Netflix Asia-Pacific Revenues Spike 66% as It Readies to Take on Disney

Success in Asia will be vital for Netflix’s continued growth

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

“Never get involved in a land war in Asia,” Vizzini warned in The Princess Bride.

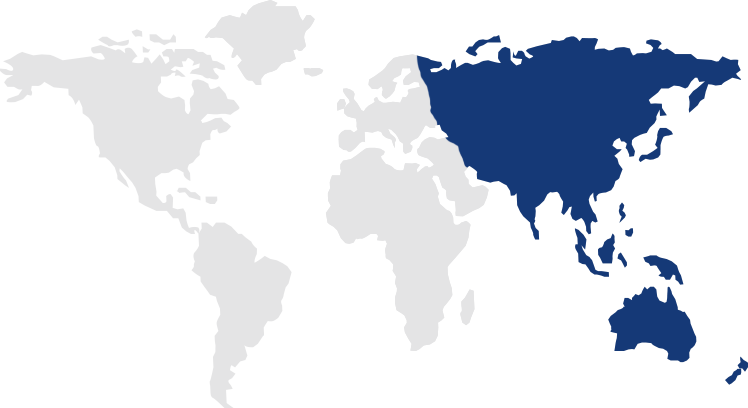

Good advice in a deadly battle of wits with the Dread Pirate Roberts, but perhaps less apt for Netflix, whose latest quarterly earnings suggest it’s making progress in the Asia streaming wars, cutting deals, creating local hits and making other strategic moves especially in India as it tries to expand in some of the world’s most populous markets.

Netflix subscribers in its Asia-Pacific region jumped 62% over the past year, the company said in its Tuesday earnings announcement. Revenue from the region grew even more, up 66% year over year. For comparison, subscriptions in Netflix’s home region, the United States and Canada, grew only 8%t in the same period, and revenues only about 12%.

“We’re pleased with the progress we’re making in this region and, in particular, that we’ve achieved double-digit penetration of broadband homes in both South Korea and Japan,” Netflix said in its shareholder letter for the quarter. “While this is encouraging, we still have much work to do and were working hard to replicate this success in India and other countries.”

Those strong numbers were in contrast with a more muted quarter overall, especially compared to the first half of the year, when the pandemic drove signups and view time through the roof. Even with a slow Q3 overall, the company has added more new subscribers three quarters than it did through four quarters of 2019.

Success in Asia will be vital for Netflix’s continued growth as it builds out its global footprint, cementing consumer and content-creator relationships while most of its shiny new U.S. competitors are still figuring out how to get and keep audiences in their domestic backyard.

And though the APAC region remains the smallest in terms of subscribers for Netflix, vast markets such as India and Indonesia beckon, as well as South Korea and Japan.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

The APAC region contributed almost half the company’s net subscriber adds in Q3, though admittedly during the slowest quarter the company has had in a long time.

And the company has several initiatives underway in India despite stout competition, including Disney’s Hotstar streaming subsidiary, Amazon, and plenty of local challengers.

One big move this quarter was localizing the service to Hindi, which with English is one of two national languages in India’s vast, polyglot markets, the company said.

A partnership with Indian telecom giant Reliance Jio bundled Netflix with that company’s mobile and broadband plans, including integrating the service onto two of Jio’s set-top boxes. Netflix also partnered with multiple Indian financial institutions, to simplify payments, a move that could help with customer retention.

Still to come is a plan to offer the service free across an entire market for a weekend, to encourage sampling and signups.

“It’s an idea we’re excited about,” said Netflix Chief Product Officer Greg Peters. “Giving everyone in a country access to Netflix for free can be a great way to expose the service to more people. We’re going to try that in India, and we’ll see how that goes.”

The company also is investing in local programming from several Asian markets. India provided the hit unscripted show Indian Matchmaking, which Netflix said had been watched by a quarter

of member households there and “millions of members outside India in its first four weeks.”

The company is also getting traction with programming from other Asian markets, especially Korean dramas that play well both in and beyond the country, and Japanese animation, or anime, which similarly has a devout fan base sprinkled across the globe.

So far, Netflix has had relatively little competition internationally from U.S. streaming services, though Disney Plus is rapidly moving into more international markets, and launching its new general-interest international channel Hotstar Plus in Singapore.

Other Hollywood studios, by contrast, are still figuring out new business models, reorganizing siloed operations, and deciding the fate of a plugged pipeline of pricey blockbusters.

In Netflix’s Q2 earnings call in July, Co-CEO Reed Hastings strongly tamped down expectations for Q3, which turned out to be prescient, given the relatively slow quarter globally. But he remained optimistic about what could be a record year for the company, especially if it can continue building on the beachhead it’s building in that Asian land war.

“The next time we get together, we should be over 200 million members, completing a year of 34 million (new subscribers), an all-time record, and free-cash-flow positive,” Hastings said in closing the earnings call. “We’ve got an amazing content, technology and marketing engine humming. So, we’re really looking forward to next year.”

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.