Gig Economy Steady, Not Ascendant

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In this period of extraordinary low unemployment, the supposedly ascendant "gig economy" is not all it seems to be.

In fact, "contingent and alternative employment arrangements" have remained amazingly level during the two decades since the Labor Department's Bureau of Labor Statistics (BLS) began compiling statistics on temporary and contract workers, according to a new analysis of that data.

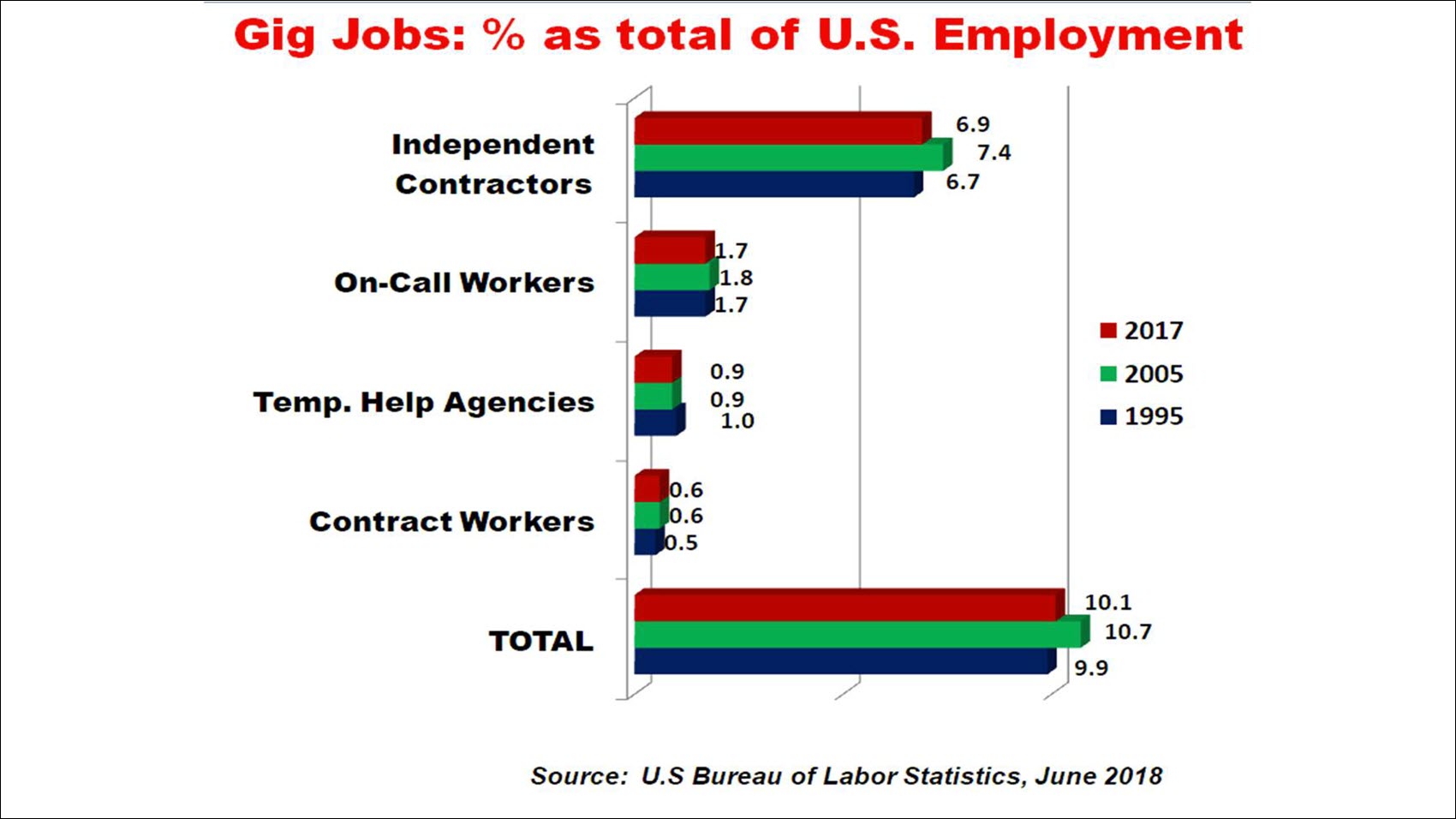

Altogether, about 22 million people work on a "gig" basis, the BLS said. The new report, issued earlier this month, found that the total number of gig workers has changed very slightly in the past 20 years. They constituted 9.9% of total U.S. employment in 1995; 10.7% in 2005 and 10.1% in 2017 (see chart). Independent contractors represented the largest group within the gig labor force: 6.7% in 1995; 7.4% in 2005 and 6.9% last year.

Although "gig" jobs are often generalized as freelance projects, or new-economy opportunities such as driving for Uber or Lyft, the BLS categories also include on-call workers or people brought in from temporary-help agencies to supplement permanent staffs or for seasonal staffing. But the BLS report conceded that the definition of gig jobs is vague, and hence its data may not accurately reflect the full labor situation.

"The concept and measurement of contingent work hinges both on the temporary nature of a job and on workers' perception of their job security," according to the BLS summary. "Some workers have been in jobs for a short time and do not expect these jobs to last. Others have been in jobs for many years yet still sense that their continued employment is tenuous."

Frustratingly, the current BLS gig jobs report does not break out industries or categories for such work; neither does it delve into whether gigs are a second source of income for people employed full-time elsewhere. The BLS said it expects to gather and reveal more data later this year about the gig job marketplace.

The BLS study has been challenged by outside analysts and other recent reports. For example, renowned analyst Mary Meeker of Kleiner Perkins Caufield & Byers, in her 2018 "Internet Trends" report last month, predicted that the gig workforce would climb 26% this year over 2017, adding 7 million people to the gig pool.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

An Edelman Intelligence analysis late last year, commissioned by Upwork and the Freelancers Union, concluded that 57.3 million Americans -- 36% of the U.S. workforce -- are freelancing.

Separately, a Treasury Department study last year, using administrative tax records, estimated that gig work represented less than 1% of the economy, but a Federal Reserve Board report put gig employment at about 30%, according to published summaries.

Predictably, millennials represent the largest pool of gig workers. Still other data showed that minority workers are a large share of the ill-defined gig workforce.

What It Means to Media/Technology Providers

Beyond the confusion about what these conflicting analyses mean, employers should be interpreting the role of gigs in both their job planning and (for media companies) their market outlook. Gig workers may be less dependable as potential customers if their chosen lifestyle keeps them on the move -- less likely to put down roots and subscribe to wired services.

Separately, as potential employees, they pose challenges for training and other requirements of "regular" workers. The category of "contractors" itself poses secondary employment factors since, for example, operators of wired and wireless systems have long relied on third parties to build and maintain infrastructure. Now those companies may also be relying on gig workers to handle or at least supplement their workforces.

The chattering class (many of us relegated to the gig world ourselves) quickly pounced on the BLS study as an indicator of either (a) the over-hype about gig jobs or (b) the looming changes in the American job scene. These observations add to the confusion about how important gig jobs will be.

Ultimately, the BLS report and its eventual update represent snapshots worth watching to identify where employees are coming from, and how to leverage the (slightly) shifting options in labor trends to match the (often) shifting needs to keep operations running.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.