T-Mobile and Sprint Close $31B Merger

Deal will likely expand the presence of pay TV play TVision

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

T-Mobile and Sprint have officially closed a merger of the Nos. 3 and 4 wireless carriers in the U.S., a deal valued at $31 billion.

As per earlier announced parts of the agreement, longtime T-Mobile CEO John Legere will step down, departing the company in March. Mike Sievert, who previously served as chief operating officer under Legre, will lead the combined company.

Also, as per agreement with regulators, T-Mobile and Sprint will sell wireless assets valued at $5 billion to Dish Network. These assets include T-Mobile’s wireless prepaid business, which include the Virgin Mobile and Boost Mobile brands, and will ostensibly replace the lost competitive balance in the U.S. wireless market by enabling the formation of a fourth carrier.

Since first announcing the merger back in June 2018, Legere and T-Mobile have touted the synergies as they relate to buildout of next-generation 5G networks. With Sprint’s assets in hand, T-Mobile has promised to spend $40 billion to reach 99% of the U.S. population with 5G service within six years. It has also pledged to reach 90% of rural areas with 50 Mbps broadband.

This network buildout will include fixed 5G home services, which will compete head-on with the dominant home internet service businesses of Comcast, Charter Communications and other cable companies.

T-Mobile is similar to Verizon, in that it doesn’t own major video content assets, similar to AT&T’s WarnerMedia position.

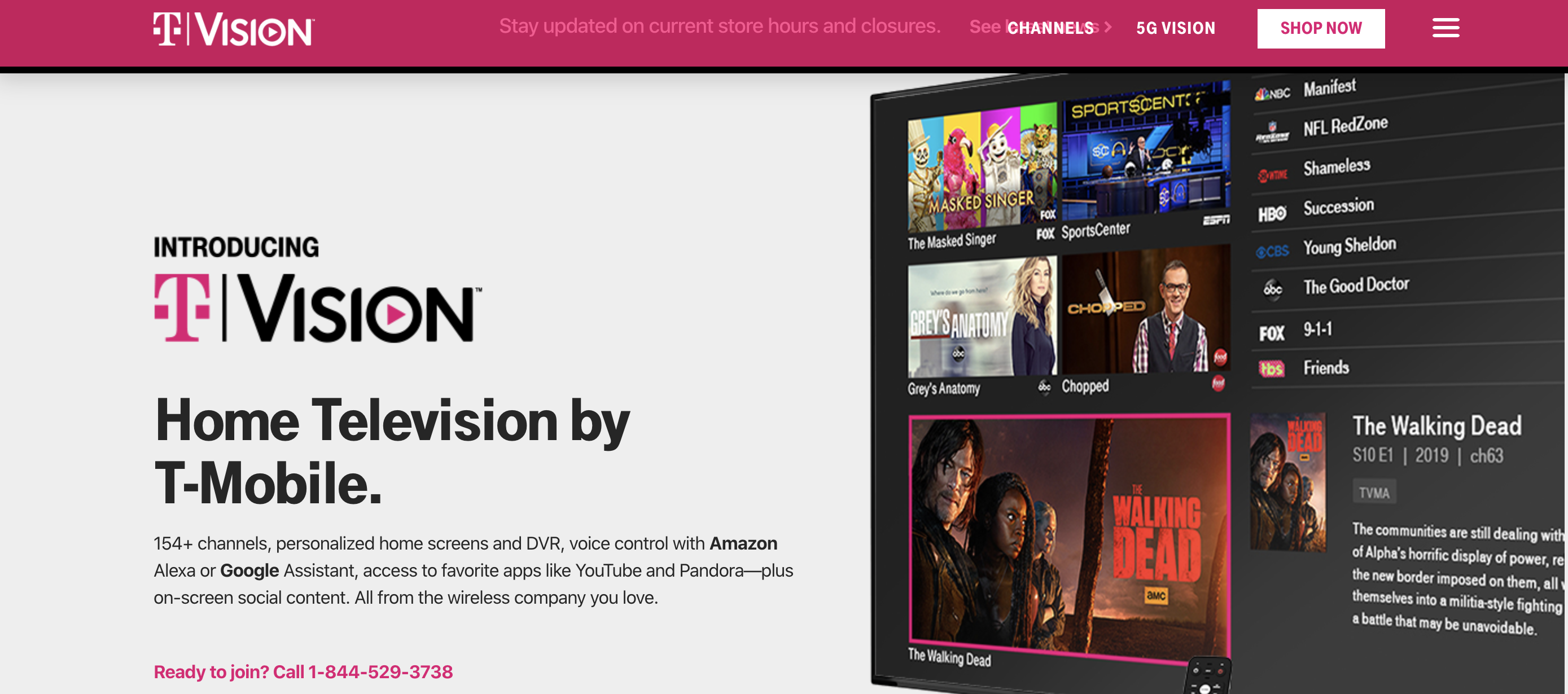

However, expect TV to be a major part of the so-called “New T-Mobile’s” evolution in the coming months and years, with the company already parlaying its $325 million purchase of Layer3 TV in January 2018 into the pay TV service branded as TVision.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

TVision, which offers a base tier of 154 channels, a choice of Amazon Alexa or Google Assistant voice support, and 400 hours of cloud DVR storage has flown under the radar to date, has flown under the radar, and remains underplayed on a national basis. Scale has been an issue, with programming costs coming in at 20%-30% higher than more established pay TV services, according to federal filings.

However, with T-Mobile expanding its reach, TVision will likely soon become a more ubiquitous presence in the U.S. video market.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!