Moffett: Charter’s Cloudy Video Future Is Bright

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Industry analyst Craig Moffett remains a big fan of Charter Communications’s cloud-based video strategy, agreeing with the MSO’s notion that the plan, which relies heavily on ActiveVideo’s platform, will enable the operator to significantly reduce capital spending, particularly at the set-top level.

Moffett, principal and senior analyst at MoffettNathanson, placed an emphasized on that approach in a report on Charter’s capex prospects as the operator pushes ahead with its proposed acquisitions of Time Warner Cable and Bright House Networks.

Moffett said “the most interesting number” in Charter’s pro forma projections for those deals is 11.8% -- the MSO’s “aggressive” pro forma capital intensity forecast for 2019E.

“Charter sees the number not as a short term blip but instead as an indication of a fundamentally different long-term capital intensity profile for the business,” he wrote.

Moffett, which has raised his price target on Charter to $230 to $210, believes that projection for lower capex intensity is “plausible” for Charter, “at least for the residential segment of their business.” For its part, MoffettNathanson’s own analysis of Charter envisions a 12.2% capital intensity, slightly above Charter’s forecast.

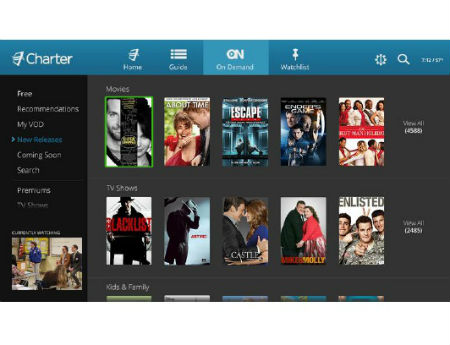

A big part of that decrease in capex intensity centers on Charter’s plan to move toward a cloud-based approach with ActiveVideo’s technology (an Arris-Charter joint venture acquired ActiveVideo in May for $135 million) that will allow the MSO to offer its new Spectrum UI and new apps across its footprint to both new IP-capable, such as its emerging Worldbox, as well as to legacy QAM-based boxes that don’t speak IP.

“[W]e believe Charter’s aggressive software and cloud-based approach will lead to a dramatic reduction in…CPE spending,” Moffett noted. “The potential capex savings from the transition from a hardware-based platform to a software-based one appears to be genuine, and make us incrementally more bullish on Cable, particularly on Charter.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

By comparison, he said Comcast, which has conducted some trials with ActiveVideo but has not committed to anything beyond that, will also enjoy a reduction in CPE capex as it expands the reach of the X1 platform, but that Comcast’s approach, which centers on the deployment of IP-capable devices, “will remain more capital intensive than Charter’s.”

Moffett also outlined the four “key” components of a cloud-based guide build: the server costs, seen as the most expensive element, as well as engineering/installation costs, network upgrade costs and app development costs.

With that as the basis, he estimates $2 billion in five-year total capex for a cloud-based guide build compared to $8.4 billion – a 77% reduction in capex -- for IP-enabled boxes for a company the size of pro format Charter.

Speaking on Charter’s Q3 call in October, president and CEO Tom Rutledge noted that Charter was about six weeks behind its original rollout schedule as the MSO irons out software issues.

While that pushes Charter’s prior target of launching its new cloud-powered UI to 1.6 million boxes by the end of the year, “a delay of only six weeks for a footprint-wide rollout should be viewed as very good news,” Moffett said, adding that Charter could have a fully interactive UI in front of all its customer within a couple of years.

Looking ahead, Moffett believes that cable will gain video share thanks to improved platforms and experiences. As for pro forma Charter, he sees it adding about 130,000 net video subs in 2019E.