Sinclair Makes $10B Play For Fox’s Sports Nets

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With the auction for 21 former Fox regional sports networks all over but the official announcement as of press time Friday, Sinclair Broadcast Group has become, virtually overnight, one of the biggest players in the live sports arena.

Sinclair, along with partners, has apparently submitted a winning bid of $10 billion for the 21 RSNs that were put on the block by The Walt Disney Co. in October as a condition of federal approval of its $71.3 billion purchase of 21st Century Fox programming assets. Sinclair also is a minority partner in the New York Yankees’ $3.5 billion purchase of Fox’s 80% interest in YES Network and it has joined with Major League Baseball’s Chicago Cubs to create the Marquee Sports Network, which will launch during the 2020 baseball season.

If its bid prevails, Sinclair and its partners — Amazon and Byron Allen’s Entertainment Studios were said to be among possible teammates — will have beaten rival offers from Liberty Media’s John Malone, which teamed up with MLB in bidding for the channels, and Big3 Networks, a professional three-on-three basketball league headed by rapper Ice Cube.

Breaking Down Deal Terms

According to sources, Sinclair and Disney were finalizing the paperwork on the deal and were expected to wrap up soon. While the sale still could fizzle, one source familiar with the auction noted that at this point it was Sinclair’s transaction to lose.

The $10 billion price tag for the RSNs works out to be about 6.7 times cash flow for the networks, less than the 7 times the Yankees reportedly paid for the YES Network and well under the 12.5 times Disney paid for the channels as part of the larger Fox deal.

While that is not necessarily good news for Disney or for the state of regional sports — analysts originally expected the networks to attract bids of between $20 billion and $22 billion — Wolfe Research managing director Marci Ryvicker has called it a great deal for Sinclair. She estimated that, assuming Sinclair will get 90% control of the RSNs, the deal represents net free cash flow accretion of about $3.76 per share for Sinclair, equating to an incremental equity value of $26 per share. Sinclair was trading at about $45.39 per share last week.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

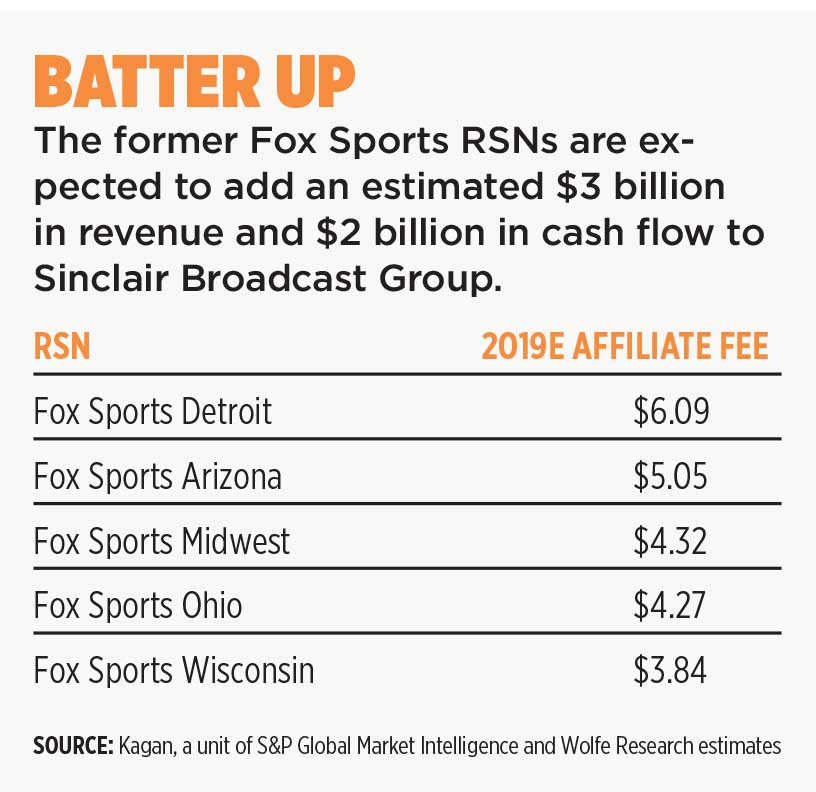

Ryvicker figures the Fox RSNs would add more than $3 billion in revenue and $2 billion in cash flow to Sinclair. In 2018, Sinclair had total revenue of $3.1 billion.

Sinclair has been aggressively adding content over the past several years, partly in an effort to keep the retransmission-consent revenue flowing from its broadcast affiliates. In addition to its sports properties, the station group also offers STIRR, a free OTT service with sports, news and movies; free local news streaming service NewsOn; action/adventure broadcast network Charge!; and digital TV network Comet TV.

Retransmission-consent growth has slowed considerably in the past few years for station groups. At Sinclair, retrans is expected to grow by “low teens” percentages in 2019 and 2020. The sports channels should help increase that pace.

But there also is a risk. Live sports is the last bastion of appointment TV, with a young, male audience coveted by advertisers. High prices for channels have caused some distributors to lobby to place them on pricier tiers that have limited audiences, though. And RSNs aren’t part of the introductory packages for a lot of streaming services, hindering their distribution growth potential.

Many Renewal Situations Ahead

Sinclair may get a crash course in the value of the channels to distributors. Kagan, a unit of S&P Global Market Intelligence, says there were nine new sports rights deals in 2018 with an average total-value increase of about 100%, and seven new deals so far in 2019 with an average increase of 109%. But the average length of those deals is shrinking amid concerns about the future of pay TV.

“In the next two years, approximately 25% of local sports rights agreements are set to expire, including five at the end of 2019, indicating that opportunities for these new entrants to expand their local sports rights collection in the near-term are limited,” according to Kagan, which said the average RSN license fee rose 8% in 2018 to $2.64 per subscriber. “In the next few years, RSNs will have to rely more on advertising revenues to make up the difference.”