Trump Administration Proposes New Vertical Merger Guidelines

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The Trump Administration is seeking comment on proposed new guidelines for vetting the competitive effects of vertical mergers--say, between a content producer and distributor.

Comments must be in by Feb. 11.

The guidelines reject the notion, according to one of the FTC commissioners who voted on them, "that vertical mergers are rarely anticompetitive and nearly always procompetitive."

Vertical mergers are ones that "combine firms or assets that operate at different stages of the same supply chain," like a product producer and distributor, whether that product is widgets or video.

The guidelines were produced by the Department of Justice and Federal Trade Commission, which together divvy up reviews of mergers for potential anticompetitive effects, both unilateral and coordinated, like foreclosing rivals and raising their costs and access to sensitive info.

Related: Delrahim Promotes AT&T-Time Warner Doctrine

Stakeholders, including the public, will have 30 days to comment on the guidelines.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

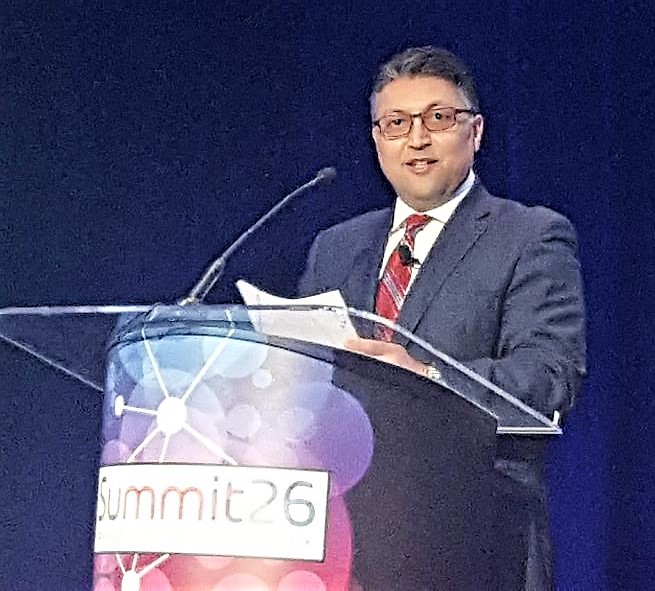

“While many vertical mergers are competitively beneficial or neutral, both the Department and the Federal Trade Commission have recognized for over 25 years that some vertical transactions can raise serious concern,” said Assistant Attorney General Makan Delrahim, who heads Justice's antitrust division. “The revised draft guidelines are based on new economic understandings and the agencies’ experience over the past several decades and better reflect the agencies’ actual practice in evaluating proposed vertical mergers. Once finalized, the Vertical Merger Guidelines will provide more clarity and transparency on how we review vertical transactions. I look forward to receiving comments on these draft guidelines and working with the Federal Trade Commission in finalizing them.”

He said the approach to vertical mergers has changed "substantially" since they were issued in 1984.

How a court viewed the potential harms of a vertical merger in upholding the AT&T-Time Warner merger was a big issue in that court case, which Delrahim and Justice had challenged as anticompetitive, which had been characterized as the first such challenge to a vertical merger in 40 years, though Delrahim disputed that.

Delrahim said while there was agreement that vertical mergers generally don't have the same issues as horizontal, that didn't mean they were per se legal.

“Challenging anticompetitive vertical mergers is essential to vigorous enforcement," asid FTC Chairman Joseph Simons. "The agencies’ vertical merger policy has evolved substantially since the issuance of the 1984 Non-Horizontal Merger Guidelines, and our guidelines should reflect the current enforcement approach. Greater transparency about the complex issues surrounding vertical mergers will benefit the business community, practitioners, and the courts. We invite comments from all stakeholders to help ensure that the guidelines clearly and accurately convey the agencies’ antitrust enforcement policy with respect to vertical mergers.”

The FTC pointed out that many of the comments it received from the its hearings on "Competition and Consumer Protection in the 21st Century" "called for additional and updated guidance on analysis of vertical mergers," as had reports from the American Bar Association and the Antitrust Modernization Commission.

The new guidelines signal that a vertical merger is unlikely to be challenged if the merged parties have less than a 20% share of the market.

Democratic Commissioner Rebecca Kelly Slaughter, who joined with fellow Democrat Rohit Chopra to abastain from the decision--the vote on the proposed new guidelines was 3-0-2--said that "safe harbor" was one of the reasons she could not vote for the item. "My apprehensions about this language are threefold: setting a safe harbor generally, the choice of 20 percent market share for the safe harbor, and the lack of a corresponding presumption of harm, or at a minimum close scrutiny, for mergers involving highly concentrated markets," she said.

Others were "the departure from Section 7 of the Clayton Act’s mandate to stop anticompetitive mergers in their incipiency," and that "certain issues lack sufficient emphasis."

But she did praise the guidelines rejection of a "verticals are generally fine" approach.

Chopra agrees the old guidelines need an overhaul and that the market does indeed look substantially different. But like Slaughter he said he could not vote for this remake. " I disagree with proposing the draft guidelines published today because they are not comprehensive or reflective of modern economic realities."

"The Draft Vertical Merger Guidelines add clarity by defining what it means for products to be related vertically and how the agencies will evaluate the competitive significance of that relationship," said Ted Bolema, a member of the Free State Foundation's board of academic advisors and a former trial attorney in DOJ's antitrust division. "This approach also allows the agencies to identify ‘safe harbors’ that, while not binding on the agencies, still provide companies considering vertical mergers to better recognize when antitrust pushback is more likely.”

“Less helpful is the rather negative way the Draft Vertical Merger Guidelines describe how the agencies will review the efficiency benefits of vertical mergers. The Draft Guidelines recognize almost grudgingly that eliminating ‘double marginalization,’ or having only one company profiting from marking up prices instead of two, often benefits both the merging companies and their customers, and only briefly acknowledged that other efficiencies are possible. AT&T’s demonstration of efficiency benefits helped it defeat DOJ’s challenge to its Time Warner acquisition, and the Draft Guidelines indicate the agencies remain overly skeptical in how they evaluate efficiency benefits.”

Contributing editor John Eggerton has been an editor and/or writer on media regulation, legislation and policy for over four decades, including covering the FCC, FTC, Congress, the major media trade associations, and the federal courts. In addition to Multichannel News and Broadcasting + Cable, his work has appeared in Radio World, TV Technology, TV Fax, This Week in Consumer Electronics, Variety and the Encyclopedia Britannica.