CCAP Sales Surge 177% In Q1: Infonetics

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Sales in Converged Cable Access Platform (CCAP) gear rose 177% in the first quarter, as MSO spending continued to slant toward a high-density next-gen architecture that combines the functions of the cable modem termination system and edge QAM and will pave cable’s path to an all-IP world, Infonetics Research said in its latest market report.

“In a dramatic shift, the vast majority of cable operator spending in the first quarter of 2014…went toward new CCAP equipment instead of the bedrock of cable broadband, CMTS,” Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics, said in a statement.

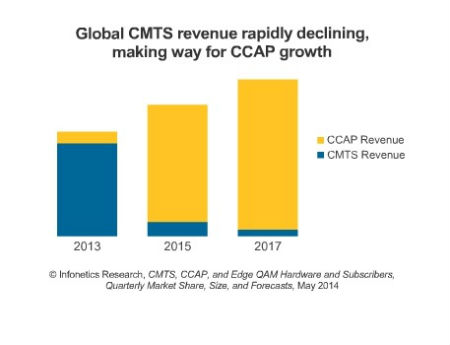

He said cable operators are on a “steady path adding significant channel capacity” for DOCSIS 3.0, IP video, carrier WiFi, businesses services, and DOCSIS 3.1, a new CableLabs spec that will support multi-gigabit capabilities. Infonetics' latest forecast (see above graph) shows CCAP revenues dwarfing those from the traditional CMTS market.

Still, the quarter presented somewhat of a mixed bag. CMTS and CCAP channel shipments reached a record in the quarter, but the combined global market for CMTS, CCAP and edge QAM gear dipped to $332 million in the first quarter, off 6% from the fourth quarter of 2013, Infonetics said.

The North American cable market is feeling the effects of the CCAP shift. According to Infonetics, quarter revenue dropped 13% despite a 20% rise in CMTS and CCAP channel shipments.

As bragging rights go, it was a good quarter for Arris, which overtook Cisco Systems in worldwide CMTS and CCAP revenues. Casa Systems, which has been gaining ground on Arris and Cisco, further solidified its position by increasing revenue by 13% in the quarter, Infonetics said.

The precise market share break among those suppliers was not immediately known.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Update: According to Heynen, Arris led the way with a 37% share of revenues for combined CMTS, edge QAM, and CCAP-pointing products, followed by Cisco's 32%, Casa's 21%, and Harmonic's 7%.

At the end of 2013, Cisco represented 44% of CMTS/CCAP revenues, followed by Arris’s 33%, and Casa’s 23%.