2021 Fixed Wireless and Hybrid Fiber-Wireless Numbers: Broadband Is Healthy

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In this Mixed Signals post, The Carmel Group reveals details of an 18-month long study and resulting report, delving into the U.S. fixed wireless and hybrid fiber-wireless industry.

We break this out into three bullet points covering three main areas: key findings, key growth drivers, and key challenges. For our readers, the “2021 Fixed Wireless and Hybrid Fiber-Wireless Report” by The Carmel Group can be accessed, for free, with the accurate entry and inclusion of four important data points at www.carmelgroup.com. The first report by The Carmel Group, completed and published five years ago is also accessible on the home page of the same URL, and is called the “2017 BWA Report.”

The foundation of both the 2017 and the 2021 report, is two separate surveys in each cycle conducted by our company, one of the operator community and the other of the vendor group. Impressively, also indicating growth within the sector during the past five years, in the 2017 version 169 from a listed total of 555 operators responded. Whereas in the 2021 iteration, that operator number grew to 244/700. For vendors, the 2017 response number was 24/44; for 2021 it came to 55/200. For the operators, even measured against The Carmel Group’s estimate of 2,800 total U.S. operators, that 2021 response rate of 244 comes to almost 10%, which is far above the typical results for an “external survey” of an industry. Additionally, thirty 90-minute executive interviews were conducted by The Carmel Group, further cementing the ideas, analysis, and conclusions of both the project and the report.

