The Top 5 OTT Start-ups Still Left on the M&A Market

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

A decade ago, over-the-top distribution was a start-up’s game, dominated by the Slingboxes and Aereos of the world, not to mention the wave of YouTube multichannel networks like AwesomenessTV.

Heck, it wasn’t that long ago that Roku, which went public as recently as 2017 and will be a billion-dollar revenue company this year, was considered a start-up. In fact, Netflix was once a start-up, too, although it went public in 2002, long before it began streaming video.

These days, of course, OTT video is dominated by Silicon Valley giants, which have—somewhat ironically—put the major media conglomerates and telecoms in the role of insurgents, with Disney, AT&T/WarnerMedia and Comcast/NBCUniversal about to launch new streaming services to try to disrupt the strongholds of Netflix, Amazon Prime Video and YouTube. Even Apple is playing the role of disruptor with Apple TV+.

Indeed, streaming is now a big company's game, with the next wave of disruption driven by some of the biggest corporations in the world. But there are a few scrappy streaming start-ups still out there, waiting to get bought.

Of course, they very infrequently say outright they want to get purchased. But it’s so obviously the plan! With that in mind, here are five notable independent OTT companies, which seem to be seeking a lot of attention these days. Note that we’re focusing on streaming start-ups here, and not ad-tech companies.

TUBI TV

Viacom had M&A talks with San Francisco-based Tubi TV in January, just before it announced its $340 million purchase of another AVOD platform, Pluto TV.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Speaking with MCN just after that Pluto TV deal was announced, Farhad Massoudi, co-founder and CEO of Tubi TV, said, “I can’t comment on M&A, but we are very confident in our path of staying independent.”

Certainly, the start-up—which was founded in 2011 as an ad tech company called AdRise, and has been privately funded to the tune of $26 million, according to its Crunchbase profile—has done everything it can to keep up its public profile.

Shortly after that conversation, Tubi TV closed on a $25 million loan with Silicon Valley Bank that it said would be used on a “nine-figure” content acquisition budget in 2019.

Indeed, Tubi TV has stayed steadily in the news, announcing myriad content deals, integrating its app natively into major pay TV platforms including Cox’s licensed version of X1, and expanding into Australia.

XUMO

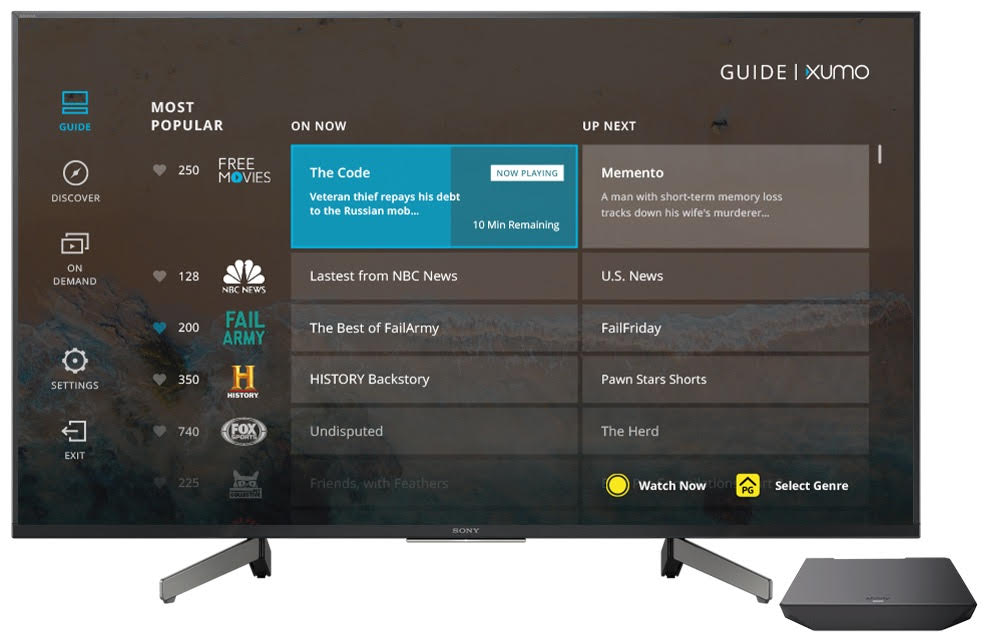

It was reported back in February that Sinclair was “kicking the tires” on this Irvine, California-based AVOD company, which supplies an app that runs natively on smart TVs manufactured by Panasonic, LG, Sharp and Hisense.

