Serving New Market Entrants for Fiber Deployments

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

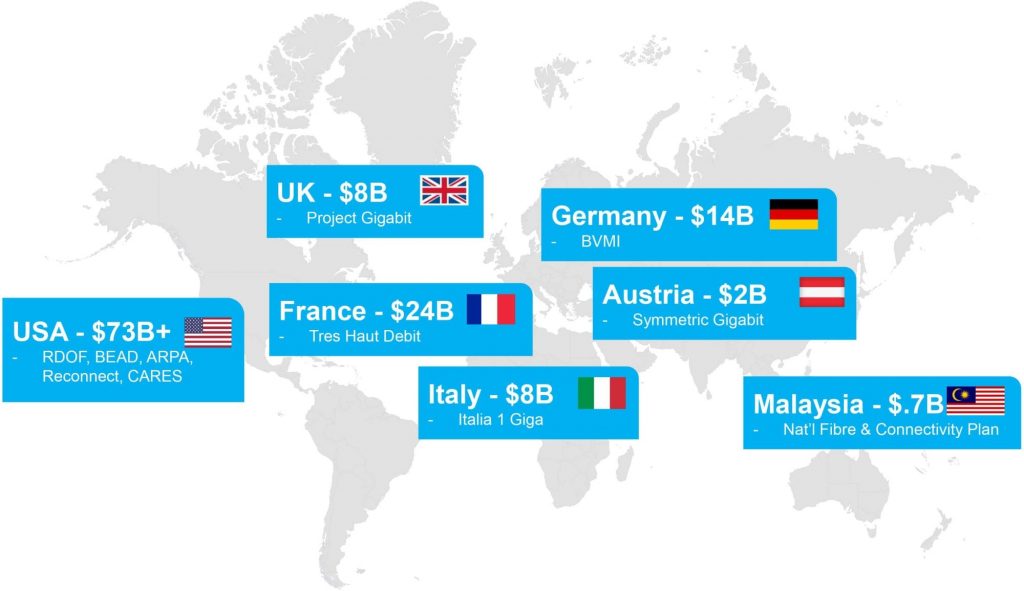

The pandemic has exposed the pernicious effects of digital disparity on health, education, and other aspects of life, prompting governments worldwide to invest massively in bridging the so-called digital divide. The U.S. government alone is allocating over $73 billion to extend broadband’s reach to unserved or underserved markets and is investing an additional $14.2 billion to subsidize broadband cost and devices for lower income subscribers, spurring demand.

Traditional broadband providers, such as telcos and cable companies are major players in this massive broadband expansion, but they are not the only ones. Funding is increasingly being awarded to municipalities, utilities, tier 3 operators, and others. For industry vendors, this presents a significant opportunity, but also multiple challenges, including:

- The new industry players may have new requirements that vendors, whose solutions were developed for more “traditional” players may not meet.

- Unlike “traditional” players, who typically fund their deployments from cash from operations or from capital markets, the new entrants need to apply for grants from governments. Grant applications require a specialized skillset, a good understanding of what is needed, and network buildout plans with approximate costs.

- The new entrants are often not subject matter experts, and therefore need more education, training, support, and often turnkey capabilities.

- The new entrants present a fragmented market, and significant diversity in their requirements. For example, even at a simplistic level, a utility will have a different set of needs than a municipality.

- They present significant challenges from a go to market (GTM) perspective. Vendors typically have well defined go to market strategies that are aligned with the existing ecosystem that their customers live in. The new players exist in often completely different ecosystems and need new GTM strategies.

- The new players often rely on ecosystems that could be divorced from the ones more traditional operators live in.

So, what is a vendor to do to capitalize on this massive opportunity?