Key 2021 Findings

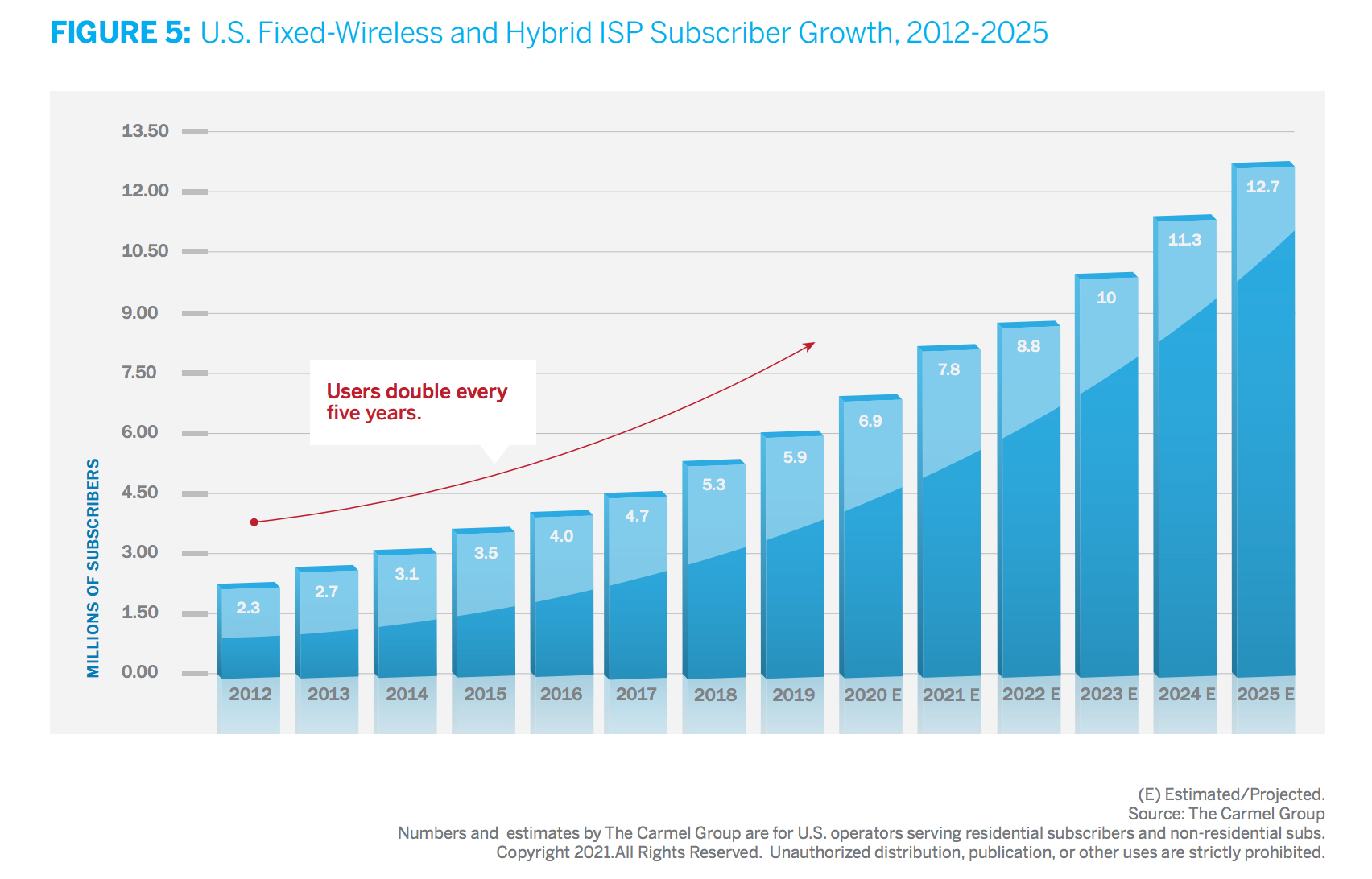

- From the report’s “Executive Summary,” determinations were made that growth is there, and its continuation is predictable based upon a handful of important trends and competitive observations. The estimated list of U.S. network providers includes 2,800 operators. Nearly 13 million subscribers or a market share approaching 10% comprise the base that is expected by 2025. Core industry revenues are projected to reach nearly $11 billion in the next five years.

