Silos vs. Mixed Signals: Strategies for the Future of Telecom Delivery

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

A couple of decades ago, Multichannel News’ editor, Mark Robichaux, asked me to use a couple of words that would best describe the overall message and mission of my new column. I said straight away, “Mixed Signals.” That’s because I sensed from my earliest days of closely observing TV, back in the 1970s, that it was a business where consumers did not care if the content arrived via satellite, wire, or wireless. Rather, they just wanted a sound and video product that offered value and quality. Indeed, my conviction then was that supplementing a core delivery method with another was THE future. In short, a combination of those delivery methods would work…and/or would eventually be preferred.

To use just one distribution method seemed to be amazingly short-sighted. Yet, even today, that’s what most providers of broadband, broadcast, and pay TV content do.

Nonetheless, as they always tend to, things are changing.

HughesNet’s Gaske

Paul Gaske and I first ran together along a Tennessee river back in the mid 1990s. I will never forget two things: how badly he outran me, and how sweaty it was that day before our first satellite conference together at Opryland.

Recently, Gaske, as the decades-long general manager and executive VP at EchoStar and Germantown, MD-based HughesNet, conducted a video interview, conducted by Light Reading’s Nicole Ferraro. HughesNet champions its moniker as the “largest provider of satellite broadband services in the world.” The interview/podcast is about a new $600 million HughesNet orbiter, capable of delivery speeds of 100 Megabits/second. Near the end of the 14:28-minute query, Gaske concluded that as far as he saw it, the future of HughesNet’s geostationary Earth orbiting (GEO)-delivery of ones and zeros was together with fixed wireless. “Keeping up requires that flexibility of systems,” meaning, clearly, that yet another telecom deliverer had determined its strategy based upon the concept of “Mixed Signals.” In HughesNet’s world, eventually low Earth orbiting (LEOs) satellites are expected to blend into that mix, as well. Fiber already serves to access towers and satellite uplink/downlink gateways, he explains.

To drive home his emphasis, Gaske adds, “Business Enterprise is a perfect example. More and more they cannot, ever, afford to be down.” That means these businesses can easily justify spending on a huge full-time pipe that may include 24/7/365 access to wire, satellite, and wireless, all at the same time. “A well-performing back-up is essential,” he adds.

Gaske further and more broadly summarizes HughesNet’s strategies, rather aptly noting, “The technology at both ends of that fiber has to change constantly for you to be future-proofed. And that’s the next proposition.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

I find it satisfying that Gaske, like me, also has changed: today he, too, has added regular bicycling to his exercise mix.

AtLink’s Access

Oklahoma City, Oklahoma-based AtLink is a broadband provider with more than 11,000 subscribers. With a current base of 90 employees, it has been focused on subscribers in the lower-middle part of the country for 16 years, since 2005.

In a recent text exchange, CEO Samual Curtis and I discussed the future of broadband delivery strategies, based upon my sending him a message about the future of LEO-based content distribution. LEOs are a particular interest for Curtis and AtLink.

Curtis: I’m curious of what your take is on this [linked] article about Musk’s Starlink…

Schaeffler: As to your question: smart guys like you will reach out to Musk and Company early. You’ll figure out how to mold your business toward the greater realm of things: as a broadband provider with many pipes, fixed wireless being just one of those (i.e., along with sat, cable, and fiber, and …?). Because at the end of every day, the end customer doesn’t care about how they get the signal or content, they just want the signal and the content! (emphasis supplied).

In a more recent discussion, Curtis reiterated the same goal, but tweaked the aspects of implementation. He explained that AtLink is indeed currently working toward incrementally adding fiber, but is doing so in a most cautious and prudent manner. Some of that has to do with fiber’s far slower return on investment (See, page 19, Figure 8, “Comparative Economics of U.S. Internet Access Solutions,” from The Carmel Group’s 2021 report, the homepage and log-in are found at www.carmelgroup.com). It also, however, has to do with several of the essential positives attributed to fixed wireless, which represents the lion’s share of AtLink’s current broadband distribution system. Fixed wireless’ efficiency of installation and maintenance, plus the industry’s relatively rapid innovation cycle, were highlighted.

