For Altice USA, Programming Costs Consume 67% of Video Revenue

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Can a pay TV operator with less than 5 million subscribers make it in today’s video business?

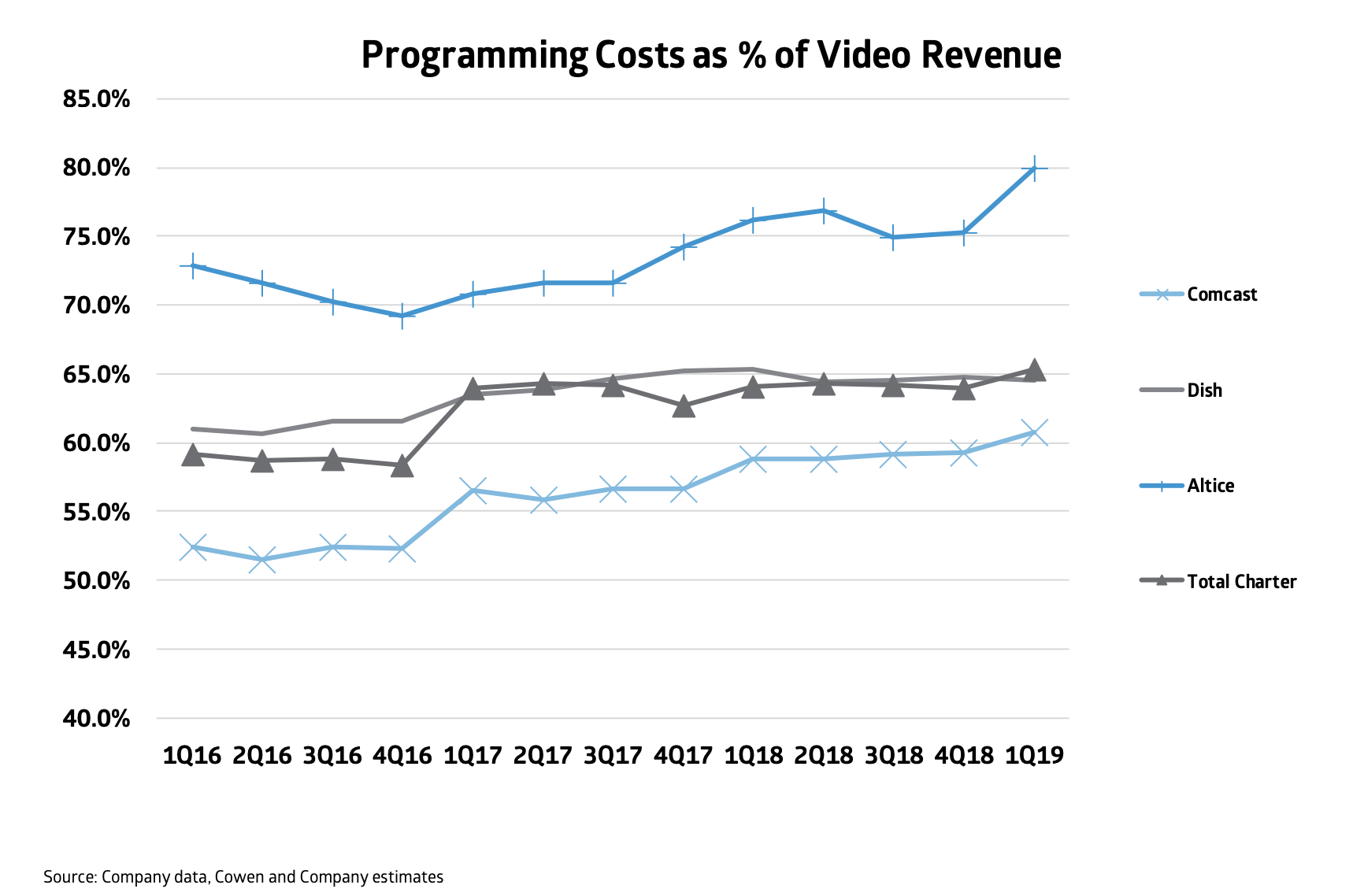

As this chart compiled by equity research company Cowen reveals, scale certainly means a lot. For Altice USA, which finished the first quarter with just under 3.3 million video customers, programming costs consume 80% of total revenue.

UPDATE:Altice USA said Cowen's tally of $813 million for first-quarter program licensing costs is actually the wrong figure. The correct figure, according to the cable operator, of $682.4 million puts Altice largely in line with other tier 1 pay TV operators at 67% of video revenue. But the chart still shows the impact of subscriber scale on programming costs.

For Comcast, which finished Q1 with around 21.8 million video customers, program licensing accounts for about 60% of revenue.

Below Comcast, Charter Communications and Dish Network—which finished Q1 with 16.4 million and 9.6 million video subscribers, respectively—pay 65% of their revenue in programming costs.

Related: Montana Provider to Pull Plug on Video

Notably, it’s still going up for everyone.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

According to Cowen, programming costs represented 73% of revenue in the first quarter of 2016. The figure was around 53% for Comcast at that time.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!