Key 2021 Growth Drivers

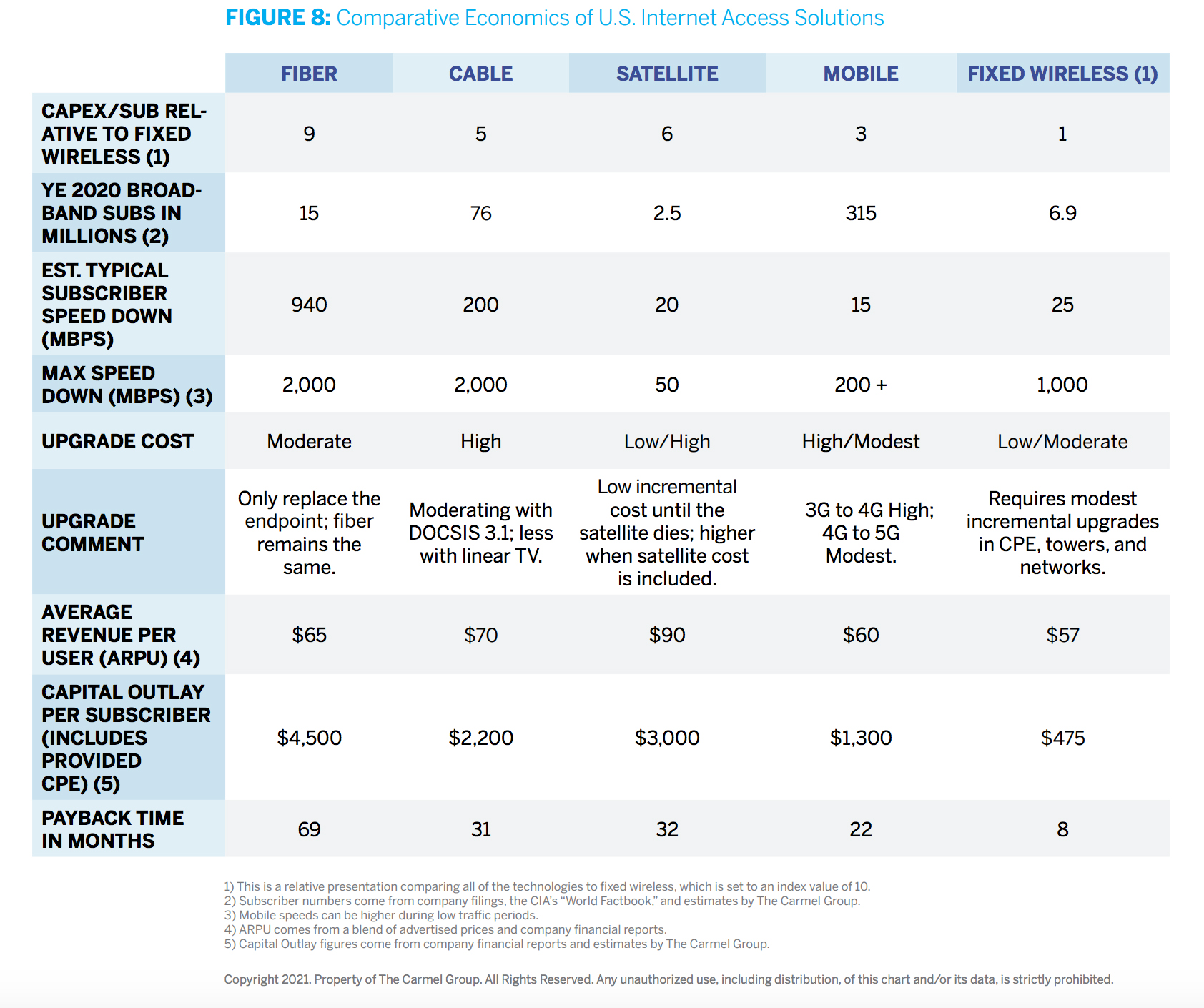

1) Fixed-Wireless and hybrid networks cost less: One good chart is worth 10 thousand words! Isn’t there a saying along those lines? The figure below captures the breadth of this message. Fixed wireless is a better value.

2) Consumer demand is robust: Subscriber growth is the dynamic here. It is robust. And more and more competitive, even in urban America. Just ask Starry.

