Another Soft Quarter For CCAP Revenue

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

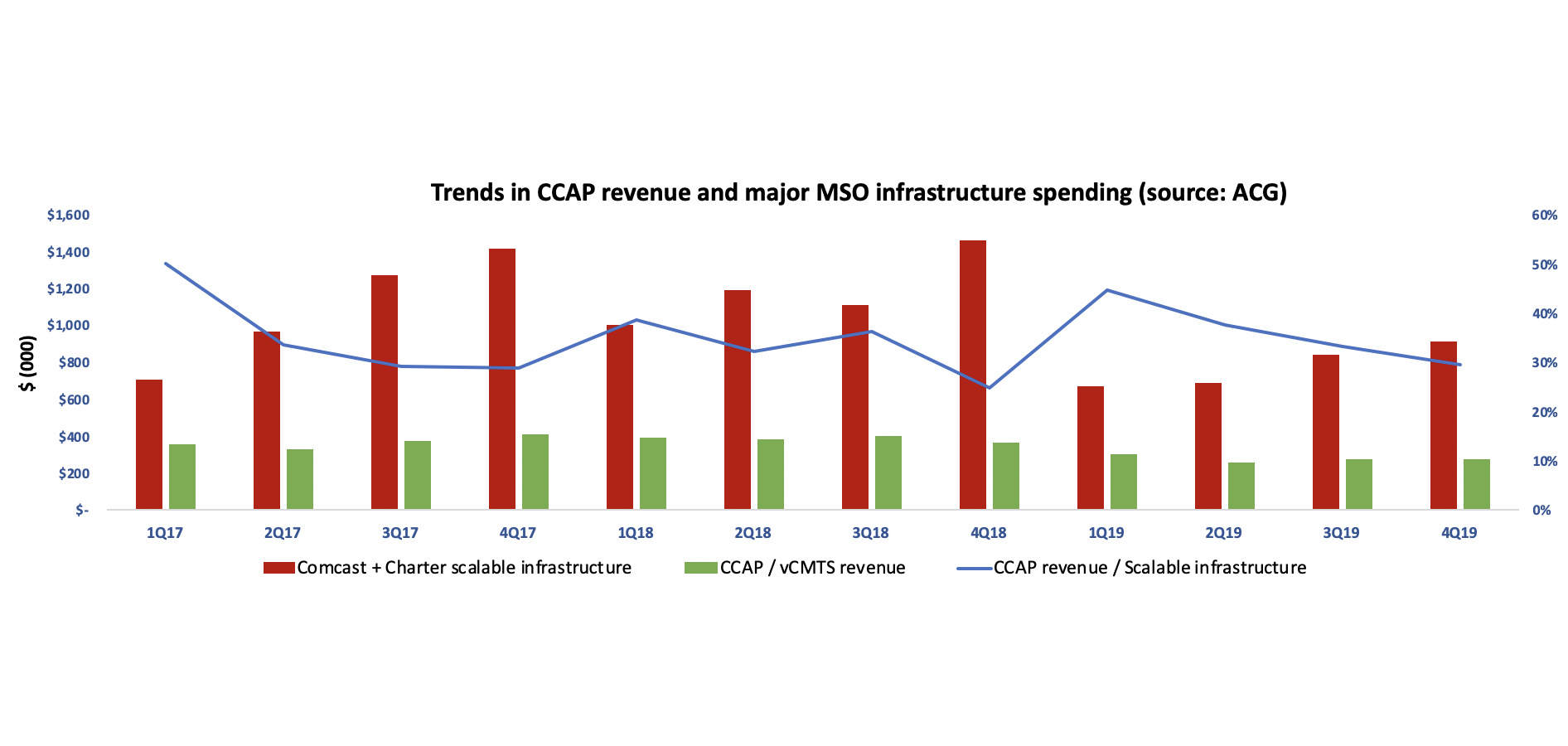

Overall revenue from Converged Cable Access Platform solutions in 4Q 2019 was soft, continuing a trend that has prevailed throughout 2019. Revenue in 2019 was down about 28% year on year from 2018. This softness is at least partly related to the reduction in capital spend of major MSOs. In fact, scalable infrastructure spending for Charter and Comcast was down about 35% during the same period.

Why are major operators spending less when the demand on their networks keeps growing? Part of the answer is that they have largely wrapped up their DOCSIS 3.1 deployments. But there is more.

The industry is at an inflection point. The Distributed Access Architecture (DAA) provides a good framework for operators to add capacity without a corresponding need for additional headend space and power and leads to improvements in service quality because signals become digital rather than analog. However, DAA takes operators into a new operational paradigm that demands careful planning, substantial testing, and even organizational realignment. Here are some of the issues with which operators have to contend:

- Today, the Remote PHY version of DAA is more widely deployed than Remote MACPHY because the specs and solutions are more mature. In Remote PHY, the MAC and PHY are separated unlike in the integrated CCAP; this means that operators have to address PTP timing issues between the CMTS and the Remote PHY devices (RPD)s, which can be in the access node or in a Remote PHY shelf. When Remote MACPHY is field deployed at scale, it is likely that other challenges will emerge.

- As mentioned, in DAA, signals are carried over IP. This brings significant improvements in service quality but requires a different skillset. It is true that IP expertise is more widely available, and the new environment requires less industry-specific expertise; however, OSP personnel that spent their careers dealing with RF will not become IP experts overnight. This requires training, and in some cases, new talent.

- Interoperability remains a challenge despite the valiant industry efforts under CableLabs’ stewardship. DAA is a young technology, which means that solutions are being refined as vendors and operators learn from live field deployments. As solutions evolve, interoperability testing needs to be repeated. The ecosystem will settle over time, but it is not surprising that most current field implementations are bookended (RPDs and CMTS are from the same vendor).

- Operators need to take great care to select a solution that supports all their existing services and to extensively test the new solution to ensure that all services are adequately supported and that customers will not be negatively impacted.

- The current methods and procedures playbooks need to be modified as the traditional processes for things like leak detection and set-top box control are no longer applicable in the new environment. It is true that the new environment over time will become easier to operate with much improved error prevention and remediation.

- Design of the Converged Interconnect Network; this is the Ethernet network that interconnects the CMTS cores with the RPDs. Designing and implementing such a system is not a trivial task and requires careful planning.

These are but a few examples of what an operator that is planning a move to DAA has to consider. It is, therefore, not surprising that operators are carefully and deliberately developing their migration plans. For those that have witnessed other instances of new technology introduction in the live network of an operator, such a measured pace is normal and expected. It is not the first time that a new technology gets hyped up with aggressive forecasts for field introduction but inevitably meets the laws of gravity.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Guest blog author Liliane Offredo-Zreik is a principal analyst at ACG Research, where she is responsible for cable access infrastructure market research and consulting practice. Offredo-Zreik is also president and founder of boutique advisory firm The Sannine Group.