Segmenting SVOD

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

General entertainment services like Netflix, Hulu and Amazon Prime along with the rise of more genre-focused over-the-top video services that have entered the fray have been fueling the growth of subscription VOD services.

A new study from The Diffusion Group has taken a deeper dive into the SVOD pool to discovery how that market has been segmented. Notably, it’s not all about the small but growing number of consumers who have cut the cord or have never had a traditional pay TV service.

RELATED: SVOD-Smacked (subscription required)

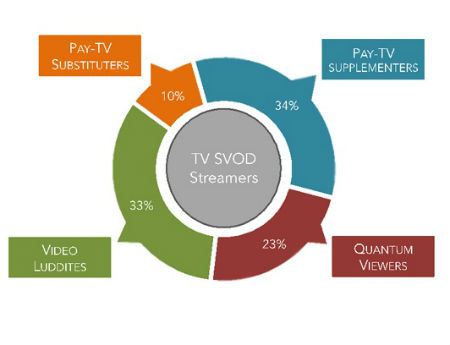

TDG’s study, based on a survey of 2,003 U.S. adult broadband users conducted in late November/early December 2016, found that the largest group, at 34%, is made up of what TDG calls “pay TV supplementers” who use SVOD to complement their TV viewing, rather than as a pure substitute or replacement.

That was followed by “Video Luddites” (33%) that spend the least amount of time watching video across all devices, but still steer toward online video as a key source of entertainment.

Not far behind are “Quantum Viewers” (23%), the youngest of TV subscription streamers that have a proclivity to watch SVOD on all types of devices.

The smallest of the four major groups determined by TDG’s study is comprised of “Pay TV Substitutors” (10%), which have a general aversion toward traditional pay TV services and a strong affinity toward SVOD as their primary video source, accounting for about two-thirds of their total viewing time.

TDG estimates that about two-thirds of U.S. adult broadband users take an SVOD service on a home TV, and that one-fourth of TV subscription streamers turn first to SVOD services and spend an average of 41% of their weekly TV time watching streaming video of some kind, with SVOD as the most dominant choice.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.