Netflix Adds 10M Subs in Q2, but Tempered Growth Projections Send Stock Tumbling

Shares fall more than $50 in after-hours trading

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Netflix reported another big jump in subscribers, more than 10 million in its second quarter, but predicted that it had done so well in the first half of locked-down 2020 that it would see only modest further subscriber growth the rest of the year.

That sent shares tumbling more than $50, to well below $500 apiece, in after-hours trading. The plunge came despite Q2’s otherwise strong financials, including 25-percent jumps year-over-year in revenue and average streaming paid memberships.

Also read: Netflix Promotes Sarandos To co-CEO with Hastings

“The service has been able to generate amazing viewing,” said Reed Hastings, the company’s founder and now Co-CEO as long-time Chief Content Officer Ted Sarandos added Co-CEO to his title. “As it gets better and better, we’ve able to take advantage of that.”

But Hastings also said the company is “tamping down the expectations (for upcoming quarters). This is a great growth opportunity for us. Any upside would be put into more content for our members, which is more growth.”

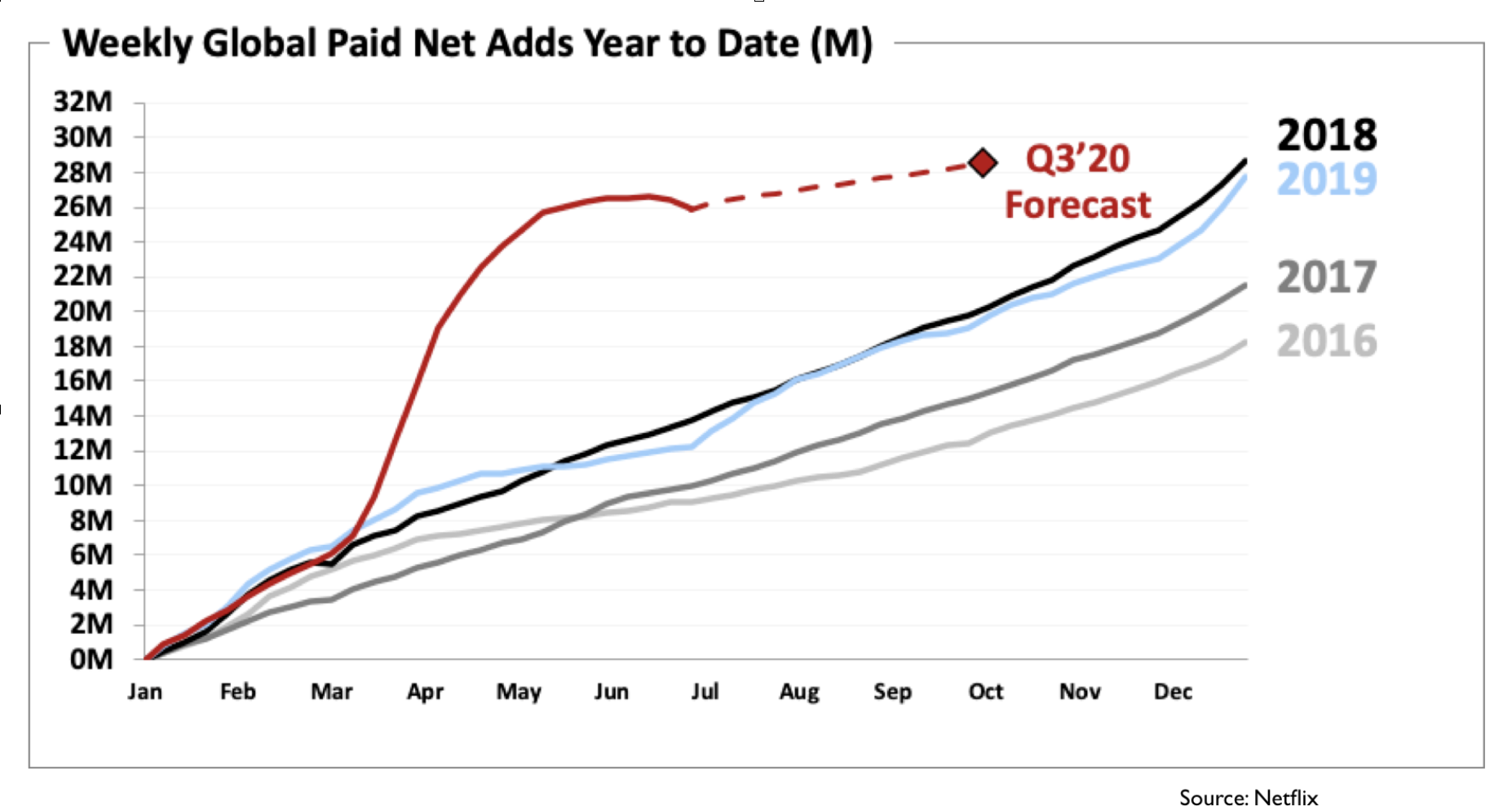

The company now has added 26 million new subscribers in the first half of 2020, nearly as much as it added for all of 2019, when it grew by 28 million to 158 million global subscribers. It has 195.45 million subscribers, perhaps the most important metric for Wall Street investors tracking the company. Most of the growth came from outside the United States, said Greg Peters, the company’s Chief Product Officer and also just promoted to COO. The growth was broadly spread across major international territories.

Also read: Netflix: ‘Extraction’ Its Most Popular Original Movie Ever with 99M Viewers

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

“However, as we expected (and can be seen in the graph below), growth is slowing as consumers get through the initial shock of Covid(-19) and social restrictions,” the company said in a letter to shareholders.

