DirecTV Loses an Estimated 400,000 Subscribers in Q2 as Base Dips Below 14 Million

DirecTV estimates included in Leichtman Research Group's tally of nearly 2 million more lost pay TV souls in Q2

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The video business has increasingly come under the control of tech giants like Apple, Amazon and Google, which bury customer data and other key metrics in diffuse reports to the SEC.

Other key operators, like DirecTV -- which was, not that long ago, the biggest pay TV company of them all -- have been recently spun off into private concerns from their publicly traded parent corporations, and are no longer beholden to any such quarterly scrutiny. (The OTT joint venture recently established by Comcast and Charter also falls into this spinoff bucket.)

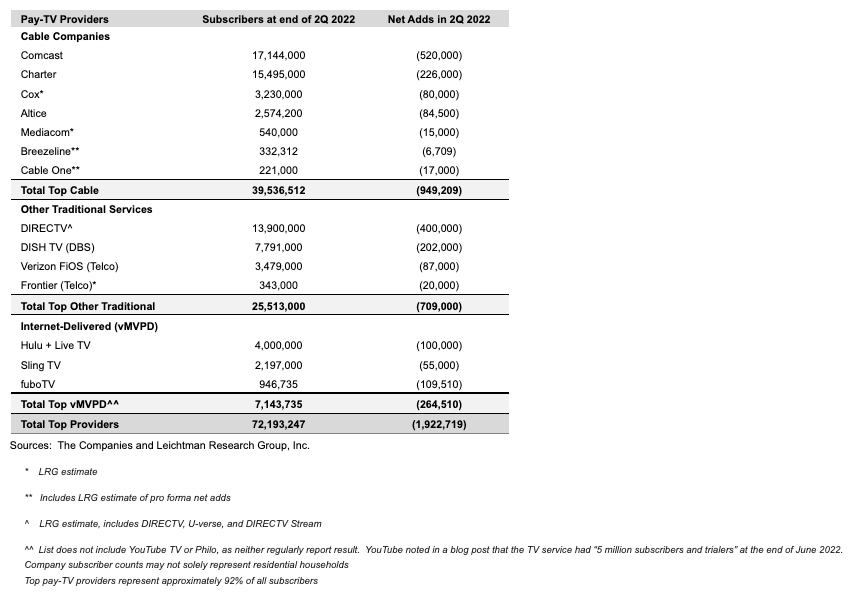

Thus, when navel gazing over issues like cord cutting, estimates from third-party research companies -- hopefully well-founded! -- are all we have to go on. Amid that backdrop, Leichtman Research Group estimates that DirecTV lost around 400,000 customers across its DirecTV satellite, DirecTV virtual and U-verse TV platforms in the second quarter.

LRG postulates that DirecTV, jointly owned by AT&T and private equity company TPG Capital, has around 13.9 million remaining subscribers. This is around 12 million fewer than existed between DirecTV satellite and U-verse back in May 2014, when AT&T agreed to pay $49 billion to buy DirecTV and -- briefly -- usurped Comcast to become the nation's No. 1 pay TV operator.

Pay TV's long secular slide started around the time of that purchase, dropping from just over 100 million American homes to around 72.2 million at the end of June, according to LRG. (The total is actually higher -- LRG's count doesn't include the 8% of the market served by vMVPD leader YouTube TV, as well as several hundred smaller regional cable companies.)

But we can say that, with its total pay TV subscriber base eroding by 46% over the last eight years, AT&T has at least managed to beat the market on something.

By LRG's tally, every publicly effacing pay TV service once again lost ground in the second quarter, just as they did in Q1. The top 13 pay TV companies, accounting for 92% of U.S. customers, lost 1.950 million users from April - June vs. a pro forma loss of 1.235 million subscribers in the same period of 2021.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Comcast was the biggest loser, bleeding 520,000 linear video customers.

Notably, LRG doesn't yet feel it has the insight to properly gauge YouTube TV, for which Alphabet/Google recently touted 5 million customers. That makes Google the fourth largest pay TV operator, but the company doesn't disclose YouTube TV subscriber growth or retraction in quarterly earnings reports.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!