Allen Loosens Charter Grip

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

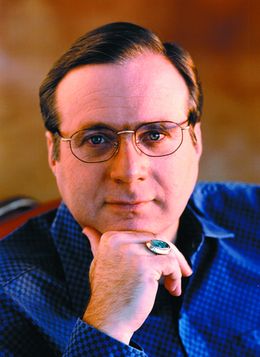

Former Charter Communications chairman Paul Allen has taken a further step back at the St. Louis cable company, reducing his voting stake to more closely align it with his economic interests.

Allen, whose Microsoft billions helped fuel an acquisition spree a decade ago that transformed Charter Communications into the fourth largest MSO in the country, has apparently stepped further into the background, converting his supervoting shares and relinquishing his right to appoint board members.

According to a press releases issued late Monday, Allen converted about 2.2 million shares of Class B supervoting stock to an equal amount of Class A common shares. As a result, Charter said that Allen "no longer has a 35% voting interest associated with the Class B common stock and no longer has the right to appoint four directors."

Charter had said in earlier filings with the SEC that its board had the right to convert the B shares as of Jan.1, 2011 and that the board would evaluate its options in the first quarter of this year.

Two directors that Allen had appointed - Vulcan Investments general counsel William McGrath and Vulcan EVP of investment management Christopher Temple - have resigned from the board effective immediately. In their place the board appointed two executives at major Charter bondholders - Oaktree Capital Management senior vice president Edgar Lee and Apollo Global Management senior partner Stan Parker.

Allen has been inching into the background since Charter emerged from Chapter 11 bankruptcy protection in November 2009. In December of that year he stepped down as chairman of the company - former Apollo Management executive Eric Zinterhofer took his place - and earlier agreed to reduce his voting stake in the company from 91% prior to the bankruptcy to 35% after it emerged. According to Charter, Allen's Class B shares converted on a one-for-one basis to Class A stock. He now controls about 3% of Charter's outstanding Class A shares and has warrants to purchase another 4% and remains Charter's largest individual shareholder. This transaction more closely aligns Allen's voting interest with his economic interest.

Since emerging from bankruptcy, Charter stock has performed well. The shares returned to the NASDAQ Stock Exchange on Sept. 14 at about $35 per share and have risen about 17% ($5.99 each) in the subsequent months, closing at $40.99 on Jan. 18. The stock was up 51 cents each (1.2%) to $41.50 in afternoon trading on Jan. 19.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.