Xumo is actually a joint venture between Panasonic and Viant, a Meredith-owned company that now owns MySpace. Speaking to MCN late last year, CEO Colin Petrie-Norris said his marching orders are to “grow the business rapidly.” The focus recently has been adding niche sports programming channels to its live-streamed, pay TV-like programming grid.

And like Tubi TV, Xumo’s name has been active in the headlines over the last six months, hiring new executives, expanding its channel lineup, and natively embedding its app into Comcast’s X1 and Android TV set-tops.

PHILO

The San Francisco-based virtual MVPD operator launched in 2010 and has been privately funded with $83.2 million through seven rounds, according to the company’s Crunchbase profile. Investors include Discovery Networks, Scripps Ventures, Viacom, A+E Networks, AMC Networks and HBO.

In April, Philo became the latest vMVPD to adjust its business model and raise rates, consolidating its service tiers into one $20-a-month offering with 58 channels, no broadcast networks or sports channels.

Led by CEO Andrew McCollum, who was part of Facebook when it was considered a startup, Philo kept it close to the vest when MCN pinged it about possible M&A opportunities. A company rep sent us the announcement from last year that Philo went live on Amazon Fire TV and Apple TV. She said that was the last time the company talked finances publicly. It was the equivalent of saying, “no comment.”

As far as we can tell, Philo hasn’t released a subscriber figure. But the company does seem to give off a decided “for sale” vibe at industry events.

Speaking at MCN’s OTT Summit conference in Santa Monica, California earlier this month, Mike Keyserling, COO and head of content acquisition for Philo, managed to boast about huge growth without giving away subscriber figures.

“We grew by 30% in the last eight weeks, and we’re really at the most accelerated growth in our company’s history,” Keyserling boasted.

FUBOTV

The New York-based virtual MVPD startup has raised more than $151 million in private funding from investors including Scripps, Sky and AMC.

Slogging it out against huge rivals backed by publicly traded telecom and tech giants, including Sling TV, DirecTV Now, Hulu with Live TV and YouTube TV, in the low-margin vMVPD business, not having to endure quarterly earnings reports has been an advantage for FuboTV early on, CEO David Gandler told MCN in an interview conducted late last year, as the company was expanding operations to Spain.

Like the aforementioned streaming startups, FuboTV has kept its name steadily in the news this year. And it doesn’t want us to call it a pivot away from the vMVPD business, but FuboTV’s latest news all centers around Fubo Sports Network, a soccer and niche-sports themed 24-hour news channel that FuboTV itself has compared to Cheddar, the 24-hour digital channel that was recently purchased by Altice USA for $200 million. The channel is available on FuboTV, but also via the Roku Channel and Samsung smart TVs.

Speaking to Business Insider recently, Gandler admitted it'll be tough for FuboTV to stay independent. "It's tough in a sector that's skewed by M&A to take that off the table,” he said.

CURIOSITYSTREAM

Founded in 2015 by John Hendricks, the former Discovery Channel architect who once pioneered the basic cable universe, nature-documentary-themed SVOD service CuriosityStream has been privately funded with $254.7 million to date.

Announcing a $140 million funding round in February, CEO Clint Stinchcomb said the service reached 1 million paying subscribers at the end of 2018, and now has library content with more than 2,000 titles. By the end of this year, CuriosityStream expected its viewers will be able to choose from more than 3,000 titles including more exclusive originals available in 4K.

Stinchcomb said in May that CuriosityStream expects to have “several million" subscribers by the end of 2019, which would be a substantial increase over the 1 million it finished 2018 with.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!