The letter reiterated previous guidance that Netflix expects subscriber demand would be “pulled forward” into the first half of 2020. Netflix now predicts it will add just 2.5 million new subscribers in Q3, compared to 6.8 million last year.

“We continue to view the quarter-to-quarter fluctuations in paid net adds as not that meaningful in the context of the long-run adoption of internet entertainment, which we believe provides us with many years of strong growth ahead,” the company letter said.

The company has been able to debut 50 to 60 new programs each month during the pandemic so far, dwarfing that of most of its competitors, especially big newcomers such as Comcast’s Peacock and AT&T’s HBO Max, which saw their debut slates of originals trimmed to less than 10 each by the lockdown’s impacts on production.

Netflix will be able to keep up its release pace through the rest of the year, the company said, but should see a lighter programming schedule the first half of 2021 as the pandemic’s effects impact the company’s long-term production pipeline. The company is “slowly resuming productions in many parts of the world,” even beginning a couple of days of filming in Los Angeles this week, and anticipates it will still release more programming in 2021 than in 2020.

The company also disclosed first-month viewership on several of its biggest hits in Q2, including:

> Mindy Kaling dreamed Never Have I Ever, (40 million households in first four weeks)

> Steve Carrell comedy Space Force (40 million)

> Unscripted dating show Too Hot To Handle (51 million)

> Unscripted reality competition Floor is Lava (37 million)

> Chris Hemworth action movie Extraction (99 million)

> David Spade/Lauren Lapkus comedy feature The Wrong Missy (59 million)

> Spike Lee feature Da 5 Bloods (27 million)

> Animated family feature The Willoughbys (38 million)

Sarandos said the company has been slowly ramping up investment in unscripted projects, and now reality competitions, because of “the love that audiences invest in it.” Too Hot To Handle was as big a hit in Japan as the United States, and with Floor is Lave represented two of the biggest hits ever on the service, of any genre.

Other programming initiatives, like spotlighting the array of older Netflix projects from African-American creators during recent racial-justice protests, also paid off, sending viewership significantly up for older projects such as 13th, American Son and Dear White People.

The company touted hit International shows that drew global audiences, such as Germany’s Dark, Mexico’s Control Z, South Korea’s Extracurricular, Poland’s The Woods, and South Africa’s Blood & Water.

The biggest international hit proved to be Money Heist: Part 4 (La Casa de Papel), which attracted 65 million viewers in the first four weeks after its April 3 release, and which Hastings said has become a valuable international franchise for the company. .

The company spoke briefly about all the new competition in the market. Q2 saw launches from Peacock, HBO Max and Quibi, along with increased spending by Apple and Amazon, and “astounding” growth from short-form social-video site TikTok.

“Instead of worrying about all these competitors, we continue to stick to our strategy of trying to improve our service and content every quarter faster than our peers,” the company said. “Our continued strong growth is a testament to this approach and the size of the entertainment market.”

Hasting spoke briefly about the Co-CEO promotion for Sarandos, who has worked at the company more than two decades and was architect of its shift to original programming in the mid-2010s. Sarandos also was elected to the company’s board of directors.

“It will be great to have some help as we move forward,” Hastings said during the earnings call. ”But I’m in for a decade. I want to be totally clear on that. I’m in for a decade. It’s two of us full-time. It’s not like it’s a part-time deal. We’re just broadening the management team and helping us grow even faster over the next 10 years.”

Peters, the chief product officer, added COO to his titles. Both Peters and Sarandos will continue to hold their previous titles as well.

The change will give Sarandos “some increased external stature and can put together some bigger deals for us,” Hastings said.

The new titles come weeks after the company announced hired Bozoma St. James, the former Pepsi and Apple Music executive who later was CMO at Uber and Endeavor during challenging periods for both companies.

The company spends $2 billion a year on marketing, but that’s only 7% of overall expenditures, low for a big entertainment company and possible because so much conversation around the company’s shows happens online, executives said.

Marketing spend in Q2 further dropped during the lockdown as awards spending, promotional junkets and similar expenses were reduced or went virtual. CFO Spence Neumann suggested the company will probably spend less on awards campaigns this year, a big shift from the past two Oscar seasons, when it spent lavishly promoting Roma, The Irishman, and a slate of other contenders.

Among important financial data points, the company said its average revenue per user rose only slightly. 0.4%, though foreign-exchange costs significantly reduced that number. It would have been about 5% otherwise. Operating margin jumped 22.1% compared to 2019, thanks to all those new subscribers.

The company also generated positive free cash flow for a second straight quarter, at $899 million, versus last year’s negative $594 million. It said it expects free cash flow, an important metric as the company continues to spend heavily on content, to be break even or positive for the rest of 2020, before dipping into negative territory again next year.

Getting to a consistent “cash content-to-content amortization ratio” of 1X on a consistent basis “is still many years away,” the company said.

CFO Spence Neumann said the unusual Q2 conditions, with lots more subscription dollars coming in even as production and other operating expenses were partly on hold, provided a “unique bit of a window for the potential of our business.” It generated a 15 percent free cash flow margin during the quarter.

“When we are in a sustained free-cash-flow positive position, hopefully that 15-percent margin is just a start,” Neumann said.

The company raised another $1 billion in debt in April. It now has more than $7 billion in cash and cash equivalents, and does not expect to need another debt offering in the next 12 months “and we believe our need for external financing is diminishing.” Investors’ biggest concern in recent years has been Netflix’s borrowing to cover production and operation costs as it scaled up, especially overseas.

You can find the Netflix Q2 investor letter and other material here.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.