Linear TV Hours Watched Dropped 2% in 2nd Half of 2022: Samba TV

Less than 50% of households watch linear TV every day

Samba TV’s The State of Viewership report for the second half of 2022 shows the continued erosion of traditional TV-watching.

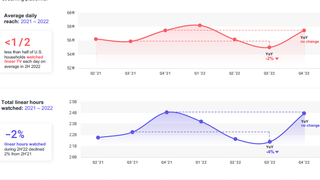

According to the report, linear viewing hours fell 2% in the second half of 2022 compared to the second half of 2021. In the third quarter, linear viewing hit its lowest level in seven quarters before a season rebound that saw viewing in the fourth quarter equal Q4 of 2022.

Less than half of U.S. households — 45 million — watched linear TV each day during the second half, and only 48% of U.S. adults have a pay TV subscription, per Samba.

“We have reached a critical turning point in television and viewing consumption. For the first time in history, a majority of Americans report they no longer have a monthly cable subscription and are totally unreachable by traditional linear advertising,“ Samba TV CEO and co-founder Ashwin Navin said. “Meanwhile, streaming has become ubiquitous among every age group and ad-supported streaming has gone fully mainstream with significant expansion across new platforms, including industry leaders like Netflix and Disney Plus entering the world of ads.

“While the market has never been more fragmented and rife with challenges for streamers and advertisers alike, there are also unprecedented new opportunities to drive engagement and ultimately market success for those who embrace a streaming-first, data-driven mindset,” Navin said.

The erosion of linear viewing is a concern to advertisers. With less than half of all households watching linear TV each day, the same consumers see the same ads over and over, which hurts brands. Younger people are less likely to subscribe to pay TV: 65% of Gen Z consumers had no cable subscription, according to Samba.

Samba found that 93% of linear ads reached only half of U.S. households, with the top 20% of linear viewing consuming the vast majority of linear TV.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“While half of Americans were under-reached or not reached at all, the other half were bombarded by more than 100 television ads daily, driving ad fatigue among the overexposed,“ the report said. “The need to drive incrementality and reach unique audiences, while also managing frequency to avoid consumer burnout, has never been more urgent.”

The report wasn’t all good news for streaming either.

Samba TV said that while 79% of U.S. adults stream TV content, 54% of streaming households watch two or fewer services.

A large number of streamers lose interest in a subscription service after watching one show. The report said that 57% of Apple TV Plus users watched just one show on the service. For Paramount Plus, that figure was was 54% and for HBO Max it was 63%. Only 28% of Netflix users watched just one show.

A significant number of consumers tuned out of a subscription service after one month. For Paramount Plus it was 18%, while it was 16% for Apple TV Plus. Only 1% of Netflix subscribers tuned out after a month.

The shows that attracted the most viewers in the first 15 days available were HBO Max’s House of the Dragon and three Netflix series: Wednesday, Dahmer–Monster: The Jeffrey Dahmer Story and The Watcher.

How much does Paramount Plus owe Taylor Sheridan? His Tulsa King and 1923 were No. 5 and No. 7 on the list.

“Sheridan is single-handedly bringing in and retaining a large portion of viewers for Paramount Plus, with almost one in four Paramount Plus viewers throughout the second half of 2022 only watching one of his shows,” the report said. “Meanwhile, Sheridan’s smash hit, Yellowstone, which airs on Paramount’s linear channel, was the number one scripted TV premiere of 2022, coming very close to 10M households within its first 15 days.”

Yellowstone appeals to households in the middle of the country, with Phoenix, Cleveland and St. Louis among the markets over-indexing, while New York and Los Angeles under-indexed. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.