Bandwidth Consumption – What's Ahead?

As the world dealt with COVID-19 death over the past 15 months or so, broadband has emerged as a rare bright spot

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

As the world dealt with the agony of disease, lockdowns, and COVID-19 death over the past 15 months or so, broadband has emerged as a rare bright spot, keeping the world connected, enabling a segment of the workforce to continue to work from home, and for those fortunate enough to have decent broadband access to receive medical care, education, entertainment, and other services. To their credit, broadband providers were able to meet the moment, by utilizing previously planned headroom and by racing to add capacity, largely using node splits and other traditional methodologies.

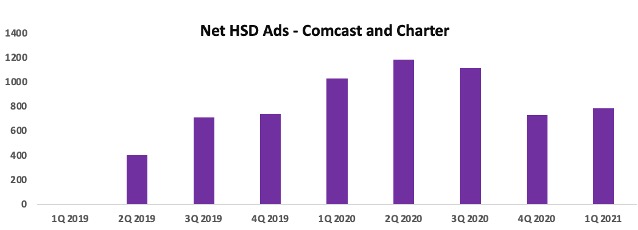

The two major U.S. cable operators (Comcast and Charter) alone added 3.8 million HSD subscribers in the year ending on March 31, 2021, and cable access vendors CommScope, Harmonic, and Casa had notably strong revenue growth in the last few quarters.

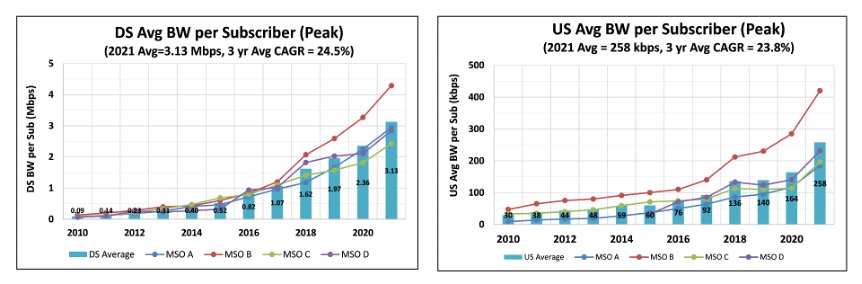

At the same time, analysis by CommScope, which has been assessing the average peak-time busy-hour bandwidth consumption (Tavg) for four North American MSOs for the past years, found that downstream (DS) Tavg increased 32.5% in January 2021 versus pre-pandemic in January 2020. For the same period, Tavg for upstream (US) utilization increased a significant 57%. What is notable, CommScope found, is that the DS:US ratio is trending downward toward 12:1 (from about 15:1). In other words, upstream is growing at a faster rate than downstream, and is expected to continue to do so for the foreseeable future.

So, what does this mean going forward?

The world we will emerge to when the pandemic finally subsides will not look like the pre-pandemic world. Some of the new business models, regulatory developments, and new habits formed during the pandemic will persist in some fashion, and some of the new frameworks and business models are seeking to integrate some of the recent successes going forward. At the same time, the pandemic brought into sharp focus the disparity in access to broadband (commonly referred to as the digital divide), leading governments to provide subsidies and to focus on expanding broadband access to remediate this glaring problem.

The Subsidies

Some of the subsidies and initiatives that seek to mitigate the digital divide:

- The Emergency Broadband Benefit program is a $3.2 billion subsidy for Americans who cannot afford broadband. It provides up to $50/month in broadband subsidy (up to $75/month in tribal areas) and up to $100 toward the cost of a device. Although this is a temporary benefit during the pandemic, some lawmakers are already calling for it to be extended, and some even call it the future of the Lifeline service.

- The Rural Digital Opportunity Fund allocates $20.4 billion over 10 years to bring broadband to under-connected areas. It precedes the pandemic.

- The FCC has also allocated $450 million to fund telehealth during 2021; in round one earlier this year, it provided $200 million in funding, and is in the process of reviewing applications toward disbursing $250 million in additional funding. The funding is primarily for telehealth devices and connectivity.

Although these programs are U.S. focused, other countries are also allocating resources to expand broadband access.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

The Demand Drivers

- Work from home (WFH) has garnered significant attention during the pandemic for obvious reasons. As we start contemplating some sort of normalcy, many companies are drawing plans for what’s ahead. The jury is still out, but many companies are beginning to speak to the benefit of showing up to the office, at least some of the time. It is expected that WFM will continue to drive bandwidth utilization but to a lesser extent than was observed during the pandemic.

- In education, although many organizations are developing plans for hybrid learning models, the importance of in-person education, at least in K−12 cannot be over-estimated. Online education will have a modest impact on the growth of bandwidth consumption going forward, but may play a major role in college education and continuing education.

- Health care has seen a substantial transformation. Although some of the changes were already in progress, the pandemic provided an impetus for a much faster transformation, ushering in an era of relaxed regulation and fast innovation. Healthcare’s digital transformation will have significant implications on broadband utilization and business models in the future.

- Streaming will continue to drive broadband consumption, but as people resume in person activities, they are likely to stream less than during the pandemic.

We currently are at an inflection point. The trends that had caused bandwidth consumption to grow substantially over the past few years, while still there, will be supplanted by emerging trends. WFH, although it will decrease meaningfully from the days of the pandemic, will be an important trend to watch. What is even more exciting is the emergence of the home as a major location for health-care delivery. This will have profound implications for broadband service providers.

Liliane Offredo-Zreik is a principal analyst with ACG Research. She covers cable and digital health enablement.

Guest blog author Liliane Offredo-Zreik is a principal analyst at ACG Research, where she is responsible for cable access infrastructure market research and consulting practice. Offredo-Zreik is also president and founder of boutique advisory firm The Sannine Group.