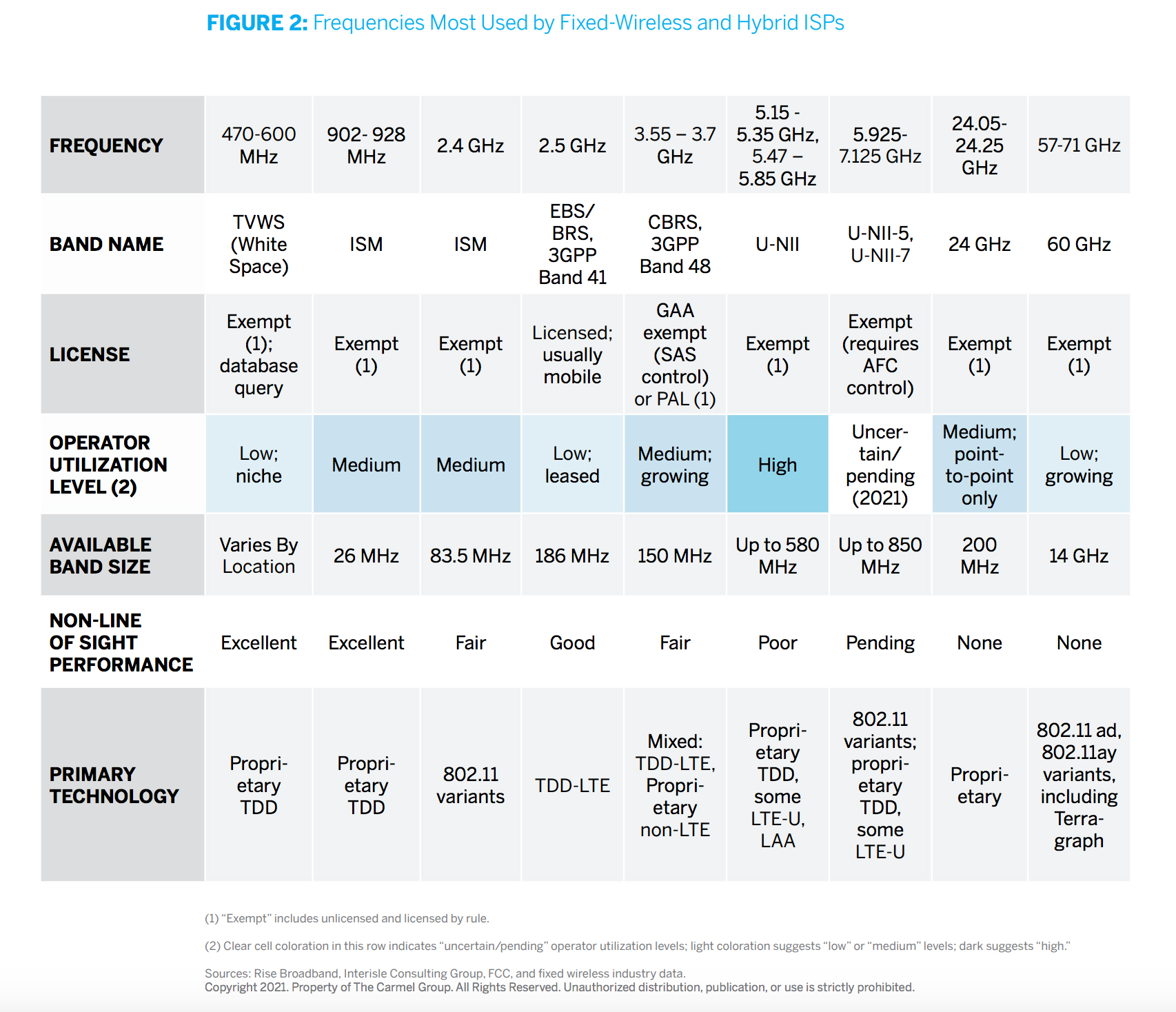

3) Favorable Spectrum Trends: The U.S. industry is leading the way with better equipment to better utilize scarce spectrum resources, and the U.S. government and its lawyers and economists appear to be better and better tuned into this concept as well.

4) Tech is helping ISPs: A realization of the value of standardization has become an accepted part of U.S. broadband, and that certainly includes the fixed wireless and hybrid fiber-wireless subsectors. Spectrum efficiency techniques are assisting greater and greater bandwidths and speeds. And more and more vendors are making fixed wireless and hybrid fiber-wireless strong revenue units within their businesses.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

5) Growing capital and government support: Six sources of financial support are behind this clear trend, each is identified at length in the report itself.

Key Challenges

- The old adage has it, “know your friends well, your enemies better.” Thus, for those of the pay TV multichannel world, and those of the broadcast and rival broadband industries, having an idea of challenges faced by the opposition is important.

In that vein, The Carmel Group’s 2021 report identified five main challenges. That said, it should be noted that there are more difficulties the industry faces (as is true for any similar competitor), but this handful is deemed the biggest of the trees inside that forest. At least for now.

- Competition: Competitive dynamics include ultra-entrenched and immensely powerful competitors, especially in the wired and broadcast realms. Competition from Low Earth Satellites (LEOs) is also raising new interest. (See, StarLink article: https://www.telecompetitor.com/space-x-notches-another-win-at-the-fcc-for-improved-starlink-satellite-broadband/)

- Vertical content: A key element of the generic “Competition” listing immediately above, the U.S. fixed wireless industry will be looking to create accommodations and handicapping that ensures its consumers are treated fairly in the marketplace.

- Spectrum challenges: Especially as long as unlicensed wireless spectrum dominates the domestic marketplace, operators will constantly be seeking out interference mitigation efforts and devices.

- Government process: Education, education, education. Those are this fixed industry’s short-term and longer-term incentives. That means getting policymakers and funders to appreciate and act upon the opportunities, especially like those displayed in the “Comparative Economics” chart above (which is Figure 8, page 19, in the actual 2021 report).

- Funding: See above.

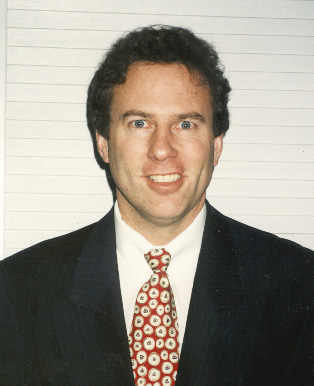

Jimmy Schaeffler is chairman and CSO of The Carmel Group, a streaming/broadband, broadcast and pay TV/video consultancy based in Carmel by the Sea, California. He writes about telecommunications, entertainment, and media.

Jimmy Schaeffler is chairman and CSO of The Carmel Group, a nearly three-decades-old west coast-based telecom and entertainment consultancy founded in 1995.