Kagan: TV Spins Dominate Deal Market

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

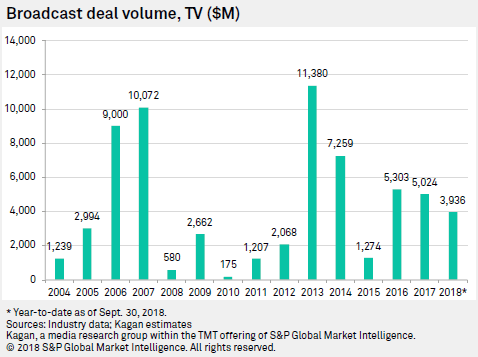

Broadcast station deal volumes reached $657.8 million in Q3, fueled mainly by spinoffs from larger deals, according to S&P Global Market Intelligence media research group Kagan.

According to Kagan, Gray Television’s $3.6 billion purchase of Raycom Media created overlaps in nine markets, and in August Gray sold nine stations to four different buyers for a combined $235.5 million. Three of these transactions represent the quarter's three top TV deals: TEGNA Inc. bought two stations for $105 million, Lockwood Broadcast Group acquired four stations for $67 million and E.W. Scripps paid $55 million for two stations plus one Class-A station.

Kagan added that Raycom bought the licenses of two stations, which it had operated under shared services agreements, from two license owners for $16.77 million. Nexstar Media Group Inc. purchased the license of KRBK in the Springfield, Mo., market from Koplar Communications for $16.45 million. Nexstar was already operating the station under a local marketing agreement.

Related: Tribune Terminates Sinclair Deal

Kagan added that it has revised its Q2 2018 deal volume estimates to account for the cancelled Sinclair/Tribune merger. Kagan had estimated in July that the spinoffs from that merger alone would amount to about $1.48 billion. The deal was scrapped in August after federal regulators recommended an administrative law judge review the deal. Kagan revised its records for the quarter and and now estimated that Q2 2018 TV deal volume was about $3.55 billion.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.