Strategies for SmartSpending After Crisis Lifts

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Addressable ads can be used to selectively deliver messages to states as they re-emerge from coronavirus safety measures keeping many businesses closed, executives said during the Advanced Advertising Virtual Summit’s conclusion on April 23.

Television ad spending is expected to take some big hits during this pandemic response as key categories including travel pull back. Already ad inventory is up and prices for airtime are down, executives said during this four-day virtual summit, produced by Broadcasting+Cable business editor Jon Lafayette. For some marketers, looking to establish new brands such as newly launched streaming video services, it can be an opportunity to take market share and hang onto it later, as has happened after dramatically negative events such as the 2008-09 recession and 9/11, executives said.

When businesses reopen and ad spending picks up again, budgets will likely be reduced and there will be increased scrutiny on getting a return on that investment. “That dollar will matter more than ever,” Kevin Arrix, senior VP at Dish Media Sales, said at the virtual summit on April 23. He and Tim Sims, senior VP of inventory partnerships at programmatic vendor The Trade Desk, said ad buyers should be looking to put more of their spend into household-addressable ads that can demonstrate results against measurable performance indicators.

Arrix of Dish Media, which includes Dish Network and Sling TV, said after traumatic events companies might want to “retreat into safety” and buy on old Nielsen metrics of ratings points ot the time to do that,” he said, but instead to “lean into all the different tools and technologies that are available” to target messages to specific audiences.

Sims noted “we will likely see a rolling restart” to the economy, with some states reopening faster than others, and said addressable campaigns can start with those early states and add others later. He used the example of a national quick service restaurant chain that might see 20% of its stores opened in June, 20% in July and the other 60% in August.

Arrix said moving into advanced advertising can seem daunting at first, with differing measurement, technologies and data sets.

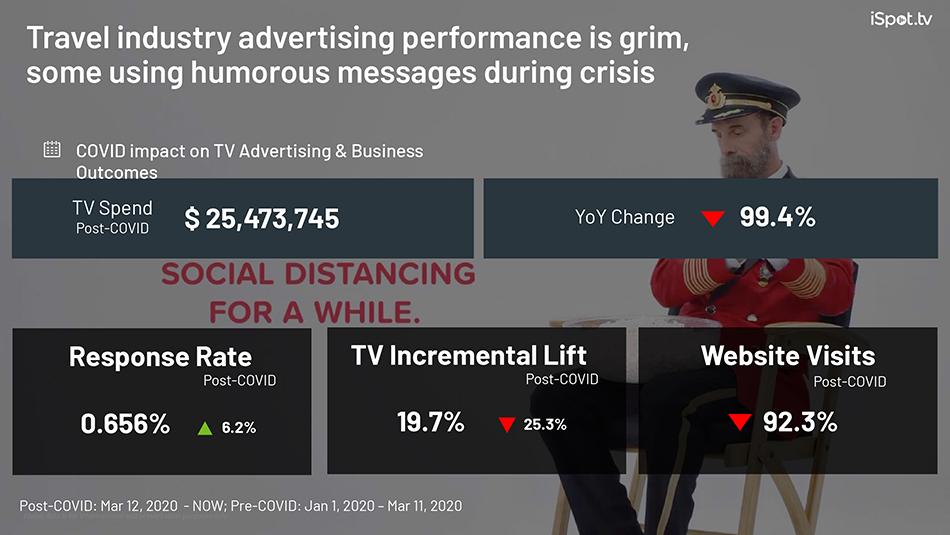

Sean Muller, founder and CEO of iSpot.TV, illustrated the ad impact of coronavirus with research showing that travel ad spending was down 99.4% in recent weeks compared with the same period a year ago, and that auto spending was down 53.4%. In contrast, insurance carriers were spending only about 14.8% less, and pizza restaurants’ spending was about even, even though live sports were a big part of their buys and that programming has all but vanished.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Dan Ackerman, chief revenue officer at Samba TV, also shared research indicating time spent watching Netflix and Amazon streaming services has risen 41% year over year in the recent period and time spent watching Hulu was up 48%. Viewers are eager for live sports to return, he said, “but that is being fulfilled with the depth of the libraries in the streaming services.”

As for what data advertisers are looking for to enhance their marketing, Claudio Marcus, VP of strategy at Comcast Advertising, said it was the consumer data and viewing data, with personally identifying information anonymized, and that addressability had two benefits: to target ads to individual households and then to measure whether or not those households had been reached.

Kent has been a journalist, writer and editor at Multichannel News since 1994 and with Broadcasting+Cable since 2010. He is a good point of contact for anything editorial at the publications and for Nexttv.com. Before joining Multichannel News he had been a newspaper reporter with publications including The Washington Times, The Poughkeepsie (N.Y.) Journal and North County News.