Broadband Is Cable’s Booster Rocket

MSO shares up 50% this year as Street learns not to worry about video losses

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

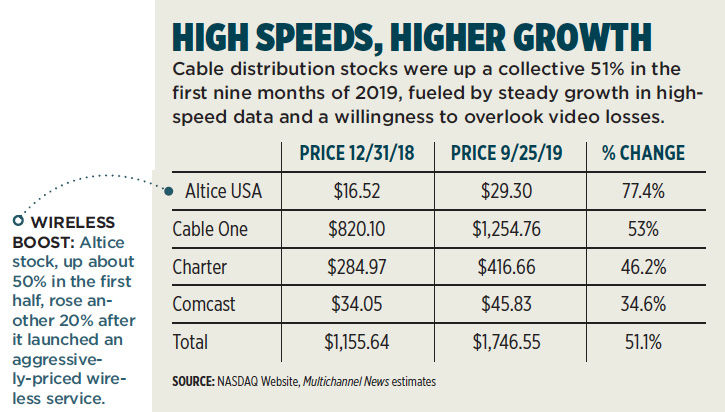

Almost a year after wall street basically left them for dead, cable distribution stocks have been on a torrid pace in 2019, with the sector rising more than 50% in the first nine months of the year. Those gains were fueled by broadband growth and a growing trend by analysts and investors not only to dismiss continued video losses, but to encourage them.

In the first nine months of 2019, cable distribution stocks are up 51.1%, led by Altice USA, up 77.4% since Dec. 31 to $29.30 per share, and Cable One, which crossed $1,000 per share in April and has been steadily rising ever since. Cable One closed at $1,254.76 on Sept. 25, 53% higher than its Dec. 31 close of $820.10.

No. 2 cable operator Charter Communications is up about 46% since the beginning of the year to $416.66 per share, and top MSO Comcast rose 35% to $45.83. That’s in sharp contrast to last year, when the sector rose just 0.6%, mainly because of gains at Cable One. Factoring out Cable One’s 16.6% increase in 2018, the sector was down about 21% in 2018.

Traditional pay TV’s claims that OTT providers couldn’t continue to offer programming at a loss for long has proved prescient, as major OTT distributors began to raise prices. The price hikes have led to defections, as shown with DirecTV Now (now AT&T TV Now), once one of the fastest-growing OTT service providers, losing about 168,000 customers in Q2.

Buoyed by Broadband

Comcast has subtracted 1.7 million subscribers since Q2 2016, while Charter has lost 1.1 million in the same time frame. But broadband growth, once thought to be nearing a wall, began to soar. Customers that were dropping or downsizing video services tended to remain broadband-only customers at a higher monthly rate. According to Leichtman Research Group president Bruce Leichtman, cable operators added 925,511 broadband customers in the second quarter, compared to 844,497 additions in Q2 2018. For the first half of this year, Leichtman estimated that cable added about 1.457 million broadband subscribers, compared to 1.43 million in the prior year.

“Cable operators are increasingly disinclined to defend video and investors are increasingly inclined to embrace rather than fret over video losses,” MoffettNathanson principal and senior analyst Craig Moffett said in a client note.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

That is evident in the multiples that the market is assigning to cable companies. Cable One — which changed its name to Sparklight this summer to reflect its focus on broadband — has the highest multiple in the sector at 15.2 times cash flow, and the lowest reliance on video, with 34.7% of its total revenue from video, according to Moffett. Charter is next with a 10.7 times multiple and 41.3% of total revenue due to video. Comcast trades at 9.5 times cash flow, with video making up 43% of total revenue.

The strengthening of the stocks also could put some of these distribution players back into consolidation mode. At Altice USA — where video makes up about 45.3% of total revenue, according to Moffett — CEO Dexter Goei has said he thinks of adding scale daily.

Goei told Multichannel News in August that the rising stock price reflects Altice’s inherent value and could be used as an acquisition currency. He went further at this month’s Goldman Sachs Communacopia conference: “I think we’re open to creating a lot of shareholder value. So, if somebody comes and wants to have a discussion about buying us, we’re absolutely open to having that discussion.”

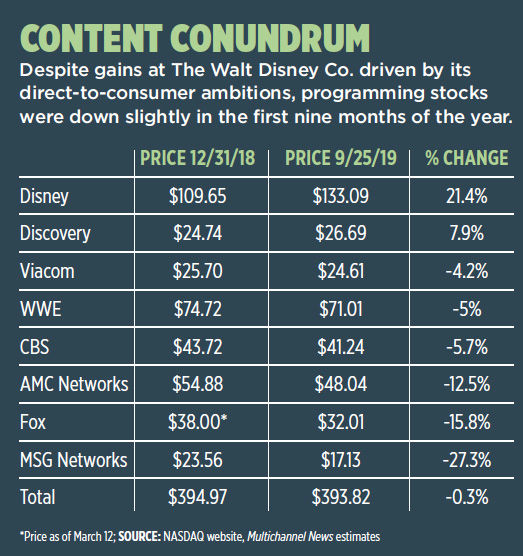

For programmers, the forecast is a little more cloudy. Overall, the sector was down 0.3% in the first nine months of the year, as optimism over new distribution outlets (which would mean a spike in affiliate fees) gave way to pessimism that offerings were either priced too aggressively or not aggressively enough.

Disney+ Drives Programmers

Gains at The Walt Disney Co., which plans to launch its Disney+ streaming service in November, drove most of the growth in the sector. Without Disney’s 21% gain for the period, the sector would have declined about 8.6%.

November also should see the debut of Apple TV+ from the maker of the iPhone. AT&T’s long-awaited HBO Max and AT&T TV offerings won’t be widely available until spring 2020.

Disney+ will be priced at $6.99 per month ($5.83 if customers pay for the full year) at launch while Apple TV+ is priced lowest at around $4.99 per month. AT&T is the wildcard having not released pricing for AT&T TV or HBO Max. Speculation is that the latter will be priced at $15 to $18 per month and will have HBO programming as well as content from WarnerMedia’s Turner networks and other properties.

The specter of more competition even hurt Netflix after CEO Reed Hastings mentioned at a U.K. TV conference that November is going to be “tough.” Netflix shares fell 5.5% on Sept. 20, erasing any gains for the year as the stock was down about 5% over the past nine months.