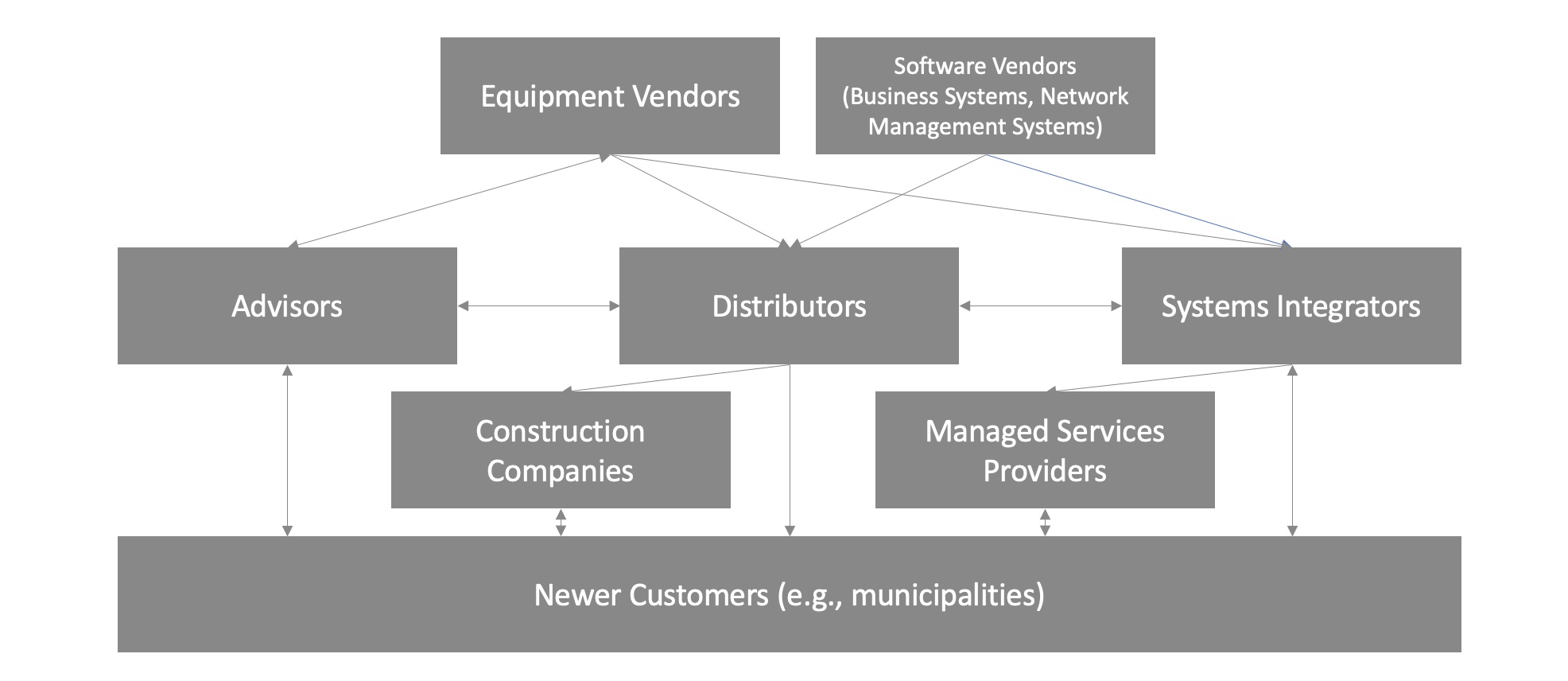

- Develop a good understanding of the ecosystems that the emergent customers live in. For example, whom do they go to for advice, help in grant writing, what vendors do they work with, what distributors, etc. Here is a high-level view of what the ecosystem may look like.

- Get in the early part of the value chain. Some of these entities need help in writing grants for government funding. Vendors can provide free resources and support, which would help the applicants and solidify the relationship. Some vendors are already doing this.

- Gain insights into target customer’s needs, decision-making process, steps, roles, timing, selection criteria and other.

- Engage with the broader ecosystem to develop a better understanding of the above:

- What type of players? Who are they?

- Who are their customers?

- What solutions and capabilities do they offer?

- What markets / geographies do they serve?

- What are their business models?

- What do they offer target customers?

- What are their needs, met or unmet?

- What organizations do they belong to?

- How do they engage with end customers?

- Identify gaps in the solutions, level of support and the broader ecosystem.

- Establish relationships with the end customers to better understand personas, needs, buying behaviors and so on.

The vendors’ ultimate goal is to evolve their solutions to be better suited for the needs of these developing market segments and create go to market strategies that best suited to enable them to gain market share.

We at ACG Research are investing effort in understanding this new ecosystem, in order to help develop go to market strategies for vendors who are looking to capitalize on this growing market opportunity.

Contact Liliane or Mark to learn more. ■

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Guest blog author Liliane Offredo-Zreik is a principal analyst at ACG Research, where she is responsible for cable access infrastructure market research and consulting practice. Offredo-Zreik is also president and founder of boutique advisory firm The Sannine Group.