Bernstein media analyst Peter Supino did an analysis in mid-October of the potential impact of a Democratic victory on the cable business, determining that a 7% increase in the corporate tax rate, to 28% from 21%, would mean a 10% decline in profits for operators with mostly U.S.-based operations like Comcast, Charter Communications and Altice USA.

Comcast has been a regular federal taxpayer for years and Charter is expected to become one next year. Altice USA hasn’t had to pay federal taxes yet, according to Supino, but is expected to join its peers in paying Uncle Sam in 2021. AT&T is the wild card, the analyst wrote, “as they have had wildly different cash tax payments relative to expenses in the past.”

Still, the overall impact isn’t expected to be too great.

Shares in the top publicly traded distribution stocks were up even as the outcome of the election was awash in uncertainty early on Nov. 4. By late that afternoon, Charter was up 7.4%, Cable One had rose 7%, Altice USA was up 5.6% and Comcast was up 2.7%.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Our coverage companies are well-practiced in tax optimization strategies, so we expect certain company cash flows to be impacted less than accounting earnings,” Supino wrote, noting that after the 2016 election, companies with higher proportions of U.S. income outperformed others for a period of weeks. He didn’t expect as dramatic a decline in a Biden administration.

Other potential tax changes — an alternative minimum tax of 15% on companies with accounting profits of $100 million or higher, raising the tax rate on foreign income of U.S. companies to 21% and imposing a 10% surtax on companies that post jobs overseas to sell goods to Americans (which will mainly apply to companies with call centers) — could all have an impact.

Supino noted that although Comcast and AT&T have the biggest international revenue streams, they are small enough that the tax impact will be insignificant.

“Because a Biden victory in 2020 would be less surprising than was the Trump victory in 2016, and because the proposed change in corporate tax rates is smaller than was the Trump proposal, we believe that the underperformance of the same stocks after a potential Democratic victory in 2020 would be less sharp,” Supino wrote.

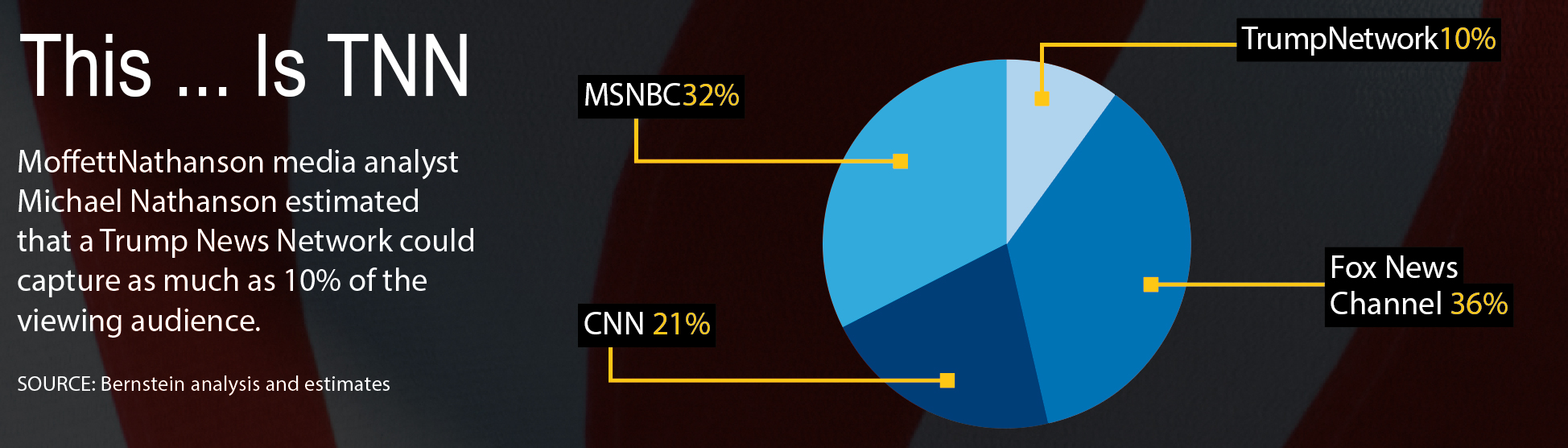

On the programming side, MoffettNathanson media analyst Michael Nathanson wrote that the biggest threat of a Biden presidency is to Fox Corp., parent of Fox News Channel, which stands to lose the most if Trump starts his own rival news network. In a research note, Nathanson estimated that a Trump Network could poach about 20% of FNC’s news audience and capture 10% of the total news market. That could cost Fox News around $225 million in lost ad revenue and about $200 million in EBITDA.

“Given the singular financial importance of Fox News to Fox Corp., the fear of a new rival competing with Fox News has created a new, bearish narrative that appears to be restraining Fox’s equity momentum,” Nathanson wrote.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.