Midco’s Match

Sioux Falls, South Dakota-based cable operator Midco purchased 4,000 fixed wireless subscribers and the business of Grand Forks, North Dakota-based InvisiMax in early 2018, which today represents approximately one percent of the joined company’s total 460,000 subscriber base. Fiber-to-the-Household (FTTH) makes up another 5,000 customers.

Jon Pederson, Midco’s chief technology innovation officer, describes a future growth strategy built around what he calls a “multiaccess fiber network.” At the ends are either fiber, wireless, or coaxial cable. Which gets placed in which locations depends on the geography, the demographics, and the economics. Thus, for Midco, fixed wireless works well in rural areas; fiber or coax are typically used in urban areas. Another factor is whether the subscriber represents a new build or an upgrade.

“Our choices today are like a Swiss Army knife: I don’t often use the screwdriver, but it’s nice to have it there,” he compares.

Midco’s current footprint is focused on states ending in OTA, which would mean North and South Dakota, as well as Minnesota, as well as Kansas and Wisconsin.

Also tweaking his message and strategic philosophy, Pederson supplements, “We have what we call an ‘Edge Out’ strategy. We ask not just if [it] makes sense to put up a tower for a given area. We want to know not just does it work here alone, but is this location on the way to somewhere else? That’s part of a ‘Message of Ubiquity.’”

So the Future Is?

Because the collective and individual demand – and eventually the need – for broadband will continue to grow so very exponentially, not any one delivery form will be capable of single-handedly delivering that value and quality nearly all actual and potential consumers demand. For example, for a fiber network in a given geographical area, often the presence of geographical features and the cost of laying fiber takes that player out of the mix for remote customers in that part of the country. Yet, add an alliance with a low Earth satellite or a tower-to-home-and/or-business fixed wireless alliance, and suddenly that fiber player is back in the mix for that town limited area, broader county area, or more.

In addition, although many advocates in Washington, DC and elsewhere are arguing that laying fiber is the only future-proof solution, that singular solution is flawed. That is because, as noted above, fiber can be a far from practical delivery form in many parts of a landmass.

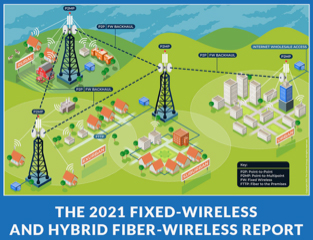

The Carmel Group recently completed its second global report for the U.S. fixed wireless industry trade group, WISPA, referred to above. In that, we championed a form of “Mixed Signals.” That is because we termed and wrote about what we called the “2021 fixed wireless and hybrid fiber-wireless report” (See, the homepage and log-in at www.carmelgroup.com).

What is important to note, finally, is that in our strong and measured opinion, most future successful content delivery products and services will be based upon a variation of this “Mixed Signals” strategy. For many, fiber will be the trunk service, and wireless will deliver more granularly to the last mile. For others, satellite will be the trunk service, accompanied by both or either fixed wireless and/or cable. In another variation, a cable and fiber base will share access to customers with fixed wireless and LEO satellites.

Whatever the mix, more flexibility and more revenues will come to those who can successfully (i.e., that value and quality thing) reach the most customers in a given area. That “area” typically includes signal delivery to urban, suburban, and many shades of rural.

Figure out how to get to them all -- or most of them -- and you are ready for the future.

P.S. - What is also fascinatingly strategic is to see where data gleaned by satellites globally will eventually (or even soon) be available to ALL content providers, so that they can better and more readily figure how to use that data to better serve their customers (See, https://news.berkeley.edu/2021/07/20/a-machine-learning-breakthrough-using-satellite-images-to-improve-human-lives/). For example, if you can use that data to determine where to lay roads, you can use it to determine where to string (or lay) fiber or cable. Or where to place towers to reach more subscribers.

Jimmy Schaeffler is chairman and CSO of west-coast-based The Carmel Group, a streaming/broadband, broadcast, and pay TV/video consultancy. He writes about telecommunications, entertainment, and media.

Jimmy Schaeffler (AKA “Shamus Schaeffler”) is chairman and CSO of The Carmel Group, a west coast-based consultancy founded in 1995. He can be reached at jimmy@carmelgroup.com.