Harmonic Eyes First CCAP Orders in Q2

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Following several MSO trails, Harmonic is close to netting its first orders for a new platform that will evolve to meet the specs of the Converged Cable Access Platform (CCAP), a high-density architecture that combines the functions of the edge QAM and the cable modem termination system (CMTS) and puts cable on an all-IP services path.

“We anticipate formal product acceptance and first orders this quarter,” company president and CEO Patrick Harshman said Tuesday during Harmonic’s first quarter earnings call. “From here we expect to see the business ramp, with a step up in 2014 as the platform’s full two-way capabilities begin to ship.”

He said the initial order is expected to come in from one of Harmonic’s top five cable customers. Word of CCAP momentum comes at a good time, as Harmonic sales to U.S. cable operators remained weak in the first quarter.

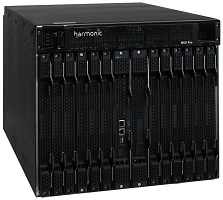

Harshman’s comments are in reference to the NSG Pro, the CCAP product Harmonic unveiled at last year’s Society of Cable Telecommunications Engineers (SCTE) Cable-Tec Expo in Orlando. But it’s not a full CCAP yet. The initial “CCAP-compliant” version of the NSG Pro will serve as a giant downstream-only edge QAM. Harmonic will tack on the CMTS components, including the upstream line card, later. But to demonstrate the progress it’s making, Harmonic did demonstrate a prototype upstream card at last year’s cable technology confab.

Harmonic’s entry will compete with CCAP products from Arris, Casa Systems, Cisco Systems and CommScope, as all parties chase after a market that’s expected to be worth about $1.04 billion by 2017, according to a forecast from Multimedia Research Group.

Motorola Home had a CCAP product in the works, but the final fate of that product remains unknown as Arris resolves how it will integrate overlapping products it obtained from its recent $2.35 billion acquisition of the company. This week, Arris president and CEO Bob Stanzione told investors that the company expects to start “shipping significant volumes” of the E6000, its CCAP-in-the-making. Arris is taking a different approach than Harmonic, as the E6000 is starting out life as a high-density CMTS, and will integrate the edge QAM pieces further down the road.

Harmonic has identified CCAP as one of its key business drivers, alongside the also nascent markets for High-Efficiency Video Coding (HEVC) and other gear and software for multiscreen and Ultra HD video. To help it focus on those areas, Harmonic recently sold its cable access unit, which makes lower-margin optical transmitters, amplifiers, receivers and nodes, to Aurora Networks for $46 million.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

And for Harmonic’s sake, the faster those markets take off the better. Harmonic posted a first quarter pro forma loss of 2 cents per share on sales of $101.7 million, missing Wall Street’s expectation of $113.9 million. Harmonic expects second quarter sales of $105 million to $115 million, well below consensus of $123.9 million, Raymond James analyst Simon Leopold wrote in a research note.

Not counting the access business, cable represented just 39 percent of revenue during the first quarter, about what it got from broadcast and media customers. Satellite and telco customers contributed 23 percent of revenue.

“We remain hopeful for a seasonally stronger 2H13 as European sales improve and next generation video encoding sales ramp, however domestic cable spending continues to sound challenged and we worry about cable Edge QAM sales,” Leopold noted.