Broadcast Stalls as Entertainment and Media Revenue Recover: PwC

Report sees global industry revenues hitting $2.6 trillion in 2025

The global entertainment and media industry was hurt less than the overall economy by the COVID-19 pandemic in 2020 and is expected to grow faster through 2025, according to PwC’s new Global Entertainment and Media Outlook report.

After dropping 3.8% to $2 trillion during the COVID-19 impacted year of 2020, entertainment and media revenues are projected to increase to $2.2 trillion in 2021 and continue to climb reaching $2.6 trillion in 2025, according to PwC.

The pandemic, combined with changes in technology, affected the way people consumed content.

“A significant proportion of the habits accrued over those restricted periods will endure. Many of the shifts that were already in play—the move towards digital products and online sales, the relentless rise of streaming, the growing influence of gaming and user-generated content— gained momentum and are poised to barrel forward,” the report said. “The resulting power shifts will transform the industry in the years to come.”

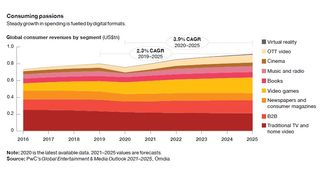

Consumer spending on entertainment and media revenue is projected to rise to $914.9 billion, representing a 3.9% compounded annual growth rate from 2021. The stagnation of legacy sectors such as newspapers and magazines will be more than offset by rapid revenue growth from booming areas that cater particularly to younger consumers, such as video games and esports (CAGR of 5.7% to 2025) and over the top video (CAGR of 10.0% to 2025).

Traditional TV and home video, PwC says will continue to account for the largest share of total consumer revenue. But it won’t be growing. In fact, PwC sees it declining 1.2% annually.

By 2025 online and connected TV advertising will add $22 billion to the global entertainment and media industry.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“After a difficult decade in which broadcasters coped with declining viewership and threats from online advertising while still investing in infrastructure and technology, the sector will near a tipping point by 2025, when revenue from online and connected TV will be just $1 billion smaller than multichannel TV advertising revenue,” PwC said.

North America is the largest traditional TV and home video market with a 42.3% share of global revenues, or $94 billion in 2020. However, revenue is falling, and the region will account for just more than a third of the global market in 2025, the report says.

"Changes in consumer behavior have driven powerful shifts in E&M business models," PwC said in its report. "Foremost among these shifts is the way the streaming boom of 2020 has set the industry on a new growth trajectory. Streaming video-on-demand (SVOD) revenues will grow at a 10.6% CAGR through 2025, by which point SVOD will be an $81.3 billion industry."

PwC streaming growth will be limited by the number of subscriptions households are willing to buy and by the fact that consumers will be able to cancel OTT services with ease.

“We may be moving into a new phase of streaming growth—one that is more measured, more focused on improving the experience of customers, and more intent on retaining and creating value from the immense subscriber bases that have materialized,” the report said. “At the heart of it lies an arms race for content. A common strategy for achieving both goals—a better experience and higher retention—is commissioning large amounts of material that is recorded and viewed at customers’ convenience. This content is increasingly being produced locally and in local languages by both global and domestic players”

PwC estimates that Netflix spent $15 billion on content in 2019 and Amazon spent $5 billion.

A U.S. government more interested in enforcing antitrust rules could also affect the industry and merger and acquisition activity.

“With he more active antitrust regime in Washington, widespread hostility to the big platforms across the political spectrum and rising consumer expectations, it’s clear that the operating environment for Big Tech is set to get a lot more challenging,” the report says.

“All of which means that sitting still, relying on the strategies that created value and locked up market share in the past, will not be the most effective posture going forward,” the report concludes. “The world is beginning to emerge from the painful shared experience of the pandemic. Amid destabilizing power shifts, those who lean in to the changes, probe the data and seek deep insights from their customers, co-workers and collaborators will maintain their balance—and be well placed to reap their fair share of future growth.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.