T-Mobile Touts Wireless Broadband, Pay TV Ambitions

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

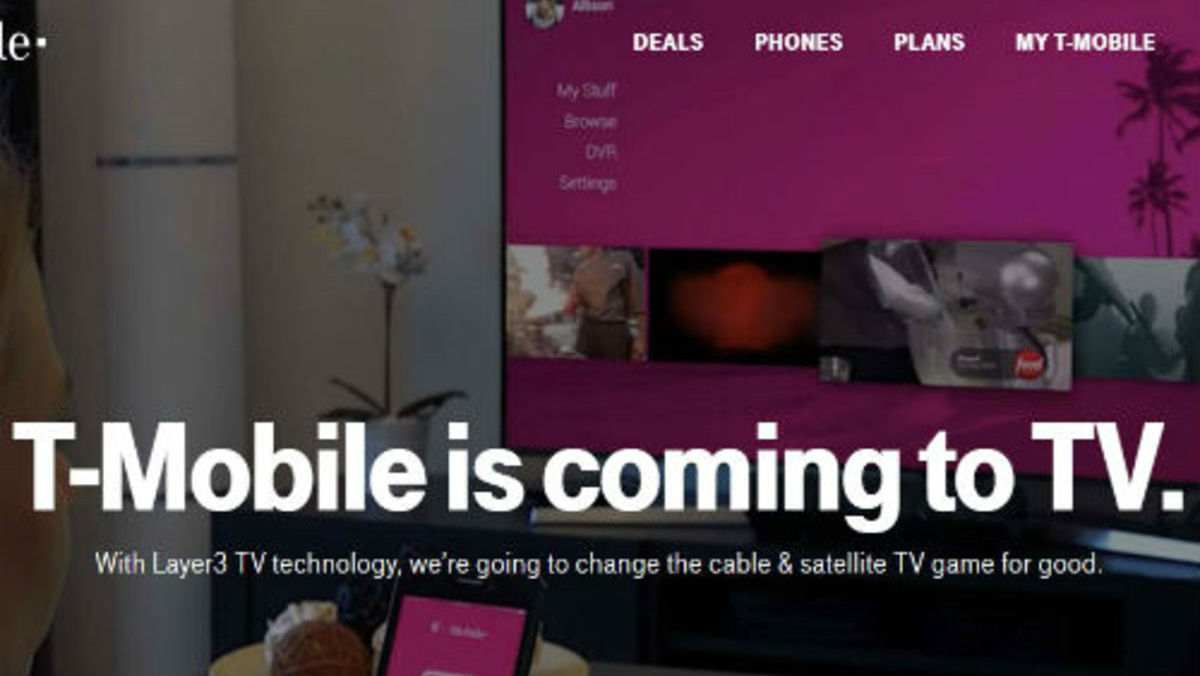

T-Mobile’s pending merger with Sprint and its recent acquisition of Layer3 TV will help to power a new “quad play” that includes speedy wireless broadband and pay TV services, company execs said on Tuesday’s Q1 earnings call.

RELATED: T-Mobile, Sprint to Combine in $146B All-Stock Deal

With an eye toward 450 Mbps via a national 5G network, “of course, we can be a competitor in that [broadband services] space,” Braxton Carter, T-Mobile’s CFO, said, when asked if wireless can be viewed as a wireline replacement. “And this is a market that is incredibly underserved…There’s a huge opportunity here for us to bring real competiveness to that market for the first time.”

T-Mobile’s ambitions for entering the TV business, via the Layer3 TV deal, is also poised to ratchet up with the proposed combination with Sprint, he said.

RELATED: T-Mobile Paid $325 Million for Layer3 TV

“Now you have a network, where you can provide...IPTV service not just through [the] home broadband connection…but through a wireless alternative to their home broadband as well,” Carter added.

T-Mobile’s Q4 release also shed a bit more detail on the Layer3 TV acquisition, which closed on January 22. As a result of that deal, T-Mobile included an adjustment of 5,000 “branded prepaid customers” to its reported subscriber base as of January 22. Customer activity from Layer3 TV post acquisition was included in T-Mobile’s net customer additions for Q1 2018. T-Mobile reported 1.43 million total net adds in Q1, which included 199,000 branded prepaid net adds.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Prior to its acquisition by T-Mobile, Layer3 TV was focused on an in-home, IP-delivered pay TV offering in select markets that include Los Angeles; Chicago; Washington D.C.; Dallas/Ft. Worth; and Longmont, Colo. (in partnership with a municipal provider called NextLight).

Looking ahead, T-Mobile has plans to launch a national OTT TV service later this year. T-Mobile has not announced pricing and packaging for that offering, but it’s expected to compete with traditional MVPDs (cable, telco and satellite) as well as a growing mix of internet-based, virtual MVPDs that today include DirecTV Now, Sling TV, Hulu, YouTube TV, fuboTV and PlayStation Vue.